Last Updated on October 22, 2022 by Rebecca Lake

Living on a tight budget can be motivating, as it challenges you to make the most of every dollar. But it can also be a source of stress if you’re constantly worried about how to pay bills and save money.

An estimated 59% of Americans say they worry about their finances daily, according to a Dave Ramsey survey. If you’re one of them, you may be looking for solutions on how to improve your financial situation.

There are different reasons for living on a small budget.

For example, you might be a stay at home mom whose spouse or partner is the family breadwinner. Or you may be a dual-income family but a high cost of living means your money doesn’t go as far. And you could be a single parent who’s trying to make ends meet.

Whatever the reason, living on a tight budget means you need to be creative with your finances. Today, we’re sharing some of the best tips to help you make the most of the money you have so you can enjoy life without feeling broke.

Related post: Why Is Budgeting Important?

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

What Is a Tight Budget?

In simple terms, it means you don’t have a lot of extra money to spare each month once your bills are paid and basic living expenses are covered.

There’s a difference, though, between living on a tight budget and living above your means.

When you live above your means, you spend more than you earn. To make up the difference where your paychecks fall short you might charge things to credit cards or use loans to cover spending.

If your budget is tight, it means that you’re most likely living at or just below your means.

In other words, you’re spending all or most of the money you earn each month. But you’re not necessarily spending more than that because your budget doesn’t allow it.

Related post: How to Track Spending Each Month and Stop Blowing Your Budget

15 Simple Ways to Live Well on a Tight Budget

Living on a tight budget can feel restrictive but it doesn’t have to. It’s possible to live well on little money if you’re creative about managing your income and expenses.

These money-saving tips can help you get a better grip on your finances and create some wiggle room when your budget is tight.

1. Learn to love budgeting

Budgeting often gets a bad reputation but it’s truly your friend, not your enemy. So if you’ve avoided budgeting in the past or you look at it as a dreaded chore, it’s time to rethink things.

A budget is simply a plan for managing your money.

That’s it. It’s not some torturous thing that means you can’t have any fun ever. A budget is just you telling your money where to go each month.

Learning to love (or at least like) the idea of being in charge of your money is key for living on a tight budget. Because there’s only so much money to go around.

Here’s where creating some personal money goals can help. Ask yourself what purpose living on a tight budget serves.

Sometimes you don’t have a choice because of income limitations or something else. But other times, you might be choosing to downsize your budget because there’s something bigger you want.

Maybe it’s paying off all your debt or upgrading your home or just having some savings in the bank so you’re not constantly worried about an emergency blowing your plans out of the water.

Keeping your vision in sight can help make the idea of budgeting less scary so it’s something you want to do.

Relate post: How to Make a Budget When You Hate the Idea of Budgeting

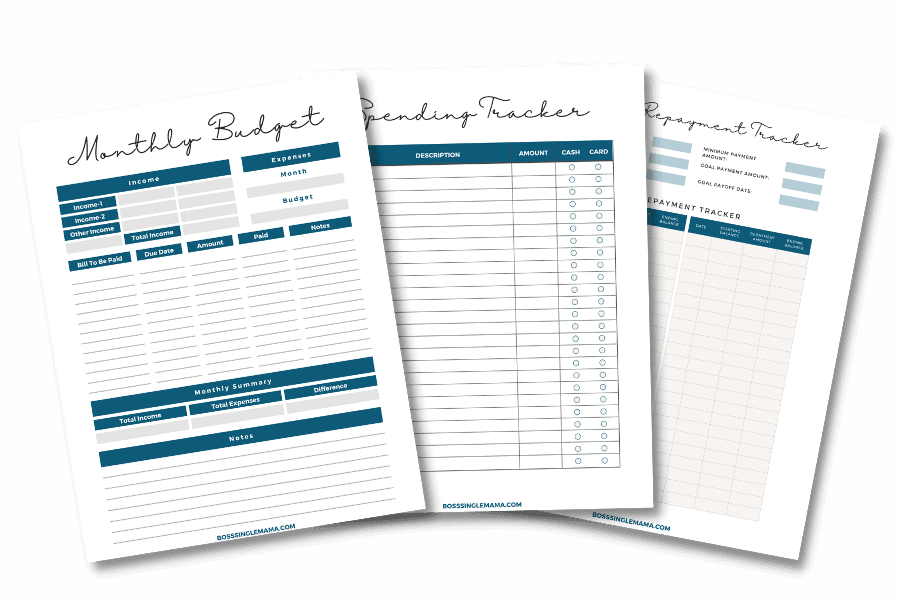

2. Use a budget planner

A budget planner can make managing your money so much simpler, especially when you have to track every penny.

The best budget planners allow you to keep track of:

- Income and what you’re earning each month

- Expenses and what you’re spending

- Debt repayment

- How much you’re saving

- Progress toward your financial goals

There are lots of free ways to create a budget planner. I’ve got a free budgeting template that can get you started.

But if you’re looking for more than just a basic budgeting worksheet, be sure to check out my top picks for the best budget planners.

Take Control of Your Budget!

Grab these FREE budgeting printables and get your finances on track when you join the weekly newsletter!

3. Figure out your wants vs. needs

To live well on a tight budget, you have to be crystal clear about what you’re spending money on and why. So ask yourself what’s most important when prioritizing wants vs. needs.

Needs are the essential things you require to live, such as housing, food, clothing and health care. Wants are anything you can live without but like to have.

Make a list of everything you spend money on. Then really consider what’s a need and what you can cut out.

One way to test this is to try a no-spend challenge. This is where you commit to not spending money on anything other than essentials for a set period of time, like a week or a month.

Not spending money does something really powerful for you. It helps you get some clarity on what’s truly needful and what’s not.

If you haven’t given a spending freeze a try before, I highly recommend it. You might be surprised at what you don’t need to spend money on.

Being able to cut out even one thing from your spending can help create some wiggle room in a tight budget.

Related posts: 40 Ways to Cut Expenses and Stop Wasting Money

4. Choose a budgeting system that works for you

The great thing about budgeting is that there’s no one way you have to do it. There are lots of different budget systems you can try as a family.

For example, you might use any of these budget methods:

- Zero-based budgeting

- Cash envelope system

- Half-payment method

- Values-based budgeting

- 50/30/20 budgeting

- 50 15 5 rule saving

If you’re new to budgeting or you’ve tried before but couldn’t make it work, then it could be because you were using the wrong method.

For example, the cash envelope system is the easiest to start with.

You create envelopes for different budget categories, then allot your budgeted amount of cash to each envelope. Once you’ve spent all the cash in the envelope, you can’t spend anything else in that budget category for the month.

If you’re looking for some cash envelopes to get started, be sure to check out the cute options in the Boss Single Mama shop!

5. Pay yourself first, no exceptions

“Pay yourself first” is something almost every financial expert says. And if you live on a tight budget, it’s a smart rule to follow.

The question is, how do you save money when you’re broke?

No matter how tight your budget is, it’s still important to make saving a priority. Having money in a savings account makes it easier to sleep at night in case an emergency comes along.

As you’re putting together your budget, add saving as one of your regular monthly expenses.

And it’s fine if it’s only $5 or $10 a month. The amount doesn’t really matter at the beginning. What’s important is saving this money regularly.

Because the act of saving alone sends a signal to yourself and the universe that you’re not letting a small budget hold you back. And remember to choose the right savings account to get the best rate on your money.

For tips on saving money, check out these posts:

- 150+ Best Frugal Living Tips to Save a Ton of Money

- 17 Dave Ramsey Tips That Can Help You Stop Being Broke

- Save Money Live Better (20 Easy Ways Save More This Year)

- 52 Week Money Challenge Explained (+ Free Weekly Savings Challenge Printable)

Looking for the best high yield savings option? Compare savings account rates online at top banks and credit unions now!

6. Track your spending

When you live on one income or a small income, you can’t afford for any of your dollars and cents to go astray. Keeping track of your spending can help you avoid blowing your budget or running up debt.

Because here’s the thing, it’s so easy to spend money mindlessly. And that can create real headaches for you if you only have so much money to go around each month.

There are plenty of great financial tools you can use to track your spending. (My favorite is Personal Capital.)

But you could just as easily write it down in a notebook, spreadsheet or budget binder. The point is to be consistent with it, just like saving, so you stay in control of your spending.

Looking for a simple money management tool? Empower makes it easy to track spending, saving, investing, and budgeting in one place so you can tackle your financial goals!

7. Find (and plug) money leaks

Sometimes you need an extra pair of eyes to see things you might be missing with your money, even when you think you’ve cut out all the fat.

For example, you may have gone over your expenses thoroughly but you could still have some things that are costing you cash. That’s where a money tool like Trim can help.

Trim is a financial manager that reviews your spending and looks for things you can cut. Think bank fees or unwanted subscription services.

It’s super easy to use to cut expenses.

And the truth is, anything extra you can cut out helps when you have a tight budget to work with. Even eliminating $10 a month in bank fees means you have $10 extra to put toward debt or save.

8. Negotiate your bills

When you’re on a tight budget, just blindly paying the bills without considering the cost can lead to money headaches.

While some things, like your rent or mortgage, may be non-negotiable, you might be able to get a better deal on some of your other bills, including:

- Cellphone services

- Utilities

- Car insurance

- Homeowners’ or renters insurance

- Cable and internet services

Go over your bills and consider what you might be able to reduce without getting rid of it completely.

If you don’t have time to haggle with your billers, Billshark will do it for you.

Billshark reviews your bill payments, then negotiates with your billers on your behalf to try and secure a better deal. You can learn more about how it works in this detailed Billshark review, or sign up for Billshark now to start saving money.

9. Stop using credit cards

Credit cards can sure a purpose in your financial strategy if you’re using them wisely. For example, if you charge purchases to your cards and earn cash back, then pay the balance in full each month that’s a smart way to use credit.

On the other hand, debt can cramp your style if you’re already living on less money. So if credit cards are your financial Achilles’ heel, then it’s time to break the habit.

You don’t have to close your credit card accounts altogether; and actually, that can hurt your credit score. But you should be ready to wean yourself off of them so you can reset your budget and spending.

Breaking a credit card habit starts with budgeting and cutting expenses. So if you’ve gotten this far in this list of tips for living on a tight budget, you’ve already got a blueprint for managing debt.

10. Create a debt payoff plan

Here’s a secret about paying down debt: there’s no magic formula for how to do it.

You just have to commit to it and do it, which starts with having a plan and a strategy for paying down debt.

There are two main approaches for paying off debt that are popular: debt snowball and debt avalanche. With either method, you list all your debts and then pay them off in a specific order.

The difference is that with the debt snowball, the payoff order is from the lowest balance to highest. With the debt avalanche, it’s the highest APR to lowest.

The snowball will help you wipe out some of your smaller debts faster. But the avalanche will save you more money on interest.

I used the snowball method to pay off all my credit cards and loans. I needed that motivational boost that comes from seeing a zeroed-out balance. But you should choose the method that works best both financially and mentally for your family.

Also, you can make debt repayment easier on yourself by making your debt less expensive.

So if you have credit cards, you might try a 0% balance transfer or a debt consolidation loan. For student loans, you can consolidate or refinance them.

It can take a little effort to lower the interest rates on your debts but it can be well worth it if you want to save money on one income.

If you’re looking for 0% APR balance transfer offers for credit cards, check out Credit Karma.

You can also use a tool like Tally to save money on credit card interest. Learn how Tally works to help you pay down credit card debt.

And if you’re interested in student loan refinancing or consolidating other loans, you can take a look at borrowing options from SuperMoney.

11. Automate bill payments

If you’re trying to make living on a tight budget work, automating your bills is a must.

It’s so much easier to handle your budget when you’re not worrying about whether you forgot to pay a bill. And it’s super easy to schedule payments to work with your chosen budget system.

So, for example, if your family gets paid on the 1st and the 15th of every month you might use the half-payment budgeting method. You can then schedule bills to be paid automatically from each paycheck.

Automating can help you avoid late fees and money stress, not to mention saving you time.

12. Automate your savings

When you’re setting up automatic bill payments, go ahead and set up automatic deposits to savings while you’re at it.

Automating your savings can help you stick to the “pay yourself first” rule. Otherwise, the money you plan to save each month may never make it to savings.

There are a few ways to automate savings:

- Have your employer direct deposit part of your paycheck into your savings account

- Schedule automatic transfers from checking to a high yield savings account each payday

- Using a spare change app to save for you

The last option is one of my favorites because it’s so stupidly simple.

You sign up for a spare change app and link it to your bank account. The app then rounds up your checking account transactions and saves the difference.

That’s exactly how Acorns works and I love the simplicity of it. You’re saving money without having to think about it or make any extra effort.

I don’t know about you but when it comes to saving money, easy is always what I love best. And the beauty of something like Acorns is that you can literally save pennies, which is perfect if you have a tight budget.

13. Save money on food costs

Food may be the biggest part of your budget, after housing.

The average American household spends over $4,000 per year on food at the low end and just under $14,000 per year at the high end.

Food costs can drain a tight budget in no time but there are some things you can do to save money in this area.

Some of easiest ways to save money on food include:

- Planning meals. Meal planning can save you time, stress and money because it’s so much easier to stick to your grocery shopping budget when you know exactly what you’re going to make. You can grab a free meal planning template here or check out $5 Meal Plan for low-cost, premade meal plan ideas.

- Know the cheapest foods to buy. Some foods are more expensive than others and you can easily eat well on a tight budget by sticking to the cheapest options. Here’s a list of the 35 cheapest (healthy) foods to buy now to stretch your grocery budget.

- Stick with low-cost meals. Making dinner, even if you’re feeding a large family, doesn’t have to break the bank. By sticking with dirt cheap meal options, you can eat well for pennies per serving!

- Use Ibotta to grocery shop. If you’re not using Ibotta to shop for groceries, you’re missing out on a simple way to save money on food. Ibotta is an app that pays you cash back when you shop for groceries, clothes and other items at participating merchants. Learn how Ibotta works or sign up for Ibotta now to snag $20 in bonuses!

Related post: 35 Easy Ways to Save Money on Groceries (Without Coupons)

14. Save your windfalls

Every now and then, you might get a little extra money that you weren’t expecting.

For example, that can include:

- Tax refunds

- Stimulus checks

- Rebates or refunds

- Money you inherit

- “Found” money you forgot about

It’s tempting to spend these mini-windfalls, especially if living on a tiny budget has you feeling a little deprived.

But if you can resist that temptation, saving it might be the better option.

For instance, you can use unexpected money to start your emergency fund. Or you might use it to fill up some of your sinking funds savings buckets if you have them.

Again, every extra penny really does count for making your budget work when you don’t have much wiggle room.

And here’s one more tip: If you get paid biweekly, save your extra paychecks.

Getting paid every other week means that there are some months where you’ll get three paychecks instead of two.

If you want a quick way to boost your savings, mark your calendar for those extra paydays. Then stash the money in a high yield savings account until you need it.

15. Find ways to grow your income

These tips can help you make living on a tight budget work. But you may not want to stay stuck in budget purgatory forever.

So what do you do?

Paying off debt, cutting expenses and committing to saving can certainly help. But even those smart money habits may only take you so far.

At some point, you may need to consider what you can do to make more money.

That might include:

- Starting a side hustle

- Starting a business

- Negotiating a pay raise at work

- Getting a part-time job

- Getting a second job

Out of all these options, I like starting a side hustle or business the best.

When you start a side hustle or business, you can be in charge of when you work and what you earn. And there are lots of ways to make money on the side, including:

- Freelance writing

- Starting a blog

- Becoming a virtual assistant

- Doing online proofreading jobs

- Online transcription jobs

- Grocery shopping for other people

- Delivering food

I could go on and on. If you’re not exploring ways to make extra money yet, these posts can give you some inspiration for how to get started!

- 50+ Legitimate Ways to Make an Extra $1000 a Month

- 142 Side Hustles You Can Start Now to Make Extra Money

- 25 Flexible Side Hustles That Pay $10000 a Month

- 25 High Paying Side Hustles for Single Moms

Final thoughts on living well on a tight budget

Thriving on a small budget is possible if you’ve got the right plan and you’re committed to following through. The more money you can save, the easier it becomes to work toward your financial goals. And making some of the changes mentioned here could make a big difference in your family’s overall financial health.

And remember to grab your free budget template and savings tracker!

Need more money tips? Read these posts next:

- Budgeting for Teens: An Easy Guide to Teen Budgets

- Baby on a Budget: 23 Smart Ways to Save on New Baby Expenses

- Single Mom Budget Guide (9 Smart Budgeting Tips for Single Mothers)

- How to Budget Using the Digital Envelope System

- Budgeting for Kids: Best Tips for Teaching Kids 2 to 18 About Money