Last Updated on November 12, 2022 by Rebecca Lake

How to Save 10000 in a Year

Want to know how to save 10000 in a year? Wondering whether it’s even possible?

Saving $10,000 in a year might matter to you if you have big financial goals you’re trying to reach.

For example, you might need $10K for a down payment if you’re trying to buy a home. Or you might be interested in how to save 10000 in a year so you can buy a new car.

Saving $10000 in a year isn’t impossible though it does require some hard work and a plan.

If you’re ready to stop spending money and start growing your savings balance, knowing the best ways to do it can help you on your financial journey.

Taking the first step can be a little daunting. So here are some of the most creative ways to save 10000 in a year.

Related post: How to Make 10k in a Week (10 Awesome Ways to Make $10,000)

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

How much do I need to save a month to get $10000?

One year isn’t a long time when you think about it. If you’re trying to figure out how to save 10000 in a year, the first thing you need to do is figure out how much you’ll need to save each month.

Having a monthly savings goal can make saving $10,000 in a year less overwhelming. When you break big financial goals into small pieces, they become easier to achieve.

To figure out your monthly savings goal when working out how to save 10000 in a year, you’d divide $10,000 by 12 months.

To save $10,000 in a year, you’d need to save $833 each month.

What if you want to approach your financial goals a different way?

Saving $10,000 a year works out to saving…

- $384.62 biweekly

- $192 in weekly savings

- $27 a day

When you set goals this way, it’s easier to see how to save 10000 in a year.

Related post: 220+ Ways to Save Money on Nearly Everything

How to Save 10000 in a Year

Ready to start working toward your goal of saving $10,000 in 52 weeks?

Putting these tips to work can be a great way to improve your financial situation.

1. Budget for your monthly savings goal

You already know that you’ll need to save $833 per month on average to save $10,000 in a year. The next step is building that amount into your monthly budget.

Review your budget and monthly expenses to see if you already have $833 per month available to save.

If you don’t, then you’ll need to go over your spending again to see what you can cut out. And if you do, then make saving that amount a line item in your budget each month.

Having a set amount allotted for saving in your budget can make it easier to reach your goal without as much effort.

Related post: Why Is Budgeting Important? (10 Life-Changing Benefits of Budgeting)

2. Save before you spend

“Pay yourself first” is the golden rule of saving money.

And if you’re serious about how to save 10000 in a year then it’s important to keep that rule in mind.

When you pay yourself first, it’s a lot less tempting to spend instead of saving. And it’s easy to do.

You can set up an automated transfer from your checking account to a separate savings account each pay period. Or if your employer gives you the option, you can have some of your paychecks sent to savings via direct deposit.

Automatic transfers ensure that you’re saving before you’re spending. And here’s another important tip:

Make sure you’re keeping your savings in the right place.

A high-yield savings account, for example, can be a great place to save. Online banks can offer savers a solid interest rate while charging minimal fees.

You can also open a money market account or CD account to hold your savings.

Looking for the best place to keep your money when trying to save 10000 in a year? Try Axos Bank.

3. Save your spare change

Saving $10,000 in a year is no small feat and it can be challenging when you’re on a tight budget.

Setting aside spare change can help you make progress toward your financial goals without putting a strain on your monthly income.

When you sign up for an app like Digit, for example, you can save spare change automatically.

The app links to your bank and reviews your spending to find the money you can afford to save. Once it finds that money, the Digit app automatically transfers it to savings for you.

You can use Digit to save smaller amounts of money on top of the larger amounts you might be setting aside each pay period.

Acorns is another app you can use to save a little bit of money at a time.

Just like with Digit, Acorns links to your bank account. But instead of looking for extra money to save, Acorns rounds up your purchases and invests the difference in the stock market.

You can build wealth in investment accounts without much money required upfront. And little things like a penny here or a dollar there really do add up over time.

4. Earn cash back to save

Using apps that pay cashback when you buy groceries, shop online or book travel is a smart idea for how to save 10000 in a year.

These apps pay you cash based on your typical spending habits. So if you’re visiting the grocery store, for example, you could earn 2 to 5 cents back or more on every dollar you spend.

This is a creative way to save money based on how you live your everyday life. And you could earn a little bit of cashback (or a lot) depending on how you spend.

Not sure which apps to use?

Here are three of the best ways to earn cashback on purchases:

Rakuten: Earn up to 40% cash back at partner merchants, plus get up to $40 in bonus cash just for signing up! Ibotta: Earn cash back on groceries and shopping, including Walmart Grocery and Instacart. Get up to $20 in cash bonuses when you download the Ibotta app! Dosh: Dosh pays you cash back on shopping, dining and travel. Sign up for Dosh to earn cash back on top of cash rewards you're earning with your credit card!

You can download one app or all three. And besides earning cashback on purchases, you can earn more cash when you refer friends and family!

Related post: 50 Free Money Hacks to Earn Extra Cash

5. Save your extra paychecks

Here’s a simple fix if you’re struggling with how to save 10000 in a year: Save your third paycheck.

If you get paid biweekly, then at least a couple of times a year you’ll end up getting three paychecks for the month instead of two.

An easy way to add money to your $10k savings goal is to save the money from the extra pay period.

And if you’re budgeting your other two paychecks for the month correctly, you won’t even miss the money!

Related post: Budget Percentages Explained: 3 Easy Ways to Create Your Ideal Budget

6. Eliminate wasteful spending and streamline monthly payments

Paring down your budget matters when you’re working toward how to save 10000 in a year. That means looking at your biggest expenses and your smallest ones, too.

Grey charges, for example, are small, recurring expenses that can add up to a lot of money wasted. They include things like:

- Recurring fees you’re charged after a trial membership ends

- Automatic renewals for computer software programs

- Credit card protection insurance

- Fees for subscription services you no longer use

- Gym membership fees

Grey charges can drain your budget but there’s a simple way to get rid of them.

You can use the Trim Financial Manager to find these hidden expenses charged to your debit card or credit card accounts and cancel them.

Trim will go over your transaction history with a fine-toothed comb to find any grey charges or recurring subscription fees that you don’t need. And Trim will also cancel them for you, saving you money and time to boot.

7. Lower your bills

Some monthly bills stay the same month to month.

For example, housing costs are typically fixed, in terms of what you pay for rent. Or if you own a home, the only way to lower your mortgage payment might be refinancing.

(And if you’re thinking about that, check out Supermoney to see if you qualify for a lower rate.)

But other bills you may be able to reduce, which means more money you can add to savings. For example, you be able to save on:

- Utility bills

- Car insurance

- Homeowner’s insurance

- Cell phone service

- Cable and internet

If you don’t have time to call up insurance companies, the cable company, your cell phone company or other billers, there’s an easy fix.

You can have Truebill negotiate your bills for you and drastically cut your expenses.

Truebill is the easiest way to find subscriptions, manage bills, and even cancel recurring charges with a single click.

Sign up now to start saving on utility bills and other monthly expenses.

8. Cancel your contract cell phone

If you’re still paying money for a contract cell phone for yourself or a family member then you have a prime opportunity to save big.

Once upon a time, my phone bill was around $225 a month. That was a lot of money for something I didn’t even use that much.

So I canceled my contract and switched to a prepaid phone instead.

My phone bill went from $225 a month to $50 a month, saving me $2,100 a year.

If you’re serious about how to save 10000 in a year, an extra $2100 could go a long way toward making progress.

Switching to a prepaid phone service like Tello can help you find instant savings.

Tello offers family plans for under $50 a month and they have a great selection of phones to choose from. You can read about my experience using Tello or head to the Tello website to compare plan pricing.

9. Save your windfalls

Windfalls, bonus money, found money–whatever you want to call it–can all help give your $10k savings goal a huge bump.

Any time you receive money you weren’t expecting, you can save it instead of spending it. That includes saving:

- Tax refunds from federal taxes or state taxes

- Stimulus checks

- Rebates

- Refunds

- Bonuses at work

- Employer reimbursements you weren’t expecting

- Cash gifts from friends/family

- Employer match contributions to a 401(k)

For example, the average tax refund for 2021 was just shy of $3,000. That’s $3,000 that could help you make real progress toward your goal of how to save 10000 in a year.

And if for some reason you haven’t filed your federal taxes yet, get on it!

If you owe taxes, then waiting to file could result in penalties and interest. And if you’re due a refund, you’re basically letting the government enjoy your money in the form of an interest-free loan.

You can start filing taxes for free right now with Credit Karma.

10. Check your tax withholding

If you work a regular job and aren’t self-employed, then you probably filled out a Form W-4 when you got hired.

This form tells your employer how much to withhold from your paychecks for federal taxes.

Sounds simple, but it’s possible that you could be withholding too much. A simple way to tell if you are is if you get a tax refund each year.

Getting a tax refund means you paid too much in taxes so the government’s giving the extra back to you when you file your return.

Adjusting your withholding and filling out a new Form W-4 means you won’t get a refund. Instead, you’ll get that money in your paychecks every payday.

You could then save that money throughout the year and earn interest on it. (Again, instead of letting the IRS use it as an interest-free loan.)

If you don’t know how much to withhold, the IRS offers a free withholding calculator you can use to find the right amount.

11. Try a spending freeze

A simple way to accelerate your savings and boost cash flow is to stop spending money for a set period of time. That’s what a no spend challenge does.

No spend days mean you don’t spend any money on nonessentials.

For example, you could try a week-long spending freeze to save money toward your $10k goal.

Instead of spending money on dinner out you could meal plan at home. Or you could skip a shopping trip to enjoy the fresh air at a local park.

You may decide to go without spending for 30 days if you’re more ambitious. Some people have even done a no spend year!

The point is to focus on your needs versus wants to get perspective on how much you actually spend. And you might be surprised at how much you could save with a spending diet.

Here are 10 simple tips for crushing a no-spend challenge if you’re not sure how to get started.

12. Make debt less expensive

If you have student loan debt, credit card debt, personal loans or other debts, getting a lower rate could help you save money and pay them off faster.

For example, you could refinance student loans to get a better deal. Or you might consolidate credit cards with a 0% balance transfer offer.

The faster you can reduce debt, the easier it becomes to have enough money to save.

Related post: Right Hand Itching? (Why Your Itchy Palms Could Be a Good Luck Charm)

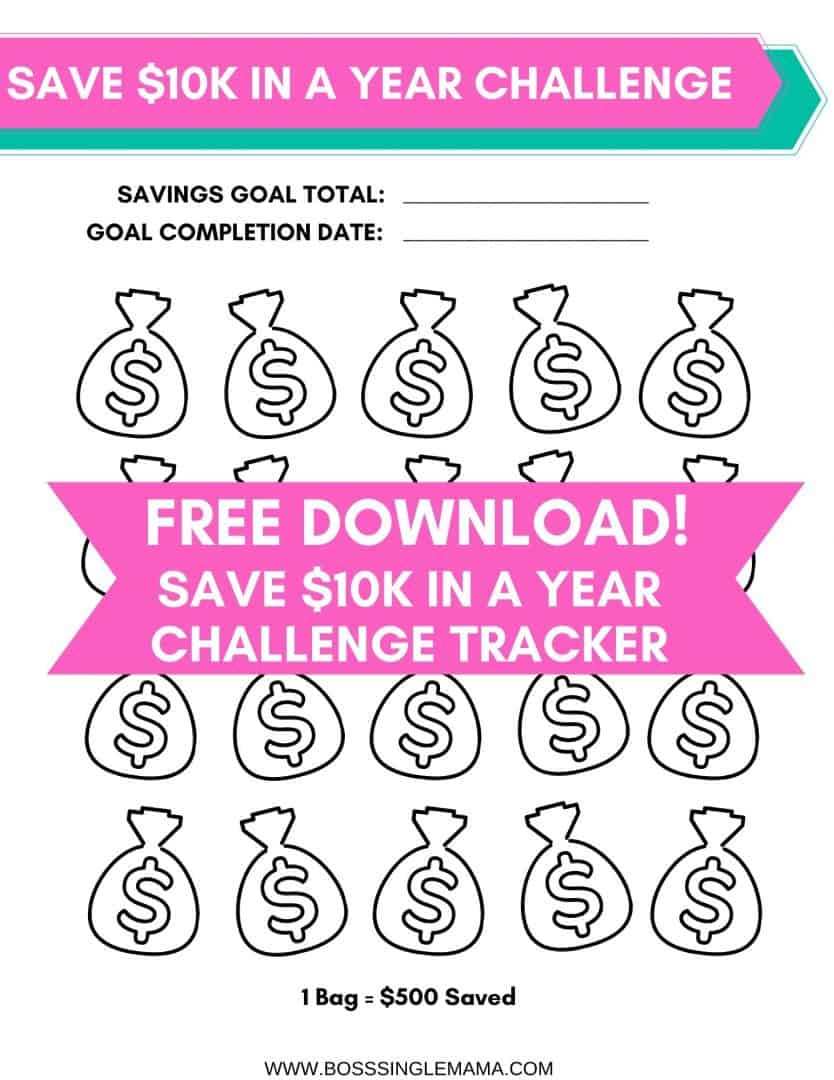

How to Save 10000 in a Year (Printable Savings Tracker)

Want a simple way to keep track of your progress in saving 10000 in a year?

Click the image to sign up for the Resource Library and download your free save 10k challenge printable tracker!

Bonus tip: Increase your current income

When deciding how to save 10000 in one year, making more money can always help.

But how do you make more money so you can save 10k in a year?

Here are four ways to increase the amount of money you bring each month.

1. Negotiate a raise

If you’re paid a salary, then making more money can start with asking for a raise.

Negotiating a raise isn’t always easy, though. You’ll need to be able to show your employer why you deserve a bigger paycheck.

First, do your research. Look at what other people in a similar role are earning, compared to what you make.

Then, figure out what makes you unique and what value you bring to the company.

For example, did you recently help the company land a $1 million client? Have you been able to help your employer save $100,000 by cutting out wasteful spending?

Those are things that can help you shine and convince your employer that you’re worthy of a raise.

Need more tips on negotiating a pay raise? Check out these strategies for getting a raise from Indeed.

2. Increase your hours

If you’re paid by the hour instead of a salary, you could make more money toward your how to save 10000 in a year goal by working more.

Whether this is feasible can depend on whether your schedule allows you to work more and whether your employer has extra hours on the payroll.

Just consider how much more you might have to pay in taxes on anything you make above your normal earnings.

3. Get a part-time job

A part-time job can also help with bringing in the extra money you need to save 10k.

The key is finding a part-time job that works around your schedule so you can make money in your free time.

Some of the part-time jobs you might consider include:

- Working at a retail store

- Delivering newspapers

- Restaurant jobs

- Doing in-store food or product demonstrations

- Finding at-home call center or customer service jobs

Some part-time jobs pay better than others. So think about how much time you might have to put in and what you could make if you’re trying to save 10k in a year with extra income.

And don’t count out part-time jobs you can do online.

If you can type, for example, then you might check out online transcription jobs for beginners.

Or if you’ve got an eye for detail, you could make money with online proofreading jobs.

4. Start a side hustle

Last but not least, you could always start one or more side hustles to make the money you need for saving $10000 in a year.

Side jobs can help you achieve financial independence faster and some can even help you earn a passive income.

Here are some good things you can try to make money legitimately:

- Freelancing writing

- Blogging (great for earning passive income!)

- Being a virtual assistant

- Taking surveys for money (I’ve made over $4,500 with Survey Junkie!)

- Becoming a research study participant

- Testing out websites

- Becoming an online stylist

- Teaching kids online

There are so many ways you could make $10000 in a year with side hustles. So it pays to consider at least one money-making idea you could try.

If you need some inspiration for profitable side hustles to start, check out these posts:

142 Legitimate Side Hustle Ideas to Make Money Now

30+ Ways to Make an Extra $1000 a Month Online (or Off)

10 Side Hustles That Pay $2000 a Month

(And it’s a good idea to consider the extra cost of a side hustle before starting one.)

How to Save 10000 in a Year FAQs

How can I save $10000 in 100 days?

Saving $10,000 in 100 days works out to a savings goal of $100 a day.

To do that, you may need to cut your budget. This is the first step in how to save 10000 in 3 months.

The other is finding ways to make extra money. Luckily, there are plenty of ways to make $100 a day, including some that don’t require you to get a job.

Is $10000 in savings good?

Having $10,000 in savings is a good thing if it helps you feel financially reassured.

And it’s nearly twice the median savings account balance of $5,300 that the average household has.

So yes, having $10000 in savings is good. But remember that 10k saved is just a starting point.

Once you get into the savings habit, you can keep increasing your goal until you have $50,000, $100,000 or even $1 million saved and invested! Aiming for those kinds of numbers is what can help you go from just having extra cash to building real wealth.

Related post: How to Get Rich From Nothing (10 Proven Secrets to Become a Millionaire)

What should I do with 10000 in savings?

You might have a specific reason for wanting to save $10000. Or you might not.

If you’ve set a goal of saving $10,000 in a year just to see if you can do it, think about how you can put that money to work.

For some of the ways you could use $10000 in savings include:

- Building a larger emergency fund

- Paying off some of credit cards or student loan debt

- Putting money down on a home

- Starting a business

- Investing in the stock market

- Investing it in yourself

Having a plan can give your savings goal some meaning. And it can help you stay motivated as you work on saving your 10000 dollars.

Final thoughts on how to save 10000 in a year

Saving $10000 in a year is a big goal. And even after reading all this, you might be thinking I just can’t do it.

Personal finance can be challenging to master. So here’s one more tip for how to save 10000 in a year: Change your mindset.

Believe that you can save that first $1. And once you do, start believing you can save your first $100, then your first $1000. Having a positive money mindset is key to achieving financial security.

And remember, the best time to start saving isn’t next month or next year. It’s right now.

Don’t forget to grab your save 10k in a year challenge tracker before you go!