Last Updated on October 5, 2022 by Rebecca Lake

50 30 20 Budget Rule for Money

Need a simple way to budget by percentages? The 50 30 20 budget is one of the easiest (and most popular) ways to manage your money.

What is the 50 30 20 rule for money?

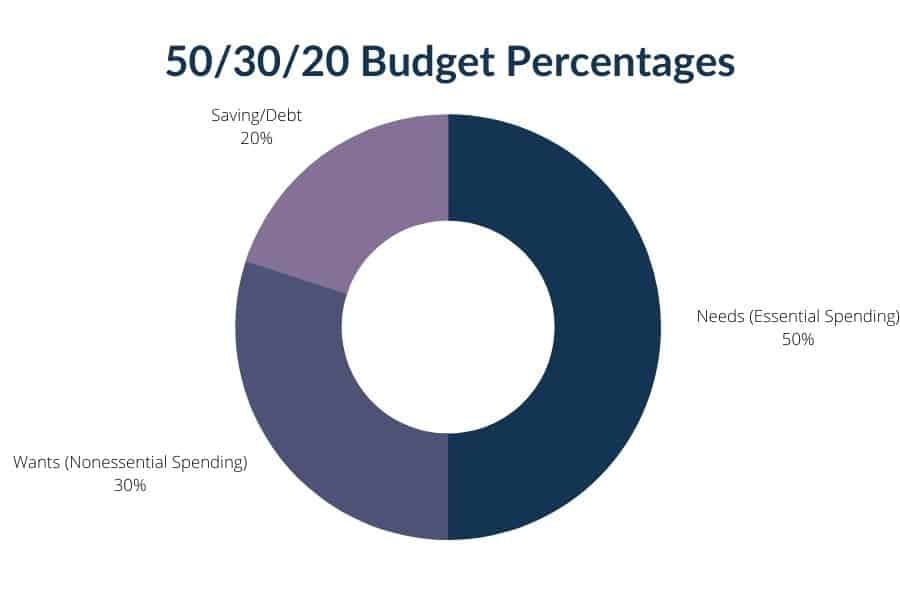

In a nutshell, the 50 30 20 budget rule divides your income into three categories: needs, wants and saving/debt repayment.

Whether you call it the 50 30 20 budget, the 50/30/20 budget or the 50-30-20 budget it all means the same thing. You’re dividing your income up by percentages each month.

And having a budget is important for so many reasons. If you’ve struggled with budgeting, this post is for you.

Today, I’ll explain:

- How the 50 30 20 rule works

- How to set up a 50 30 20 budget

- What the 50 30 20 rule of money means for your finances

Related post: Budget Percentages Explained: 3 Simple Tips for Budgeting Income

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

What Is the 50-30-20 Budget Rule and Why Should You Follow It?

The 50 30 20 budget rule is a budgeting system that was developed by Senator Elizabeth Warren (D-Mass.) in her book, “All Your Worth: The Ultimate Lifetime Money Plan.”

The Elizabeth Warren 50/30/20 budget has you divide your monthly income into three buckets:

- 50% to pay for needs

- 30% to pay for wants

- 20% to pay for savings/debt

That’s it. This is why it’s one of the easiest ways to budget by percentages.

Compared to something like a zero-based budget, which requires you to assign every dollar of income a job, the 50 30 20 budget rule offers more flexibility. And it has fewer categories than Dave Ramsey’s budget percentages.

You simply have to know how to calculate 50%, 30% and 20% of your income each month to know what goes in each bucket.

So, why should you follow the 50 30 20 rule for money?

You might like this budgeting method if:

- You’ve struggled with other budgeting rules

- You don’t want to have to give every dollar a specific job each month

- You want to find a way to balance spending and debt repayment with wants and saving

The 50-30-20 budget is an effective way to keep your spending in check. And it can also help with building wealth and reaching your financial goals over the long term.

Related post: 50 15 5 Rule: How to Save More and Spend Less

How do you do the 50 20 30 budget rule?

Figuring out your budget using the 50 30 20 rule is not complicated at all.

There are two main steps:

- Add up your income for the month

- Divide your income into percentages

That’s all there is to it.

This type of budget is good because you can update it each month as your income or expenses change.

So if you’re a freelancer or side hustler, for example, your income might not be the same each month. But you can still use this budget system if you know what your income will be for any given month.

Related post: How to Teach Budgeting to Kids

How to Make a 50 30 20 Budget Step-By-Step

Ready to make a 50 30 20 budget? Here’s all you need to do to make it work!

1. Calculate your monthly income (after taxes)

The first thing you’re going to do to make a 50/30/20 budget is to figure out what your monthly income is after taxes.

This means all the money you expect to make in a month, including income from:

- 9 to 5 job

- Part-time or second jobs

- Side hustles

- Freelancing/business income

- Alimony or child support

- Government benefits or stimulus payments

- Refunds and rebates

If you only work a paycheck job, then you should be able to see what your take-home pay is for each pay period just by glancing at your pay stubs.

This is where you’ll see all the deductions your employer takes out of your paychecks. That includes withholdings for taxes, Social Security, Medicare and insurance.

But what if you’re self-employed or run a business?

If you don’t have an employer taking money out of your income for taxes, that’s up to you. You’ll need to make estimated quarterly tax payments instead.

When adding up your income if you’re self-employed or get a 1099 at the end of the year instead of a W-2, remember to subtract anything you set aside for quarterly taxes.

You can also subtract any expenses you plan to deduct. For example, a new laptop or internet service could be a deductible business expense if you use them to run a business or side hustle from home.

Related post: Cash Envelope System for Beginners (Get Started in 3 Easy Steps)

2. Budget 50% of your income for needs

The 50-30-20 budget requires you to create three categories of expenses, starting with your needs.

Needs are anything you have to pay to maintain a basic standard of living each month. So your needs list might include:

- Mortgage or rent payments

- Utilities

- Food

- Insurance

- Basic transportation if you need to drive to get back and forth to work

Daycare could technically fit into this category too if your kids aren’t school-aged yet. Copays for doctor visits or necessary medications could also fit here as well.

The most important thing to remember is that your total needs should be no more than 50% of your income.

If your needs are greater than 50%, then you have two options:

- Find expenses to cut

- Try a different budgeting method (like the 70 20 10 budget)

But if you’re at the 50% mark (or even better, below it) then you can move on to step 3.

Related post: 21 Things to Stop Buying That Can Save You Serious Money

3. Budget 30% of your income for wants

Wants are things you spend money on but don’t necessarily need to live.

If you’re following the 50 30 20 rule, 30% of your income should go to wants each month.

So what is a want?

Your list of wants might include:

- New clothes

- Dining out

- Entertainment

- Leisure travel

- Streaming services

- Home decor

- Books, DVDs, CDs and other media

Basically, a want is anything you could live without.

When making a 50 30 20 budget, your wants should be no more than 30% of what you make.

If your wants are more than 30%, then you’ll need to review your budget to decide what’s truly essential and what’s not.

And you might be surprised at how much you can cut out if you’re willing to trim the fat in your budget.

4. Budget 20% of your income to savings and debt repayment

Let me ask you a question.

Is your savings cushion as big as you’d like it to be? Or are you part of the 25% of Americans who say they have no savings at all?

If saving is a challenge, then the 50-20-30 budget could help you overcome it.

With this budgeting system, you’re dedicating 20% of your income to savings (or debt repayment).

So, you could use this budgeting method to save for:

- Emergencies

- A new to you car

- Vacations or travel

- A down payment on a home

- Home repairs or renovations

- A dream wedding

The 50/30/20 budget helps you save because it’s built into your monthly spending plan.

But how much of your 20% should go to savings if you have debt?

Making the decision to save vs. paying down debt is a tough one. If your debts have high interest rates or the payments are a drain on your budget, you might want to get rid of them as quickly as possible.

So when working out a 50-20-30 budget, consider how much should go to debt vs. savings.

It might be an even split, with 10% for savings and 10% for debt. Or you might save 5% of your income instead and devote the other 15% to getting rid of your debt faster.

Related post: 90+ Cash Envelope Categories to Help You Budget More Effectively

Pro tip: Find ways to make your debt less expensive

If high interest rates are keeping you from getting ahead with debt repayment, there are a few things you can do to change that.

Here are some ways to make your debt less expensive and save on interest:

- Use Tally. Tally is a financial app that saves you money on credit card interest. When you get the Tally app, you can reduce your credit card APR. More of your payment goes to the debt, not interest, so you reach debt freedom faster.

- Try a balance transfer. A 0% APR balance transfer offer is another way to save on credit card interest. Just remember that you’ll have to pay the balance in full before the promotional period ends to avoid interest charges.

- Consolidate debts with a personal loan. Debt consolidation loans can help you streamline your monthly payments. And if you’re able to get a lower interest rate they can save you money as well.

Read this Tally app review to learn more about how it works. Or if you want to try debt consolidation, compare personal loan offers at SuperMoney.

50 30 20 calculator

Using a 50/30/20 budget calculator can make breaking up your income easier and less time-consuming.

If you need a 50-30-20 budget calculator, I have a free one you can use.

All you do is plug in your income and expenses in the different categories listed in the calculator.

Once you do that, you can see how your spending aligns with the 50 30 20 budget. You can even print and save your budget from this free 50/30/20 calculator!

Calculate your 50/30/20 budget here

50/30/20 Budget Example

Having an example to follow can help you make sense of how to do a 50-30-20 rule budget.

So here’s what this type of budget looks like, assuming you make $5,000 a month after taxes.

- 50% of your income for needs = $2,500

- 30% of your income for wants = $1,500

- 20% of your income for savings/debt repayment = $500

This is how much you’d be able to spend in each bucket. From here, you’d have to divide each percentage up into individual expenses.

So, for example, here’s what your 50% of income for needs bucket might look like:

- $1,200 for mortgage/rent

- $300 for utilities

- $200 for transportation

- $550 for food

- $150 for health care

- $100 for household maintenance

Now, your 30% of income for wants bucket might look like this:

- $600 for personal and family care

- $400 for leisure and recreation

- $500 for other expenses (such as charitable donations,holidays, tithing, etc.)

Finally, here’s what your final 20% of income for savings could look like:

- $250 for emergency savings

- $250 for retirement savings

- $500 for debt repayment

Remember, you can use a 50/30/20 budget calculator to work out the numbers. And you can also use a 50-30-20 spreadsheet or a 50 30 20 budget app to keep track of where your money goes.

50 30 20 Budget Rule FAQs

Still have questions about how the 50 20 30 rule for money works? Here are some quick and easy answers to the most commonly asked questions about the 50/30/20 budget.

Is the 50-30-20 rule weekly or monthly?

The 50 30 20 rule is designed to help you budget your money monthly. You start off with your income for the month, then divide it into three categories: needs, wants and savings/debt repayment.

You can, however, keep track of your 50 30 20 budget weekly.

Does the 50-30-20 rule include 401k?

The 50/30/20 rule uses your take-home pay, after deductions for taxes, insurance and 401k contributions. So you don’t need to account for 401k contributions in the 20% for savings category, since these are already taken out of your income.

You would, however, need to include deposits to a high yield savings account, Individual Retirement Account, investment account or college savings account in this 20%.

Ready to start investing for retirement? Get started with M1 Finance with as little as $100.

How much money do you save using the 50 30 20 rule?

The 50/30/20 rule says you should set aside 20% of your income for savings OR debt repayment. If you have no debt, the entire 20% could go to savings. But if you do have some debt to pay off, you’ll need to decide how much of that 20% can realistically go to savings.

What is the 70 20 10 rule money?

The 70 20 10 rule is another way to budget by percentages. With this budgeting method, 70% of your income goes to expenses, 20% goes to savings or debt repayment and the last 10% goes to tithing and investing.

Read my complete guide to budgeting with the 70 20 10 rule.

What is the 60/30/10 rule budget?

The 60/30/10 rule budget is designed for super savers. When you follow the 60-30-10 budget, 60% of your income goes to savings, 30% goes toward expenses and 10% goes to wants.

You might consider the 60 30 10 budget if you hope to retire early and you’re disciplined about saving.

Learn how the 60/30/10 budget works in this detailed guide.

Final thoughts on the 50 30 20 budget

Whether you call it the 50 30 20 rule, the 50/30/20 budget or the 50-30-20 budgeting system, it all means the same thing. It’s an easy way to budget your money each month, pay bills and save.

Have you tried the 50/30/20 budget? If so, head to the comments and tell me what you like most (or least) about it.

While you’re here, be sure to check out my favorite Smart Money Tools for making and saving money.