Last Updated on May 14, 2022 by Rebecca Lake

Why Is Budgeting Important? (The Importance of Budgeting Explained)

A budget is a detailed plan for spending money each month.

But why is budgeting important? And why do so many financial experts stress the importance of budgeting?

In a nutshell, budgeting is important because it puts you in control of your money. Understanding the importance of a budget matters when it comes to saving money, paying down debt and keeping up with your bills.

There are so many advantages of budgeting. The most important benefits of budgeting include knowing where your money is going and not being thrown off by unexpected costs.

But if you’re not making a budget regularly (and sticking to it) you could be missing out.

So today, I’ll walk you through the purpose of budgeting, why is budgeting important and what the importance of budgeting means for your financial future.

Relate post: How to Make a Budget When You Hate the Idea of Budgeting

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

What Are Budgets? And What Is Budgeting?

Before diving into why is budgeting important, let’s talk a little about what a budget is and what it means to budget.

A budget is a financial plan for how you spend money each month.

In other words, it’s you telling your money where to go and what to do. There are different budgeting methods you can use to make a spending plan.

Some of the most popular budget methods include:

- 50 30 20 budget

- Dave Ramsey budget percentages

- 70/20/10 rule budget

- 30-30-30-10 budget

- 60/30/10 budget method

These budget types are based on budget percentages. But there are other ways to make a budget that don’t use percentages, including zero-based budgeting and cash envelope budgeting.

So in answer to what are budgets? know that they’re a good tool for putting your income to work.

But what is budgeting?

Budgeting is the process or act of making a budget.

When you make a budget, you’re comparing income and monthly expenses side-by-side for a set period of time. Typically, your budget covers a single month of spending.

Making a budget isn’t hard work. But it’s sticking to your financial plan that’s the important part.

Related post: 12 Best Budgeting Planners to Organize Your Finances

What Is the Purpose of a Budget?

The purpose of a budget is to put you in control of your money.

Specifically, a budget is important because it can help you:

- Understand where your money is going each month

- Know whether you have enough money to meet your needs

- Find areas where you can cut back on spending, like groceries

- Pinpoint extra money to save

- Stop overspending and make better financial decisions

- Pay down debt

- Avoid bad spending habits

- Reduce financial stress because you’re not struggling to make ends meet

- Reach your long-term goals for money

A budget is your financial roadmap for money management. Without one, you may be more likely to overspend or not have a clue where your money goes.

The good news is more people are recognizing the importance of budgeting.

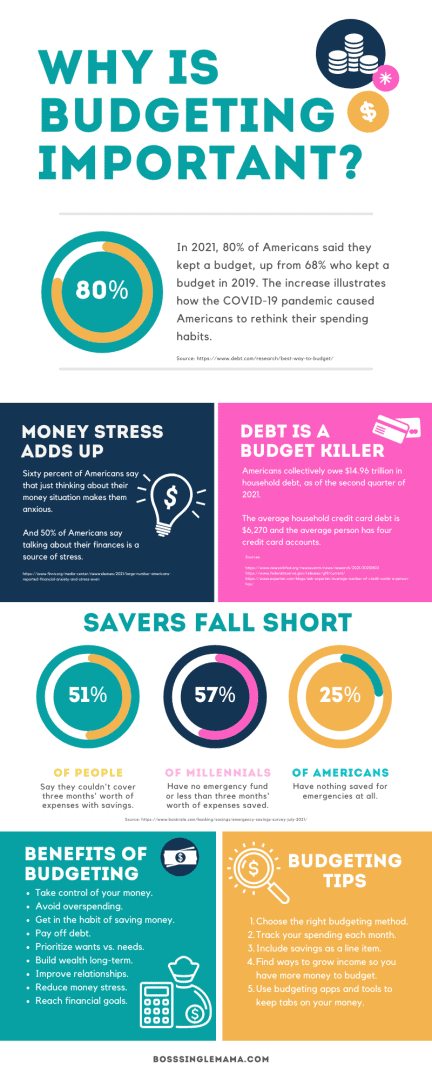

For example, a recent study from Debt.com found that 80% of people keep a budget. That’s up from 68% in 2019.

So if you aren’t enjoying the benefits of budgeting yet, it’s not too late to start preparing a budget.

Related post: How to Teach Budgeting to Kids

What Is the Importance of a Budget?

Budgeting is important for making the most of your money and reaching your financial goals.

Here’s what can happen when you don’t budget:

- You don’t know where your money goes.

- It’s easier to overspend if you’re not tracking expenses.

- You may end up with late fees if you’re not keeping track of when bills are due.

- It’s harder to save money.

- Even a small financial emergency can be a major source of stress.

- Debt may pile up if you’re not living below your means.

On the other hand, here are the benefits of budgeting you can unlock when you recognize the importance of a budget.

Here are some of the most important reasons for budgeting:

- You’re telling your money where to go, instead of it running you.

- Overspending isn’t an issue.

- You don’t pay late fees (what Dave Ramsey calls “stupid tax”) because you always know when bills are due.

- Your emergency fund is healthy and you’re also saving toward other goals, like retirement.

- You’re able to keep debt under control and pay it off.

- Financial emergencies don’t trigger panic attacks.

So if you’re asking, why budget? just remember that a budget is a tool you can use to create a richer life.

Why is budgeting important for families?

Budgeting is important for families because a budget can help you make every dollar count.

Raising kids is not cheap. According to the USDA, the average cost of raising a child born in 2015 is $233,610.

That’s the cost per child. And it doesn’t include the cost of college, which can be a steep amount of money on its own.

As a parent with growing kids, one of your biggest budget expenses may be food.

At the low end, a typical family of four spends $177.90 per week on food. At the high end, they’re spending $318 per week, according to the USDA.

So budgeting is important when it’s time to grocery shop.

And the more kids you have, the clearer the purpose of budgeting becomes as your expenses increase.

Related post: 42 Cheapest Foods to Buy on a Tight Budget

Why is budgeting important for students?

Budgeting is important for students because it can help them develop good money habits.

Some of the advantages of budgeting in college include:

- Learning how to separate needs vs. wants

- Understand the purpose of a budget for paying bills

- Getting into a regular savings habit

- Avoiding unnecessary spending and debt

As a college student, I didn’t have the first clue about the importance of budgeting.

And as a result, I graduated with a nice pile of student loan debt, some credit card debt, a terrible credit score and zero savings.

Had I understood the need for budgeting then, I likely could have avoided some of the dumb money mistakes I made in my 20s and early 30s.

So if you have kids who are approaching college age it’s never too early to teach them the importance of budgeting.

And if you’re reading this as a student, it’s a good idea to consider learning how to make a proper budget now. That can help set you up for financial success long term.

Related post: How to Budget Using the Digital Envelope System (2022)

Why is budgeting important for business?

Budgeting is important for helping business owners to manage cash flow and maintain the bottom line.

If you’re a stay-at-home mom who’s also a business owner like me, then you know what I’m talking about.

The purpose of budgeting for small businesses is similar to why budgeting is important on a personal level.

A realistic budget allows you to see how much money you have coming in and what’s going out.

This is important because it can help you decide where to invest money to grow your business. Or you can see where you may need to cut back to keep your business in the black on a monthly basis.

And that can help you to achieve the goals you set in your business plan.

Top 10 Benefits of Budgeting (Why Budgeting Is Important)

Why is budgeting important and what can it do for me?

If you’re still looking for answers on why a budget is important, here are 10 life-changing advantages of budgeting to know.

1. Budgeting gives you control over your money

It’s a terrible feeling when it seems like you have no control over your finances.

For example, if you live paycheck to paycheck you may worry that one small financial emergency is going to tip you over the edge.

As Dave Ramsey says, it’s easy to end up with “more month than money”, which can be stomach-churning, to say the least.

Creating a budget is important for banishing that feeling. When you have a proper budget, you can decide what happens with your money so you’re not scrambling at the end of the month.

And a budget forces you to be proactive in managing your money, instead of feeling helpless.

That’s an important first step in creating financial peace of mind.

2. Budgeting is important for understanding your spending habits

Do you ever find yourself wondering where your money goes? Or why you tend to spend money on certain things when you know they’re unnecessary?

A master budget is an important tool for helping you understand your spending habits and choices.

For example, you can use a budgeting planner to keep track of your expenses. You can categorize each expense to see where you spend the most.

Once you figure out where your money goes, it’s easier to find the spending patterns that may be doing damage to your budget.

Then you can work on addressing the reasons why you spend the way you do so you can spend more intentionally going forward.

Related post: 12 Best Budgeting Planners to Organize Your Finances

3. Keeping a budget can help you save money

If you take away nothing else about why budgets are important, know this: Budgeting can help you grow your savings.

More than half of Americans couldn’t cover three months’ worth of expenses, according to a Bankrate survey. And 25% of Americans have no emergency savings at all.

If you have little to no savings in your bank account, then a budget is important for changing that.

When you make a budget you can include saving as one of the line items is an integral part of it. Budgeting to save money is just as important as budgeting to spend money.

That’s especially true if you want to grow wealth for retirement. Earmarking money for an investment account, for example, could help you achieve millionaire status if that’s your goal.

And if you’re looking for the best savings account option, consider saving with CIT Bank.

4. Budgeting can help you avoid overdraft or late fees

Banks made $12.4 billion in overdraft fees in 2020, with customers paying an average overdraft fee of around $25.

Meanwhile, credit card companies can charge up to $40 per late fee if you don’t pay your bill on time.

I don’t know about you but the idea of handing over money to a bank or credit card company to cover fees isn’t appealing at all.

So that’s another great answer to the question of why is budgeting important.

When you budget regularly, you’re less likely to overspend with your debit card and get hit with overdraft fees. And you’re more likely to stay on top of monthly payments so you don’t get stuck with late fees.

5. Making a budget can improve your relationships

Money can be a sore spot for couples and it’s often the number one thing they fight about.

If you’re married or partnered up, you may know this from firsthand experience.

Some of the biggest money deal breakers that can trigger arguments include:

- Making big purchases without discussing them first

- Withdrawing large amounts of cash from joint bank accounts

- Keeping financial secrets (i.e. hiding debt or purchases)

- Not being on the same page with financial goals

Making a budget is not necessarily a magic bullet for curing money-related relationship ills.

But having a budget is important for ensuring that you’re a team when it comes to managing money, instead of working against each other.

6. A budget is important for getting out of debt

Collectively, a lot of people in the United States have debt. Specifically, Americans had close to $15 trillion in debt as of the second quarter of 2021.

That’s a lot of debt and it illustrates why budgeting is important.

Having a budget can make it easier to live within your means. And when you do that, you’re less likely to rely on credit cards to cover the gap.

Making a budget is important for getting out of excessive debt too.

For example, budgeting can help you pay off:

- Student loans

- Credit card debt

- Car loan

- Personal loans

Using debt repayment tools like Tally along with a regular budget can help you get out of debt faster while saving money on interest rates.

7. Living on a budget can reduce financial stress

Sixty percent of Americans say thinking about their finances makes them anxious. And 50% say talking about money is stressful.

If money causes you to stress, then making a budget is important because it’s a stress-reliever.

Remember, the purpose of budgeting is to put you in control.

While making a budget is not guaranteed to solve all your money problems right away, it can help you to approach your finances with a clear head.

When you can look at your money situation calmly, it’s a lot easier to come up with realistic solutions for improving your finances.

8. Sticking to a budget makes it easier to reach your financial goals

Setting financial goals is important if you want to live a richer life.

And I don’t just mean building wealth through investments.

I mean having financial freedom.

When you’re able to achieve financial independence, money is not a source of stress anymore.

You’re not a slave to your creditors and you don’t lie awake at night wondering if you’ll ever be able to retire.

Instead, you can feel confident about your financial situation and what’s happening with your money.

And that confidence is a priceless example of why a budget is important.

9. Budgeting can help you prioritize what matters most

One of the most important benefits of budgeting is that it helps you to separate needs and wants.

A need is anything you need to live or essential expenses, in other words. So that can include:

- Housing

- Utilities

- Food

- Basic transportation

- Insurance

Wants are anything you don’t need to live but are nice to have. This is your discretionary spending.

So your wants might be things like:

- New clothes

- Dinner out

- Entertainment

- Recreation or hobbies

- Travel

So how does that explain why is budgeting important?

It’s simple. Understanding the difference between the two is vital to making a budget that actually works.

If you’re spending more money on wants than needs, that could be a problem if you end up behind on the mortgage or light bill.

So budgeting is important for making sure your needs (and your family’s needs) are met.

And it doesn’t mean you can’t have any fun at all. Your budget is just there to make sure that having fun doesn’t take priority over meeting basic needs.

Related post: 90+ Cash Envelope Categories to Help You Budget More Effectively

10. Living on a budget can inspire you to grow your income

When I first became a single mom, we lived on a very tight budget.

I was able to make it work, mostly with creative budgeting. But I knew I didn’t want to live that way forever.

So I used my tight budget as a motivator to find ways to grow my income.

Since then, I’ve managed to build a freelance writing business that earns multiple six figures a year. But I wouldn’t have even imagined it if I hadn’t been tired of the low-budget lifestyle.

And maybe making a budget is the nudge you need to grow your income, too.

For me, growing my income meant really digging in and working hard on my business.

But for you, it might mean starting a side hustle. Or developing multiple streams of income passively.

Either way, budgeting is important for making the most of the money you have while working toward your extra income goals.

Best Budgeting Tools

- Personal Capital. Personal Capital makes it easy to track spending, manage bank account balances, grow savings and understand net worth.

- Qube Money. Qube Money is an essential for budgeting if you follow the cash envelope system. You can use this legit mobile app to manage spending and saving easily!

- The Total Money Makeover. “The Total Money Makeover” is the first personal finance book I ever read when learning the importance of budgeting. This book is a simple road map to good money management habits.

- Clever Fox Budget Planner and Bill Organizer. Clever Fox makes some of the best budget planners around. Check out their range of options if you need a budget planner to organize your money.

- Ibotta and Rakuten. Ibotta and Rakuten are essential for saving money as a family. Both pay you cash back on shopping, with up to $20 in bonuses available from Ibotta and up to $25 in bonuses from Rakuten when you sign up!

- Tiller Money. If you’re looking for budgeting spreadsheets or money-saving charts you can find them at Tiller Money. This is a great tool for budgeting if you like being able to see the numbers at a glance.

Final thoughts on why is budgeting important

Making a budget can be the best way to achieve financial security.

Whether you’re making a personal budget for your family or a business budget, you can benefit from having a budget plan in the long run.

When you budget regularly, you’re prepared for unexpected expenses. It’s easier to reach financial stability and avoid sleepless nights spent worrying about money.

Getting started with the budgeting process is a step in the right direction. And no matter which budgeting method you use, the important thing is getting started.

If you can do that you can be one step closer to financial independence.

Be sure to download your free monthly budget template in the resource library.

And don’t forget to check out my essential tool list of Smart Money Resources!