Last Updated on November 12, 2022 by Rebecca Lake

Struggling with how to make a budget and live below your means?

Making a budget is important, after all. And using Dave Ramsey budget percentages can be a simple way to manage your money.

The Dave Ramsey budget method involves divvying up your expenses into 11 budgeting categories using recommended spending percentages. If you don’t know, Dave Ramsey is an expert at helping people get out of debt.

Millions of people (myself included) have used Dave Ramsey money tips to pay off debt, save for emergencies and build wealth.

His book, The Total Money Makeover, outlines the household budget percentages you should be using if you’re following his baby steps system.

Ready to start budgeting the Dave Ramsey way? Here’s a closer look at how the Dave Ramsey household budget percentages work.

Related post: 12 Best Budget Planners to Organize Your Finances Now

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

What Are Dave Ramsey Budget Percentages?

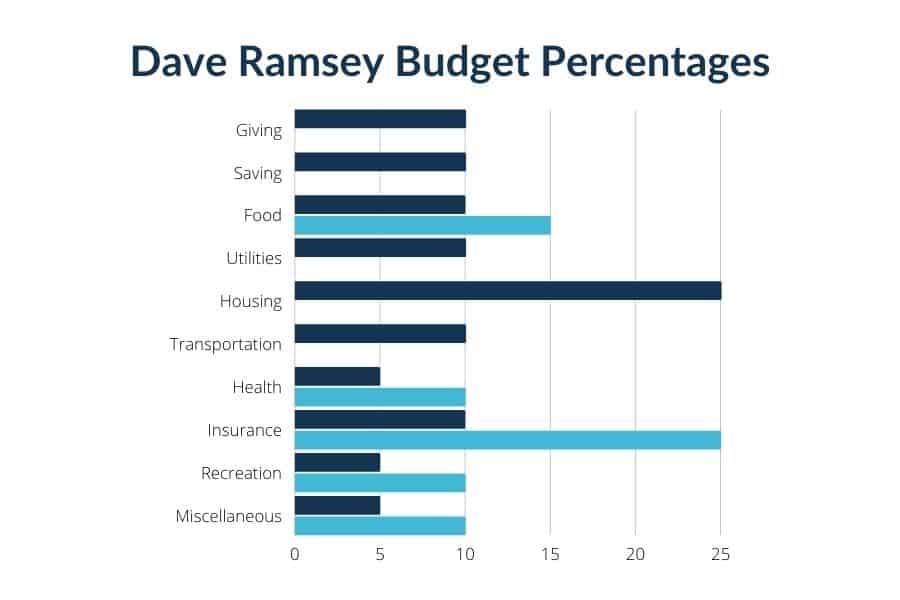

Dave Ramsey budgeting is simple and straightforward. He recommends these household budget percentages for dividing up spending:

- Giving — 10%

- Saving — 10%

- Food — 10% to 15%

- Utilities — 5% to 10%

- Housing costs — 25%

- Transportation — 10%

- Health — 5% to 10%

- Insurance — 10% to 25%

- Recreation — 5% to 10%

- Personal spending — 5% to 10%

- Miscellaneous — 5% to 10%

If you’re the visual learner type, here’s a chart that shows you what the Dave Ramsey budget percentages look like in action.

One thing that should be clear right away is that some of these budget categories have a fixed percentage. Others give you a range of percentages to work with.

So there’s some flexibility, which is good if you tend to spend a little more in some budget categories or a little less in others.

Related post: 30-30-30-10 Budget Explained (Pay Your Bills and Still Have Fun!)

Dave Ramsey Budget Categories Explained

The Dave Ramsey budget percentages method assumes you group your spending into 11 different categories. The different percentages are based on net income, or what you take home after taxes.

Here’s a closer look at what each budget category covers.

Giving – 10%

Dave Ramsey’s financial philosophy includes leaving room in your budget for giving. Specifically, he recommends earmarking 10% of your budget to giving.

This can be tithing if you belong to a religious organization or giving to causes that you believe in.

Now, what if you have debt? Does it still make sense to follow the Ramsey budget percentages then?

Dave would tell you yes, that giving 10% right off the top is a must, even if you have debt. But ultimately, you have to decide for yourself what you’re comfortable with giving and what you can afford if you have debt.

Saving – 10%

One thing I like about using Dave Ramsey budget percentages is that saving is near the top of the list.

If you haven’t read The Total Money Makeover, it’s based on Dave’s baby steps method for getting out of debt. The first step is saving $1000 in a baby emergency fund.

This $1000 buffer is meant to cover smaller emergencies so you don’t have to use a credit card to pay for them. Once you get your $1000 saved, you can work your way through the remaining baby steps.

Food – 10% to 15%

Food might be one of your biggest spending categories, especially if you have kids.

Here, Dave recommends budgeting 10% to 15% of your net income on food. That includes food at home as well as restaurant meals or takeout.

If you spend more than 10-15% of your pay on food, there are some things you can do to trim down this budget category.

For example, you could:

- Use meal planning to keep your grocery list in check

- Plan meals around less expensive food items

- Keep a list of go-to dirt cheap meals you can make for pennies per serving

You can also use the Ibotta app to earn money back on grocery trips. Ibotta pays you cash back at supermarkets and you can also earn bonuses for referring friends and family.

Use this link to join Ibotta (it’s free) and claim up to $20 in bonus cash now!

Utilities – 5% to 10%

The utilities category covers things like water, electric and natural gas–whatever you need to power your home.

You could also add cellphone service and internet service here as well. Finding ways to save on electric or cellphone service could help you get closer to the Dave Ramsey recommended percentages for this category.

For example, I save $1200 a year on cellphone service by using a prepaid plan versus a contract phone. If you’re looking for an affordable option for prepaid phone service, check out the plans available at Tello.

I’ve also tried different ways to save on electric bills, like installing a programmable thermostat and changing my air filters regularly.

Housing – 25%

Housing is a necessity and it’s likely what you spend the most money on out of your budget each month.

If you’re following Dave Ramsey budgeting rules, then this should be more than 25% of your net income.

That’s not always realistic though. According to a Harvard report, nearly 11 million renters spend over half their income on housing.

There may not be much you can do to negotiate your rent prices down, unfortunately. This means you may need to cut corners with some of your other household budget percentages.

If you own a home, refinancing the mortgage could help save money on housing. You can visit SuperMoney to compare mortgage refinance rates.

Transportation

Next on the list of Dave Ramsey budget percentages is transportation.

So this might include things like:

- Car payments

- Insurance

- Gas and oil

- Registration fees

- Inspection fees

- Tires and maintenance

Some of these expenses you may have month to month. But some, like inspection fees or new tires, may occur less frequently.

One way to plan ahead for those expenses is to create sinking funds to cover them. Sinking funds let you save money for one-time or infrequent expenses.

Health – 5% to 10%

The health budget percentage category is arguably one where you could save money if you’re fairly healthy.

This category covers expenses like:

- Over the counter medications

- Prescriptions

- Co-pays

- Dental care

- Vision are

It assumes that if you have health insurance, those premiums have already been taken out of your net pay.

Insurance – 10% to 25%

The insurance budget category covers any insurance you pay premiums for out of pocket. That can include:

- Health insurance

- Dental insurance

- Vision insurance

- Life insurance

- Disability insurance

Car insurance would go under the transportation category. Homeowners’ or renters’ insurance would go into the housing category.

Personally, I think 25% for insurance is a lot. If you’re spending that much on insurance each month, consider shopping around for lower rates. Or raise your deductible if it can help reduce your premiums.

Recreation – 5% to 10%

Recreation means fun money in Dave Ramsey budgeting terms.

So under this budget category, you might have expenses like:

- Hobbies

- Hulu, Netflix and other streaming subscriptions

- Gym memberships

- Gaming subscriptions

- Movie nights

- Date nights

If you’re spending more than 5-10% of your net income on recreation, consider what you can cut back on.

You can use the Trim Financial Manager to find savings in this budget category. Trim helps you cut out streaming services and other subscriptions you don’t use that are just costing you money.

Personal Spending – 5% to 10%

Personal spending can include spending on extras that aren’t necessarily needs.

For example, that can include things like haircuts, pedicures, new clothes, home decor items, etc. Again, these are things that might be wants versus needs.

Miscellaneous – 5% to 10%

The miscellaneous budget category is meant to cover anything that doesn’t fit under one of the other Ramsey budget percentages.

This can include things you forgot to budget for. Or you can use it as a buffer in case you end up spending more than the recommended household budget percentages in another category.

For example, say your food budget comes to 20% for the month instead of 15%. You could borrow 5% from the miscellaneous category to cover the extra.

Related post: How to Teach Budgeting to Kids

What about debt?

You’ll notice that the recommended percentages for budgeting make no mention of debt.

This might seem weird, since Dave Ramsey is all about helping people get out of debt.

Specifically, he recommends the debt snowball system for paying down debt.

With the debt snowball, you list your debts from lowest balance to highest. Then you pay as much as you can to the first debt while paying the minimums on everything else.

Once you pay off the first debt, you roll that payment over to the next one on the list. You keep doing that until all your debt is gone.

If you have debt, you might need to tweak the Dave Ramsey budget percentages to make them work for you.

So instead of 10% for giving and 10% for saving, for example, you might cut both down to 5% and put the difference toward debt. Or you might choose to cut out recreation and spend that 5-10% on debt instead.

Again, the nice thing about budgeting the Dave Ramsey way is that it does allow some flexibility. So you can experiment with different budget percentages to figure out what works best.

Related post: 42 Ways to Drastically Cut Expenses and Save Money

Are Dave Ramsey Budget Percentages Realistic?

Dave Ramsey’s budgeting style can and does work for plenty of people. I personally used his budgeting and debt snowball methods to pay off close to $100K in credit card and loan debt.

But will Dave’s budget plan work for you specifically?

The answer is, it depends.

Your income, cost of living, debt and spending habits can all influence how effective using household budget percentages ends up being.

How you feel personally about things like giving and saving also matters.

Dave Ramsey budget example

If you’re trying to decide if using the budget percentages recommended by Dave Ramsey is a good move, here’s an example of what it looks like in action.

We’ll use real median household income. According to the Federal Reserve, that’s $68,703 per year. After taxes, our take-home pay ends up being $52,228 according to this calculator.

Now, here’s how we’d break that up if we used Dave Ramsey budget percentages:

- Giving — $5223

- Saving — $5223

- Food — $5223 to $7843

- Utilities — $2611 to $5223

- Housing costs — $13057

- Transportation — $5223

- Health — $2611 to $5223

- Insurance — $5223 to $13057

- Recreation — $2611 to $5223

- Personal spending — $2611 to $5223

- Miscellaneous — $2611 to $5223

This budget example assumes that you’re spending $4352 per month on average. So is that realistic?

According to the Bureau of Labor Statistics, the average household spends $63,036 per year. That works out to $5253 per month.

The typical household spends more per month and per year than our example household. But the numbers are still close enough together to assume that if you’re sticking with the recommended household budget percentages then the Dave Ramsey method could work for you.

Alternatives to Dave Ramsey Budget Percentages

Budgeting like Dave Ramsey isn’t the only option you have. There are other ways to make a budget and take control of your spending.

Here are some other budgeting methods you might consider in place of Dave Ramsey’s budget percentages.

What is the 50 30 20 budget rule?

The 50/30/20 budget method also uses percentages to divide up your money. But instead of 11 budget categories you have just three:

- 50% of net income – Needs (i.e. housing, food, utilities, transportation)

- 30% of net income – Wants (i.e. new clothes, personal care items, home decor, recreation and hobbies)

- 20% of net income – Saving and debt repayment

Compared to the Dave Ramsey budget system, the 50 30 20 budget looks a lot simpler on paper. The 50 15 5 rule is a variation of this budget method.

But it’s important to be clear on what’s a want and what’s a need to keep spending in balance.

Needs are things you have to spend money on to maintain a basic lifestyle. Wants are anything you spend money on that you could do without.

With the third 20%, you also have to decide how much to save and how much should go to debt.

If you have a lot of debt, then you may want to save enough to get your $1000 baby emergency fund together first. Then you could put more toward debt and a little less to savings.

Here’s a step by step guide to creating a 50 30 20 budget.

What is the 70 20 10 rule money?

The 70/20/10 budget method is similar to the 50-30-20 budget. Only, you divvy up your money like this:

- 70% of net income – Expenses (including wants and needs)

- 20% of net income – Saving and debt repayment

- 10% of net income – Tithing/investing

With the 70 20 10 method, you’re grouping your essential and nonessential expenses together. So you’re paying for those things out of the same bucket of money.

You put 20% of what you take home toward savings. Unless you’ve got debt; then you’d allocate some of that 20% to it instead.

The last 10% is for giving and investing. I personally prefer to invest more than 5% to 10% of what I earn.

But the 70 20 10 money rule could work for you if you want a simple way to budget by percentages.

Here’s how to set up a 70/20/10 budget step by step.

Budget by paycheck method

The budget by paycheck method is a popular option for budgeting if you’re tired of living paycheck to paycheck.

When you budget by paycheck, you’re dividing up your spending according to your pay cycles. You’re not using categories or percentages to budget; instead, you’re budgeting according to how often you get paid.

This budget method can work if you’re paid weekly, biweekly or on the 1st and 15th of the month.

For example, if you’re paid biweekly you might use your first paycheck to cover your mortgage or rent payment, utility bills and car payment. Then your second paycheck might go to insurance or your credit card bill.

You do still have to budget out your paychecks to avoid overspending.

But if done right, this budgeting method can help you stay on top of your bills and even set aside money for savings each month.

What Should Your Budget Percentages Be?

The simple answer is that your household budget percentages need to be whatever is necessary to meet your expenses without putting you in debt.

If you’re spending more than you make, that’s a sign that either:

- Your spending is out of whack

- You’re not making enough money

Dave Ramsey budget percentages can work if your spending matches up with Dave’s budget categories. A good way to look at your spending is to create a simple chart.

Sometimes, a visual representation can make it easier to see where you may be spending too much or too little.

You can use a simple budgeting tool like Personal Capital to create budget charts and graphs. From there, you can work on finding your ideal household budget percentages.

Final thoughts on Dave Ramsey budget percentages

Dave Ramsey’s recommended budget percentages can be a helpful guide for creating a budget.

But it’s important to remember that they are just a guide.

Ultimately, the best budget for you is the one that lets you pay your bills, save money and live better. A budget shouldn’t be a headache or a source of stress.

Instead, it should be a plan for spending your money each month so that you feel in control of your finances. And that’s one of the keys to creating a richer life for yourself and your family.

Have you tried Dave Ramsey’s budget percentages? Head to the comments and tell me about it.

And don’t forget to pin and share this post!