Last Updated on November 12, 2022 by Rebecca Lake

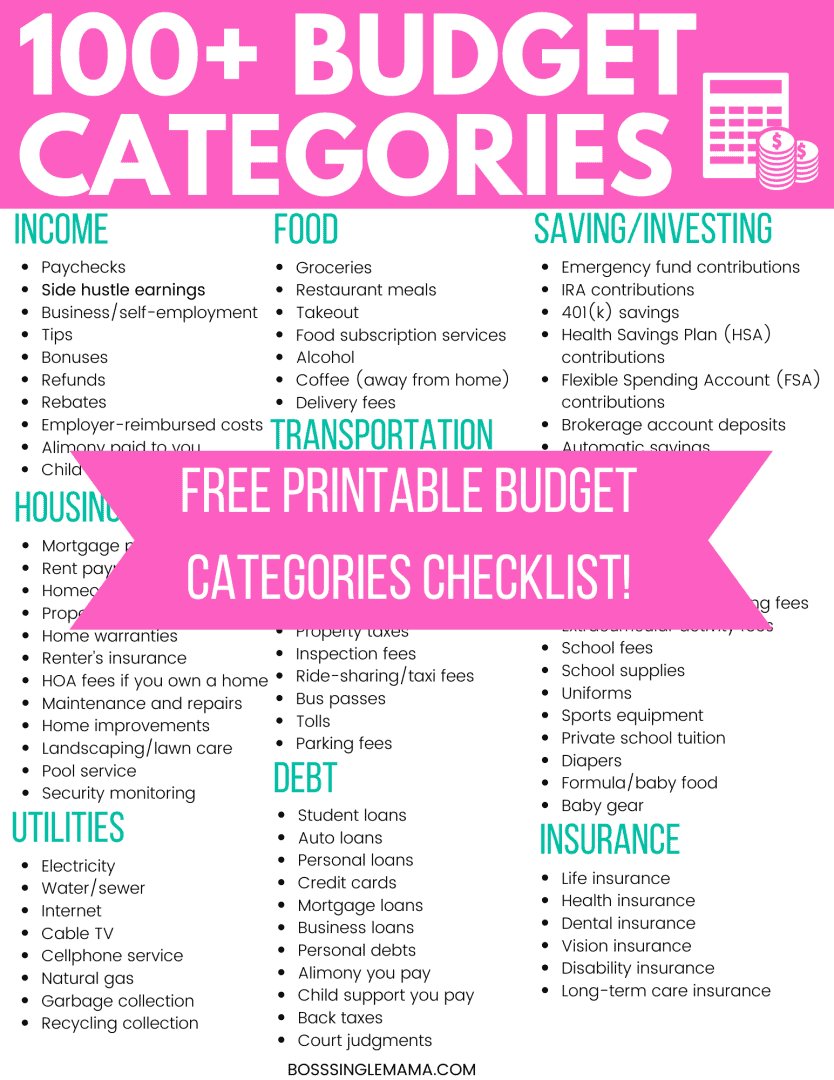

Making a budget is an important first step in reaching your financial goals. One of the biggest challenges is deciding which budget categories to include.

A budgeting category simply means how you identify and group the various expenses in your budget. Putting different expenses into separate categories can be a simple way to see where your money goes each month.

Budgeting is a useful life skill and having a budget category list to follow can make it easier to do. Today, I’m sharing a comprehensive list of budget categories to help you take control of your money.

And if you need a simple way to keep track of what’s in your budget, you can grab a free budget template and budget categories list in the resource library!

Related post: Why Is Budgeting Important?

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

What Categories Should I Include in a Budget?

Using budget categories can help with tracking personal expenses and making the most of your monthly income. You can compare how much you spent this month to the previous month, for example, to see how your expenses trend over time. And keeping a budget categories list can help with shaping your financial goals.

The main categories you include can depend on how much money you have to work with and your preferred budgeting method. Different methods work for different people.

For example, some of the best ways to make a budget include:

- 50/30/20 budget rule

- Dave Ramsey budget percentages

- 70/20/10 budget method

- Zero-based budget

- 50 15 5 Rule: How to Save More and Spend Less

Finding a budgeting method that works for you matters because the right system can make it easier to stick to your budget. The last thing you want is a budget system that doesn’t fit your expenses or lifestyle.

And you can also work on teaching teens and kids to budget early on so they develop good money habits.

Related post: Budget Percentages Explained: 3 Easy Ways to Create Your Ideal Budget

How to Build Your Budget Categories List

When you’re ready to create your list of budget categories, the first thing you need to do is decide how many categories to include.

Some people like to stick with simple budget categories so there’s less to keep track of. So you might have one category for necessary expenses (i.e. fixed expenses), one for regular expenses (i.e. variable expenses) and a separate category for “fun money” (i.e. discretionary spending).

Other people may prefer to get really detailed and have a different budget categories for each and every expense. So in your necessary expenses category, you might have various budget categories for each expense, like housing, utilities or transportation.

The most important thing is to choose an approach that fits your financial situation. Remember, this is your own budget and no one else’s.

Income budget categories

The income budget category includes all the money you have coming in each month. This can include money you receive regularly from a regular paycheck, as well as irregular income you may only receive occasionally.

Depending on how you make money, your categories for budgeting income might look like this:

- Paychecks

- Side hustle earnings

- Social Security benefits if you receive them

- Business/self-employment income

- Tips

- Bonuses

- Refunds

- Rebates

- Employer-reimbursed expenses

- Tuition remission or other employer-paid education benefits

- Alimony paid to you

- Child support

- Passive income, such as income from investments

If you’re working on your budget and it seems like you have more expenses than income, consider what you can do to start making more money.

Remember, you want to budget with after-tax income, not gross income. After-tax income is the money that actually hits your bank account on payday, after taxes and other deductions are taken out.

Budget categories list for housing

Housing expenses are the biggest expense most people have in their budgets. According to the Bureau of Labor Statistics, the typical household spends just over a third of income on housing each year.

Here’s how your budget categories might break down for housing:

- Mortgage payments

- Rent payments if you don’t own yet

- Homeowners insurance

- Property taxes

- Home warranties

- Renter’s insurance

- HOA fees if you own a home

- Maintenance and repairs

- Home improvements

- Tools and supplies

- Landscaping/lawn care

- Pool service (we have a pool so this is one of our budget categories)

- Security monitoring services

Utilities budget categories

Utilities are an essential expense. You could add utilities in with your housing costs in your budget to keep things simple. But if you like to be more detailed with tracking expenses, you could include various budget categories for each bill.

Spending on utilities means keeping the lights on and the water running. As you plan the utilities section of your budget, consider including these categories:

- Electricity

- Water/sewer

- Internet

- Cable TV

- Cell phone service

- Natural gas

- Garbage collection

- Recycling collection

Pro tip: Consider installing a programmable thermostat to save money on utility bills. It’s a simple way to conserve energy (and save your wallet, too!)

Related post: 11 Ridiculously Simple Ways to Save on Electric

Food budget categories

Food can be another major expense in your budget, especially if you have kids. When you break down the food portion of your budget, here are some of the expense categories you might include:

- Groceries

- Restaurant meals

- Takeout

- Food subscription services (like Blue Apron)

- Alcohol

- Coffee (away from home)

- Delivery fees (if you use DoorDash)

The good news is that you can save money on food by meal planning, sticking with dirt cheap meals and using Ibotta to shop. In fact, you can get up to $20 in bonuses when you download the Ibotta app!

Related post: Is Ibotta Legit? How to Use Ibotta to Save Money

Budget categories list for transportation costs

Unless you bike or walk everywhere, you’ll have to allocate some part of your budget to transportation costs. That can include adding these budget categories:

- Gas

- Oil and oil changes

- Maintenance and repairs

- New tires

- Auto insurance (or other vehicle insurance if you drive a motorcycle)

- Vehicle warranty

- Annual registration fees

- Property taxes

- Inspection fees

- Car payments (though you could include this under debt if you prefer to list them separately)

- Ride-sharing/taxi fees

- Bus passes

- Tolls

- Parking fees

Budget categories for debt repayment

Debt can be a real drain on your budget. And according to the Federal Reserve Bank of New York, Americans owe a stunning $16.15 trillion collectively.

A mortgage might be your biggest debt. But you might also have these categories to budget for with debt repayment:

- Student loans

- Auto loans

- Personal loans

- Credit cards

- Business loans

- Personal debts owed to friends/family

- Alimony you pay

- Child support you pay

- Back taxes

- Court judgments

If you’d like to spend less of your budget on debt each month or becoming debt-free is one of your long-term goals, there are a few things you can do.

For example, refinancing student loans can help you save money on interest if current rates are lower than when you first took out your loans. And that can help you pay your debts off faster. Check out SuperMoney to get a free student loan refinancing quote.

You can also use an app like Tally to pay off credit cards faster.

Tally helps to lower your credit card APR so more of your payment goes to the balance. This review explains how to use Tally to get out of credit card debt.

Budgeting categories for saving and investing

Saving money is something you can do if you’re including it as a line item in your budget. The more extra money you can save, the easier budgeting can be if you have more financial breathing room.

When making your savings budget categories list, here are some of the best options to consider:

- Emergency fund contributions (in case you have unexpected expenses)

- IRA contributions

- 401(k) savings

- Health Savings Plan (HSA) contributions

- Flexible Spending Account (FSA) contributions

- Brokerage account deposits (try M1 Finance for $0 fee stock trades!)

- Automatic savings (save with Acorns and get a $5 bonus!)

- Sinking funds

- Holiday savings

- College savings (i.e. a 529 college savings plan or Coverdell ESA)

If you’re not working toward any savings goals yet there are some simple ways to save money and live better you can try.

For example, that includes:

- Rounding up your loose change with Acorns

- Cutting one small expense out of your budget

- Using cashback apps to earn money back on shopping

And if you need a good place to keep your savings, try CIT Bank. CIT offers savings accounts with competitive rates and minimal fees.

Budgeting categories for kids

Raising kids is expensive, let’s face it.

In fact, it costs the average family $233,610 to raise a child to age 18. And that doesn’t include college, which can add thousands more to the total.

When assigning expense categories for kids in your budget, here are some of the top costs you might have:

- Daycare

- In-home care/babysitting fees

- Extracurricular activity fees (i.e. piano lessons, field trips, etc.)

- School fees

- School lunches

- School supplies

- Uniforms, if your child wears them

- Sports equipment

- Private school tuition

- Diapers

- Formula/baby food

- Baby gear

- Child support you pay (if you didn’t include it under debt)

- Birthday and holiday gifts (plus extras like Easter baskets or stocking stuffers)

Insurance budgeting categories

Insurance is good to have because it can protect you financially when you need it most.

For example, if you get in a car accident then your car insurance can help repair your vehicle or pay hospital bills. And health insurance can keep you from being left with staggering medical debt if you get sick or injured.

Here are some common insurance categories for budgeting:

- Life insurance (check out Haven Life for life insurance quotes!)

- Health insurance

- Dental insurance

- Vision insurance

- Disability insurance

- Homeowners insurance (if you didn’t include it in the housing category)

- Renter’s insurance (if you didn’t include it with housing)

- Vehicle insurance (if you didn’t include it with transportation expenses)

- Long-term care insurance

Budgeting categories list for pets

Got pets? Then you’ve got extra expenses in your budget.

And as someone who owns two dogs and three cats, it’s really easy to forget about these expenses if you’re not planning for them.

- Pet food

- Treats

- Bedding

- Toys

- Grooming

- Pet-sitting/boarding fees

- Medications (like heartworm or flea treatments)

- Veterinary bills

- Pet insurance

Budget categories for personal use

Personal care is important, especially if you’re a stressed-out parent who needs a break. So here are some of the expense categories you might add to your budget if you like to treat yo’ self every now and then:

- Haircuts (or save money by cutting hair at home)

- Salon visits

- Manicures/pedicures

- Massages

- Spa visits

- Makeup

- Toiletries

- Cosmetic treatments

Budget categories for clothing

Clothing can eat a big hole in your budget if you’re not looking for ways to save money on clothes. For example, using Rakuten when you shop online is an easy way to earn 20% or more back on clothes and other things you buy.

- Baby clothing

- Kids clothing

- Adult clothing

- Seasonal clothing

- Clothing repairs

- Dry cleaning

Medical expenses budget category

The medical expense category includes anything you spend toward health care, including:

- Copays

- Coinsurance

- Health insurance premiums

- First aid supplies

- Prescription drugs

- Over the counter medicines

- Vitamins/supplements

- Alternative health treatments

- Medical equipment (like a CPAP machine or test strips if you have diabetes)

- Physical therapy

- Behavioral therapy or counseling

Budgeting categories for household items

Household items can include small purchases, like cleaning supplies, or bigger items like new furniture. A household expense is anything you need to spend money on to take care of your home.

- Cleaning products like dish soap or laundry detergent

- Toilet paper

- Paper towels

- Pool maintenance supplies (if you don’t use a pool service)

- Indoor furniture

- Furniture repairs

- Home decor items

- Outdoor furniture

Travel budget categories

If you travel regularly or just a few times a year, it’s helpful to have separate budget categories for those expenses, including:

- Airfare

- Hotels

- Travel agent fees

- Rental cars

- Travel insurance

- Baggage fees

- Souvenirs

- Cruise fare

- Public transportation

- Passport fees

- Global Entry/TSA PreCheck fees

Pro tip: Save money on Global Entry/TSA PreCheck fees by signing up for a travel rewards credit card that includes a fee credit as a member perk.

Subscription and recurring xxpenses

Recurring expenses may be small but when you add them together, they can count for a sizable part of your budget.

As you map out expense categories, don’t forget to include things like:

- Netflix

- Hulu

- Disney+

- Amazon Prime (try it free for 30 days!)

- Newspaper subscriptions

- Magazine subscriptions

- Paid credit monitoring or credit score services (monitor your credit for free with Credit Karma!)

- Professional membership fees

- Alumni fees

- Software subscriptions

- Gym memberships

- Food delivery services (like Blue Apron)

Pro tip: Use Billshark to ditch unwanted subscriptions. Billshark can review your spending to find wasted money and they can also help negotiate lower payments for some of your bills.

Related post: Billshark Review: Can It Really Help You Save Money on Bills?

Categories for gifts and giving

Gifts and giving can be grouped together or created as separate expense categories. For simplicity’s sake, I’ve put all of the following under one budget category heading:

- Tithing

- Cash donations

- Birthday gifts

- Holiday gifts

- Gifts for other special occasions

- Cards

- Wrapping paper

- Postage/mailing fees

Budget category for hobbies and recreation

Everyone has hobbies they enjoy. Mine is reading, for example.

And if some of those hobbies involve spending money, then it’s important to make sure you’re budgeting for them.

- Books

- Craft supplies

- Knitting supplies

- Sports equipment

- Movies/DVDs

- Music streaming

- Classes

Budget categories for taxes

Everyone’s got to pay taxes, right? (And if you haven’t gotten around to filing yours yet, visit Credit Karma to file for free!)

Here are the most common tax-related budget categories:

- Federal taxes

- State taxes

- Local taxes (which can include property taxes)

- Quarterly estimated taxes if you’re self-employed

- Property taxes

You can also include things like tax software, accounting software or tax preparation fees here if you have those expenses.

Work and business budget categories

If you work a regular job, then there are certain things you might need to spend money on. So your list of budget categories might include:

- Uniforms or other required clothing

- Dry cleaning

- Lunches or dinners out with colleagues

- Coffee and snacks

- Transportaition and parking

- Professional fees and licensing

- Professional memberships

- After-work events

- Work equipment, tools and supplies

If you work from home or run a business, then your expenses might look a little different. For example, independent contractors who freelance or blog might have these business expenses in their budget if they have an at home office space:

- Accounting software or tax prep software

- Internet and cell phone service

- Home office equipment

- Home office supplies

- Laptops or cameras

- Postage and printer paper

- Virtual assistant services if they outsource some of their work

- Advertising or marketing fees

- Website hosting

The good news is that small businesses can deduct many of their expenses at tax time. So it’s important to keep good records of everything you spend money on for your business or side hustle. Tracking expenses can also help with managing business cash flow.

Miscellaneous budget categories

You can use this final budget category to include anything that doesn’t fit into another category. For example, here are some of the things that might count as miscellaneous expense categories in your budget:

- Bank fees

- Stamps/postage fees

- Professional services (i.e. attorney, accountant, etc.)

- One-time purchases (like a new laptop)

- Parking tickets or speeding tickets

- Unexpected expenses

How to Use Budget Categories to Manage Your Money

Using budget categories can be a good idea if you’ve struggled to make and stick to a budget. The first place to start, of course, is making a budget.

You can get your bank statements and pay stubs together as a starting point for making a budget. From there, you can add in things like irregular income or expenses to see how much you’re really spending.

If you’re struggling with how to track your spending, then you can use a tool like Personal Capital for that.

Personal Capital syncs up with your bank and credit card accounts to automatically record your transactions. And it’s free to use so you don’t have to add a separate budget category for fees.

Once you start tracking your expenses regularly, you can get a better idea of where they should go in terms of your budget categories. I recommend tracking expenses for at least a month; this way, you can see where your money really goes.

From there, you can work on dividing up what you spend into the appropriate category.

And I know that 100+ categories is a lot. So start with the big expenses in your budget, like housing, food, utilities and transportation.

Then focus on debt and saving next before adding in smaller expense categories. This way, you can create a budget plan that perfectly fits your spending habits.

Free Printable List of Categories for Budgeting

Need a quick and easy way to refer back to this list of expenses to include in your budget?

Click the image below to gain access to the Resource Library, where you can snag this budget categories list and a monthly budget template for FREE!

Final thoughts on budget categories

This blog post is designed to offer a guide to budgeting categories, which can come in handy if you’re tired of worrying about whether you’ll have enough money to make it to the end of the month. And if you’re just getting started with making your first budget, learning about budget categories is a great place to begin.

Budgeting can help you improve your finances in a big way if you’re committed to it. It’s possible to pay off debt, grow your savings and increase your net worth with the right budget plan.

And don’t forget to grab your free budgeting categories checklist!

Read these posts next for more budgeting tips:

- 60+ Sinking Funds Categories That Can Help You Build a Better Budget

- 9 Terrible Budgeting Mistakes That Are Costing You Money

- How to Track Spending and Never Blow Your Budget Again

- 25 Best Cash Envelope Wallets (Stylish and Affordable!)

- How to Budget Using the Digital Envelope System (2022)