Last Updated on August 18, 2024 by Rebecca Lake

If you’re looking for a simple but effective way to budget, the cash envelope system might be right for you.

When you budget with the cash envelope method, you allocate cash to envelopes that represent each of your budget categories. Instead of spending with a debit card, you spend only the cash in those envelopes.

(And if you spend any time on TikTok, you might have heard this budgeting system referred to as “cash stuffing”.)

One of the most important steps when creating a cash envelope budget is choosing your cash envelope categories.

That means deciding two things:

- Which expenses should get their own envelopes

- How much money to put in each of your cash envelopes

Figuring out which cash envelope categories to include can help you budget more accurately (and maybe even have a little money left over at the end of the month to fund your financial goals!)

Here’s a closer look at how to choose cash envelope categories if you’re ready to take control of your finances with the cash budget method.

Related post: Cash Envelope System for Beginners (Get Started in 3 Easy Steps)

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

What Is Cash Envelope Budgeting?

The cash envelope budgeting system is a budgeting method made popular by finance guru Dave Ramsey. This system involves adding cash to money envelopes, with each envelope representing different spending categories.

Here’s how the cash envelope budget works in a nutshell:

- Track your spending. This is the very first thing you need to do if you want to make a cash budget. You can use a free tool like Personal Capital to keep track of where your money goes each month.

- Make your budget (based on your take-home pay). If you don’t have a budget yet, this budgeting guide can help you make one fast. And I’ve got a free budgeting worksheet at the end of this post that you can use to make a monthly budget.

- Choose your cash envelope categories. Each envelope category represents a different variable expense. Meanwhile, you’ll pay regular bills (for example, a fixed expense like your mortgage) using your bank account.

- Decide how much cash to put in different envelopes. Some cash envelopes may have more cash than others, based on your spending habits.

- Add cash to the appropriate envelope. Again, you’ll need to have a budget to choose the right amount of money for each envelope. Using a cash envelope wallet can help you keep everything organized.

When you need to make a purchase in a particular budget category, you use cash from the envelope.

So, for example, if you’re going to the grocery store you’d pull dollar bills from your grocery envelope. You’d deduct the purchase from the monthly amount you’ve assigned to that envelope.

Once you spend all the cash in your envelopes you can’t spend anything else in those budget categories until the next month. (Or until the next paycheck if you allocate cash to your envelopes each pay period.)

If you have extra cash in your envelopes at the end of the month, that’s a bonus! Here’s what you can do with leftover cash envelope money:

- Add it to the amount of cash you earmark for that envelope for the next month (for example, you might add it to your grocery budget)

- Deposit it into a high yield savings account to grow your emergency fund

- Use it to pay down credit card debt

- Treat it as “fun money” (if you have enough money to cover all your expenses and pay bills)

The bottom line?

The cash envelope system is designed for people who want to manage their spending habits. It’s a great way to keep your monthly expenses in line with your monthly income.

Related post: 20 Things to Stop Buying That Can Save You Serious Money

👉If you’re looking for some cash envelopes to get started, be sure to check out the cute options in the Boss Single Mama shop!

How to Choose Cash Envelope Categories

The money that goes into your cash envelopes should represent your variable spending categories. Variable expenses are expenses that may fluctuate from month to month. A fixed expense, on the other hand, stays the same from month to month.

The first step in defining your variable expenses is reviewing your personal budget. If you’re completely new to budgeting, you can use your bank statements and credit card statements to categorize your spending.

Variable expenses include things like:

- Groceries

- Gas and transportation

- Personal care

- Dining out

- Hobbies and recreation

- Entertainment

- Travel

- Pet care

The reason it makes more sense to use cash envelopes for variable expenses is that you might use other methods to pay regular bills.

For example, many people use their checking account to pay fixed monthly expenses such as:

- Rent and mortgage payments

- Utility bills

- Cellphone bills

- Internet bills

- Insurance premiums

- A car payment

- Monthly credit card payment

- Student loan payments

You can pay bills from your bank account using automatic bill pay, ACH transfers, a paper check or your debit card.

If you get paid through direct deposit, that can make it easier to time bill payments each pay period. And you might use a debit card or credit card for online purchases as well.

On the other hand, it’s easier to spend cash on things like gas or grocery shopping. Carrying a paper envelope (or separate envelopes) replaces the temptation to swipe your debit card or add to your credit card bill.

This old school envelope budgeting method can be a great way to stay within your spending limits. And psychologically, using actual cash to spend is a good idea since it can help to curb impulse purchases.

Related post: How to Stop Spending Money: 23 Practical Ways to Spend Less, Save More

Recommended Cash Envelope Categories

There are a few different ways to approach stuffing cash envelopes. The best way for you will depend on each spending category you include in your budget.

First, you can go broad when creating cash envelope categories. For example, you might limit yourself to just 5 to 7 cash envelopes.

The upside of this approach is that fewer envelopes mean less to keep up with.

On the other hand, you could take the opposite approach and create cash envelope categories for all of your variable expenses, including ones you don’t necessarily have each month.

You might use this strategy if you use sinking funds to save for planned expenses.

A sinking fund is a savings fund that holds money you plan to spend later. So you might set up a sinking fund for car repairs or pet care.

This savings method helps ensure you have enough cash to cover those expenses when the time comes.

Related post: Free Printable Sinking Funds Tracker

Here are some cash envelope category ideas to get you started, with suggestions for expenses they might be used to cover.

Food

- Groceries

- Farmer’s market purchases

- Take-out and delivery

- Restaurant meals

- School lunches (if you have kids)

- Work-related meals (such as lunch outings or company dinners)

Entertainment

- Movies

- Alcohol

- Date nights

- Family nights

- Moms night out

- Concert tickets

- Sporting events

- Theater tickets

- Festival tickets

- Travel

Hobbies and Recreation

- Books

- Craft supplies

- Outdoor equipment

- Gym equipment

- Yoga supplies

- Gardening supplies

- Course fees

- Gym subscriptions

Home

- Decor items

- Home maintenance

- Home repairs

- Cleaning supplies

- Organizing supplies

- Furniture

- Accessories

- Tools

- Yard maintenance supplies

Transportation

- Gas

- Oil changes

- Vehicle maintenance

- New tires

- Car repairs

- Tolls

- Parking fees

- Bus/taxi fare

- Roadside assistance

- Vehicle registration/taxes

- Bike maintenance (if you ride a bike)

Allowances/pocket money

- Kids allowance

- Personal spending money

- Spouse/partner spending money

Pets

- Pet food

- Pet treats

- Bedding

- Accessories/clothes

- Pet toys

- Grooming

- Veterinary care

- Medicines and vitamins

- Boarding/kennel fees

- Pet sitter/dog walker fees

Clothing

- Kids clothing

- Adult clothing

- Uniforms/work clothes

- Dry cleaning/laundry service fees

- Alterations/tailoring

- Clothing repair

- Shoes

- Accessories

Kids

- Field trip fees

- Homeschool fees (if you’re a homeschooling family)

- School supplies

- School fees

- Toys and games

- Books

- Extracurricular fees

- Sports fees

- Lessons (i.e., music lessons, art lessons, etc.)

- After school care

- Babysitting/childcare/daycare fees

Health

- Prescriptions/medications

- Co-pays

- Out-of-pocket medical bills

- First Aid supplies

- Vitamins and supplements

Holidays/Special Occasions

- Miscellaneous gifts

- Birthday gifts

- Holiday gifts

- Special occasions (Mother’s Day, Father’s Day, etc.)

- Birthday parties

- Holiday parties

- Co-worker gifts

- Holiday meals

- Halloween costumes

- Holiday decorations

- Special occasion decorations

The best way to figure out which cash envelope categories to use is to monitor your spending for a month or two, then experiment.

The great thing about the cash envelope budgeting method or cash stuffing is that you have control over how–and where–you spend. So you can tailor your cash envelope categories to fit your lifestyle.

Again, you can use a free tool like Personal Capital to track your spending.

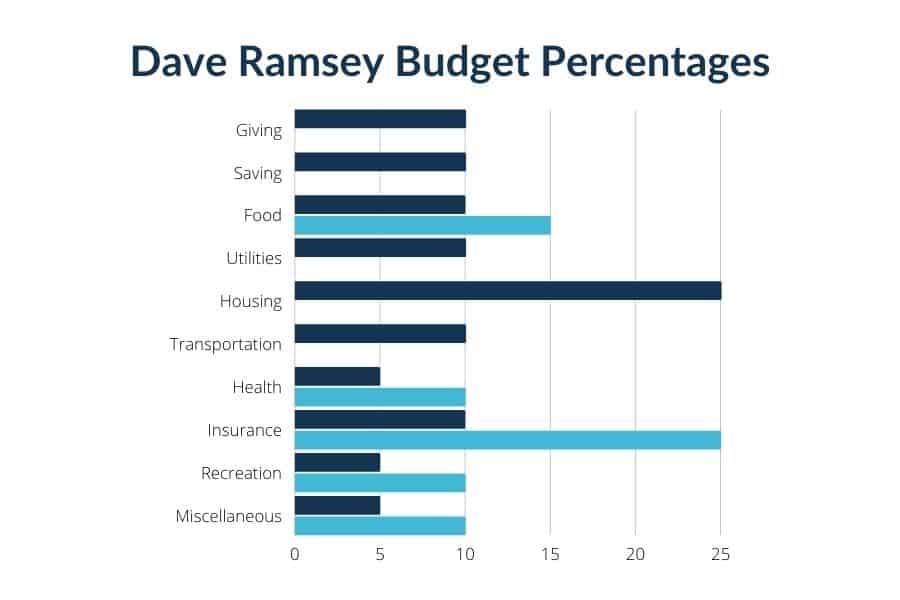

Dave Ramsey Envelope Categories

The Dave Ramsey budgeting method uses percentages to divide up your income into different budget categories. Specifically, Dave Ramsey suggests using these 11 categories to budget:

- Food – 10% to 15%

- Transportation – 10%

- Utilities – 5% to 10%

- Housing – 25%

- Health – 5% to 10%

- Insurance – 10% to 15%

- Recreation – 5% to 10%

- Saving – 10%

- Giving – 10%

- Personal – 10%

- Miscellaneous – 5% to 10%

If you follow the Dave Ramsey budget system, you could use cash envelopes to cover some of these budgeting categories.

Again, you’d want to choose the variable spending categories and pay fixed expenses from your bank account. So following that rule, you might use these cash envelope categories:

- Food

- Transportation

- Health

- Recreation

- Giving

- Personal

- Miscellaneous

Related post: Budget Percentages Explained: 3 Easy Ways to Create Your Ideal Budget

Can You Use a Cashless Envelope System Instead?

If you’d rather not carry around dollar bills in a cash envelope wallet, you could try the digital envelope system instead.

This involves using a budgeting app like Qube Money to set up digital cash envelopes. You link the app to your bank account to track your spending automatically.

For budgeting purposes, opting for a cashless envelope system isn’t much different than spending with actual cash. And you can get away with carrying less money on you.

But it may be easier to overspend using your debit card versus cash spending. So consider how committed you are to sticking with your cash envelope categories each month.

👉If you’re looking for some cash envelopes to get started, be sure to check out the cute options in the Boss Single Mama shop!

Cash Envelope Categories FAQs

How do you organize cash envelopes?

Organizing cash envelopes starts with deciding how many envelopes you need, then writing the name of each expense category on the outside of the envelope. You can then add the appropriate amount of money to each envelope.

A simple way to organize cash envelopes is using a cash envelope wallet. Here are some super cute cash envelope wallets I found on Amazon!

Cash Envelope Wallets

How many cash envelopes should I have?

The amount of cash envelopes you should have depends on how many variable spending categories are in your budget. A good number of cash envelopes to have is 5 to 7, which can help you separate spending without making it too complicated.

What do you label cash envelopes?

For each cash envelope you have, you’d label it according to its spending category. So you might have one cash envelope labeled “grocery shopping”, another labeled “gas and transportation” and another envelope labeled “home”.

Get Free Cash for Your Envelopes!

Looking for some easy ways to get free cash to add to your cash envelopes? Download these amazing cashback apps to get free money now!

Ibotta

Ibotta rewards you with cashback when you shop for groceries, household items, clothing and more from top retailers. Here’s how it works:

- Download the free Ibotta app

- Link your debit card or credit card

- Add your store loyalty cards

- Shop and earn cashback on qualifying purchases!

Ibotta will even give you up to $20 in bonus cash just for signing up. Get your free $20 cash bonus from Ibotta today!

Rakuten

Rakuten is another top cashback app that pays you real cash when you spend on everything from clothes to school supplies to travel.

You can earn cashback on purchases from top retailers like Best Buy, Macy’s and Target. Plus, you can get coupons for added savings when you spend!

Like Ibotta, Rakuten also offers a signup bonus and you can earn bonuses for referring new members. Those bonuses can be worth up to $40, so if you’re not using Rakuten to earn free cash yet, sign up now!

Dosh

Dosh makes earning cashback simple. You link your debit card or credit card, spend and earn cashback.

The great thing about using Dosh is that you can rotate between it, Ibotta and Rakuten to maximize cashback earnings everywhere you go. All of these apps are free so they basically pay you back money that you were already planning to spend.

Download Dosh and start earning cashback now!

Final thoughts on cash envelope categories

Budgeting with cash envelopes, whether you use paper envelopes or digital envelopes, might be the best option to try if you’ve struggled for a long time to find the right budgeting system. It can also help you to stop overspending so you don’t have to turn to credit cards or worse, risky payday loans, to cover the gaps.

Ready to take the next step? Get started with cash envelope budgeting today!

Need more budgeting tips? Read these posts next:

- Budgeting for Kids: Best Tips for Teaching Kids 2 to 18 About Money

- 50 30 20 Budget Explained (An Easy Way to Budget for Beginners)

- 30-30-30-10 Budget Explained (Pay Your Bills and Still Have Fun!)

- 60/30/10 Rule Budget Explained (and Can It Make You Rich?)

- 70/20/10 Budget Method: How to Use It to Spend, Save and Invest

- 60+ Sinking Funds Categories That Can Help You Budget Better