Last Updated on October 8, 2022 by Rebecca Lake

High-yield savings accounts can help you grow your money faster as you work toward your financial goals. CIT Bank Savings Connect is one option you might consider when opening a savings account.

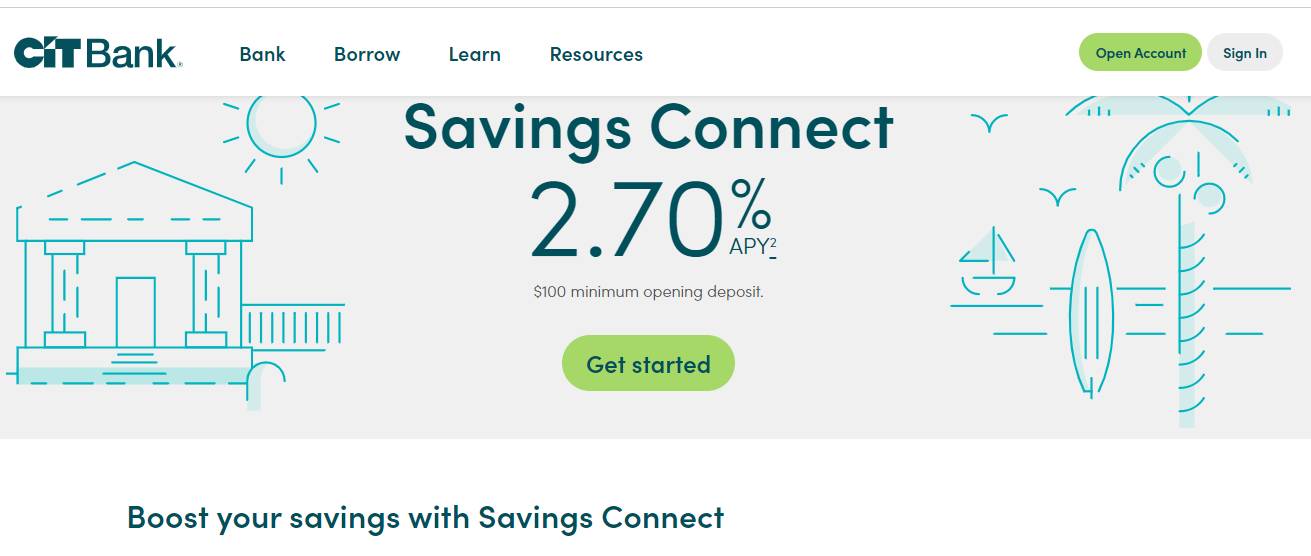

The CIT Bank Savings Connect account is an online savings account that offers one of the most competitive rates around. Savers can earn a solid APY with no monthly maintenance fees.

But is a CIT Bank savings account for you?

Keep reading this CIT Bank Savings Connect review to learn how it works.

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

What Is CIT Bank?

CIT Bank is a U.S.-based financial institution that offers online savings accounts, certificate of deposit accounts (CDs), e-checking accounts and mortgages. CIT Bank is the online banking division of First Citizens Bank, the largest family-controlled bank in the United States.

Is CIT Bank legit?

Yes, this is a 100% legitimate online bank that offers banking services nationwide. There are plenty of other CIT Bank reviews online attesting to its legitimacy.

CIT’s history actually goes back to 1908, when Henry Ittleson focused on finding new ways to make financing available in St. Louis, Missouri. Today, CIT still makes loans but it also offers a range of other products.

For the purposes of this review, we’ll be focusing on the CIT Bank Savings Connect account.

What Is CIT Savings Connect?

The CIT Bank Savings Connect account is an online, high-yield savings account. Deposits to a CIT Savings Connect account earn interest at a competitive rate, with no monthly service fees.

Is CIT Bank FDIC insured? Yes, CIT Bank offers FDIC-insured accounts. The standard FDIC insurance coverage limit is $250,000 per depositor, per account ownership type, per financial institution.

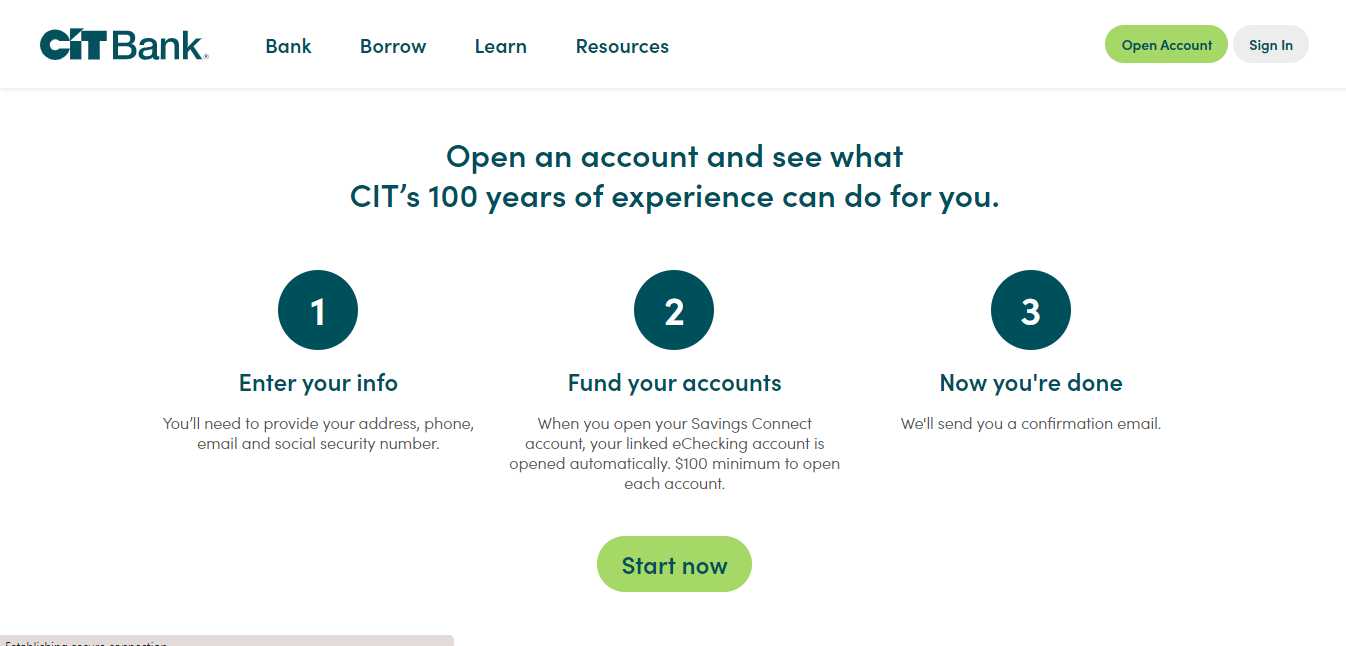

The CIT Savings Connect account has a low $100 minimum opening deposit. You can open a Savings Connect account as a stand-alone account or together with an eChecking account, which also has a $100 initial deposit. Both accounts earn interest, so you’re always growing your money.

There are no setup fees and no monthly service fees. If you also open an eChecking account, you’ll get a debit card with fee-free access to ATMs nationwide. CIT reimburses up to $30 per month in foreign ATM surcharges.

Note: CIT Bank does not have an ATM network of its own.

You can also manage your accounts online or through the CIT mobile banking app. With the app, you can use mobile check deposits to add money to your accounts, transfer funds between your Savings Connect account and eChecking account, pay bills or send person-to-person payments through Zelle. The eChecking account also links to Apple Pay and Samsung Pay for added convenience.

CIT Bank Savings Connect requirements

Opening a CIT Bank savings account isn’t that difficult. If you’re specifically interested in the Savings Connect account, here’s what you’ll need to provide:

- Name

- Home address

- Email address

- Social Security number

- At least $100 to open your account

Note: Previously, you were required to open an eChecking account in order to open a Savings Connect account. At the time of this writing, CIT appears to have eliminated that requirement.

Who is CIT Savings Connect right for?

You might consider opening a CIT Bank Savings Connect account if you:

- Have at least $100 to open a savings account

- Want to open an interest-bearing checking account

- Are comfortable with online and mobile banking

- Want to get a great rate on savings deposits

- Don’t want to pay monthly fees for a savings account

That’s a rundown of how the CIT Bank Savings Connect account works. For the next part of this CIT Bank Savings review, we’ll take a closer look at the account’s details.

Looking for the best high yield savings option? Compare savings account rates online at top banks and credit unions now!

CIT Bank Savings Connect Features and Benefits

When comparing savings accounts, there are several things that are important to consider. If you’re considering a CIT Bank Savings Connect account, here’s what you can expect.

Interest rates and APY

The CIT Savings Connect account offers one of the most competitive rates and APYs of any online savings account.

As of September 2022, savers could earn an APY that was over 15 times higher than the national average. That rate applies to all balances in Savings Connect accounts.

Note: Rates are subject to change.

Fees

Like other online savings accounts, the CIT Bank Savings Connect account is fee-friendly. When you open an account, you pay no:

- Setup fees

- Monthly maintenance fees

- Minimum balance fees

- Online transfer fees

- Incoming wire transfer fees

There’s no excess withdrawal fee for Savings Connect accounts. There is a $10 excessive transaction fee for CIT Bank money market accounts.

CIT does not charge ATM fees. But you may be charged fees by other banks when you use their ATMs. CIT will refund up to $30 per statement cycle in foreign ATM surcharges.

Online and mobile banking access

Since CIT is an online-only bank, you’ll be able to manage your accounts through the CIT website or the CIT mobile banking app. The kinds of things you can do online or through the app include:

- Checking balances

- Transferring funds between accounts

- Scheduling bill payments

- Sending money to friends and family through Zelle

- Depositing checks with mobile check deposit

If you need to add cash to your CIT Bank Savings Connect account, you’ll need to transfer funds from a linked external bank account. CIT Bank does not have branches.

Customer support

When you need help with your CIT Savings Connect account, you can contact customer support by phone. Help is available by calling 855-462-2652. CIT Bank does not have live chat support at this time.

Security

CIT Bank is an FDIC member bank. That means in the rare event of a bank failure, your money with CIT is protected up to the standard coverage limit.

In terms of online security, CIT Bank takes the necessary precautions to protect customer accounts. That includes using encrypted data, antivirus protection, layered security and automatic sign-out.

CIT Bank Savings Connect Pros

The CIT Bank Savings Connect account has plenty of attractive features that could make it a great option for saving. Here are some of the main benefits to keep in mind when comparing savings accounts.

- Low minimums to start saving. You only need $100 to open a CIT Bank Savings Connect account. If you have an extra $100 to spare, you could be on your way to growing your money in minutes when you open a CIT Savings Connect account online.

- No fees. Traditional banks can tack on fee after fee, which can eat away at your interest earnings. CIT Bank keeps a tight lid on fees so you hold on to more of your interest.

- Great rates. CIT has long been one of the best online banks thanks to the impressive rates it pays to savers. Even when the Federal Reserve cuts rates, you can still get more bang for your buck so to speak with a CIT Savings Connect account.

- Easy account opening. You can open a CIT Bank Savings Connect account online in minutes. And you can easily link up external bank accounts for convenient transfers.

- Online and mobile banking. Since CIT Bank doesn’t have branches, it’s important to be comfortable using online and mobile banking. The good news is that both online and mobile banking with CIT are easy to navigate and user-friendly.

CIT Bank Savings Connect Cons

CIT Bank could be the perfect savings option for some but it may not work as well for others. Here are some of the main cons to keep in mind with CIT Savings Connect:

- CIT doesn’t have its own ATM network

- There are no branches

Whether a lack of branches matters much to you can depend on how you prefer to bank.

If you’re okay with managing your savings account and checking account online, then a lack of branches likely isn’t an issue. On the other hand, if you like to be able to go to the bank in person from time to time, then you may need to consider maintaining a separate account at a brick-and-mortar bank.

Other Ways to Save With CIT Bank

In addition to the Savings Connect account, there are other options for saving money with CIT. Here are the other types of accounts you can open:

- Savings Builder. CIT Savings Builder is a tiered-rate savings account. There’s a $100 minimum to open a Savings Builder account and the higher your balance, the higher the APY you can earn.

- Money market account. If you’re interested in earning a high rate while enjoying flexible access to your money, you might consider the CIT Money Market account. This account earns a competitive rate with no monthly service fees and takes just $100 to open.

- Certificates of deposit. CD accounts can be used to save for short- or long-term financial goals. CIT offers standard CDs with terms ranging from six months to five years, as well as no-penalty CDs and jumbo CDs for super savers.

- Custodial accounts. Custodial accounts allow parents to save money on behalf of minor children. If you’re interested in saving money for college, for example, you could open a CIT Bank custodial account for your child.

Related post: Budgeting for Kids: Best Tips for Teaching Kids 2 to 18 About Money

CIT Savings Connect vs. Savings Builder

The CIT Savings Builder account offers an opportunity to earn a top-tier rate when you meet one of two conditions:

- Maintaining a balance of $25,000 or more OR

- Making at least one monthly deposit of $100 or more

There are no account opening or monthly maintenance fees. You can deposit checks remotely or use the CIT Bank mobile banking app. And you’ll need just $100 to open a Savings Builder account.

So which is better, CIT Savings Builder vs Savings Connect?

Based on rates alone, Savings Connect has the edge. The APY for this account is significantly higher than what you’d get with Savings Builder.

You don’t need to meet a high minimum balance requirement for the Savings Connect account either, which is great if you’re just getting started with saving.

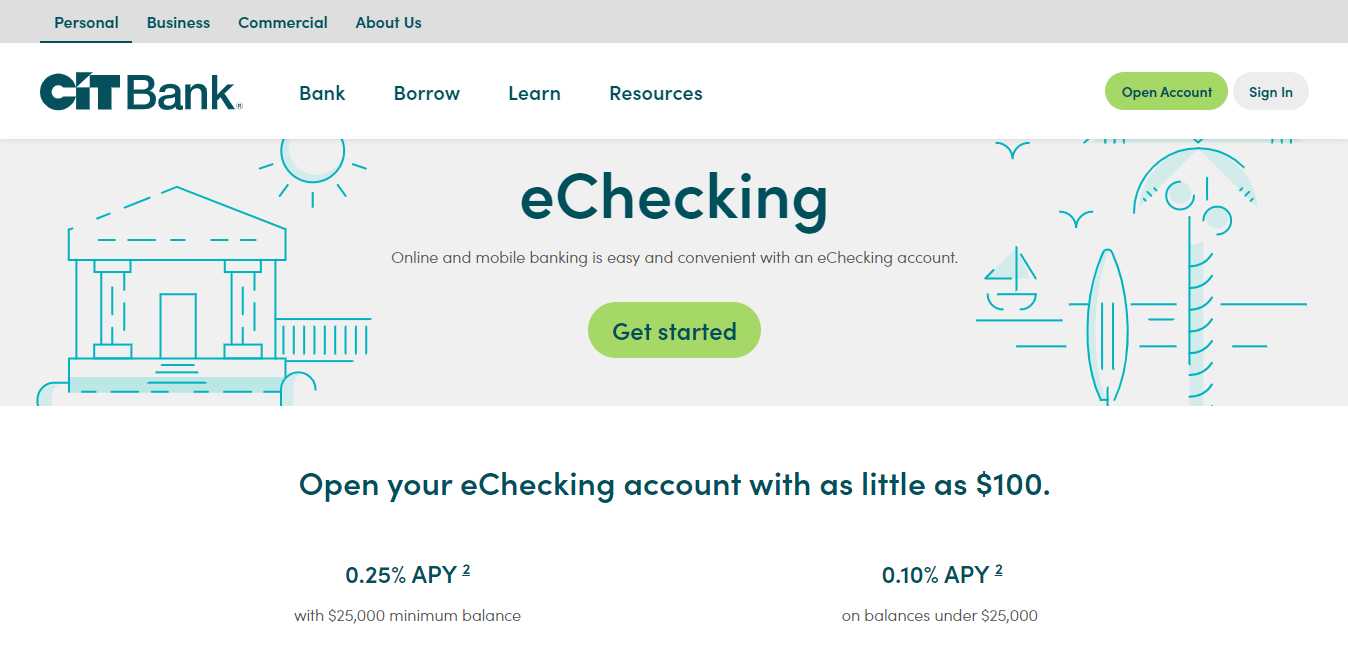

Does CIT Bank offer checking accounts?

As mentioned, CIT Bank offers an eChecking account. This is an interest-bearing checking account that offers tiered rates, based on your balance.

You’ll need $100 to open an eChecking account. eChecking features include:

- Competitive APY on all balances

- $100 minimum deposit to open

- No monthly fee

- Debit card with EMV chip technology

- Online and mobile banking access

- Up to $30 per month in ATM fee reimbursement

- 24/7 account access

Final thoughts on CIT Bank Savings Connect

The CIT Savings Connect account could be right for you if you’re hoping to earn a great rate on savings and you’re interested in opening a checking account online. There are no monthly fees and you can easily access your accounts online or through the CIT mobile app.

When deciding whether to open a CIT Savings Connect account, consider what kind of access you’d like to have to your money. And think about your goals as well to help decide if a particular savings account is right for you.

If you’re ready to open a CIT Bank account, just click any of the links below to get started:

Remember, you’ll need $100 to open a CIT Savings Connect, Savings Builder, Money Market or eChecking account. The minimum for CD accounts is $1,000.

Need more savings tips? Read these posts next:

- Bright Money Review: Pros, Cons and How It Works

- FamZoo Prepaid Debit Card Review: Is It the Best Debit Card for Kids?

- How to Do a No Spend Challenge (3 Pro Tips to Help You Save Money)

- 200 Envelope Challenge (Save $5,100 in 200 Days!)

- Save Money Live Better (20 Easy Ways Save More This Year)

Comments are closed.