Last Updated on September 3, 2023 by Rebecca Lake

Are you struggling with how to get out of debt on a low income?

Being in debt can make it harder to reach your financial goals. And you may have trouble stretching an already tight budget.

On average, Americans owe $5,221 and $17,064 in credit card and personal loan debt, respectively. When you include car payments, medical bills or a mortgage in the equation, paying off debt without winning the lottery might seem impossible.

But there are solutions for getting out of debt even when you don’t have a lot of money to work with.

In this step-by-step guide, I’m sharing some of the best tips for getting out of debt on a low income so you can get ahead financially.

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

Table of Contents

How to Get Out of Debt on a Low Income

Getting out of debt on a low income is a process and it’ll take time. That’s important to know right away, otherwise you could easily lose your motivation to keep going.

If you’re ready to reach debt freedom, these tips can help.

1. Stop adding to your existing debt

The first secret to how to get out of debt on a low income is to stop adding to your debt problem.

This means no more:

- Turning to credit cards to cover expenses

- Taking out high-interest loans

- Getting advances from your paychecks

- Shuffling balances around with 0% balance transfer offers

- Borrowing from friends and family

This can be the hardest step in the entire process because it requires you to take a hard look at what you’re spending. But it’s important to start here; otherwise, you’ll have a harder time getting your debt under control.

2. Build a starter emergency fund

Save or pay down debt, which should you do first?

It’s an age-old debate and one that financial experts have yet to agree on. But there are some good reasons to save a little money first before you dive into debt repayment head-on.

Why? Simply because having a little cash set aside for emergencies can keep you from having to pull out a credit card or get a loan if an unplanned expense comes along.

In terms of how much you should aim to save, $500 to $1,000 is usually good for a baby emergency fund. And you can grow your savings by keeping it in a high-yield savings account that earns a competitive interest rate.

Grow Savings Faster With Current

Current is a digital banking app that makes it easy to grow savings, manage spending and track your goals in one place! You can set up individual savings pods for different goals and earn the same competitive APY for each one.

Aside from making saving a breeze, Current also comes with other great features like fee-free overdraft and access to 40,000+ ATMs!

**View product disclosures

3. Add up your debt balances

Getting out of debt on a low income means knowing what you owe to the penny. So pull out your credit card statements and loan statements, then add up:

- How much you owe to each debt

- The interest rate on the debt

- Your minimum monthly payment

- The actual amount you pay monthly for each debt and altogether

- Your total debt owed altogether

If you’re behind on bills anywhere, you can also make note of any fees or penalty rates that might apply to your accounts.

This is probably the least fun step when learning out how to get out of debt on a low income. But seeing the numbers in black and white can be highly motivating to start tackling those debts.

4. Plan your budget

A budget is a plan for spending money each month. If you’re working on how to get out of debt on a low income, then a budget is non-negotiable.

When making a budget, it’s important to understand:

- How much income you have to work with

- Which expenses must be paid

- Which expenses you can cut out

Essential expenses include things like rent or mortgage payments, utilities, and groceries. Nonessentials are things like dining out, entertainment, or travel.

If you’re living on a low income, then you might only be spending money on essentials already. In that case,e you may want to try using a tool like Rocket Money to see if there are any areas where you could cut back that you might have missed.

Rocket Money helps you find savings by analyzing your spending and bills. It’s perfect for finding the smaller expenses that might be eating up your budget each month.

Save More With Rocket Money

Stop overpaying and start saving!

Rocket Money is an all-in-one personal finance app that helps you find savings instantly, lower your bills, and keep more of your hard-earned cash.

It’s a simple way to build savings back into your budget every month, without getting nickel and dimed.

5. Choose the right debt repayment strategy

If you’re trying to figure out how to get out of debt on a low income then chances are you’re not going to be able to throw thousands of dollars a month at your balances. So you need to have a strategy that allows you to pay money toward your debt consistently.

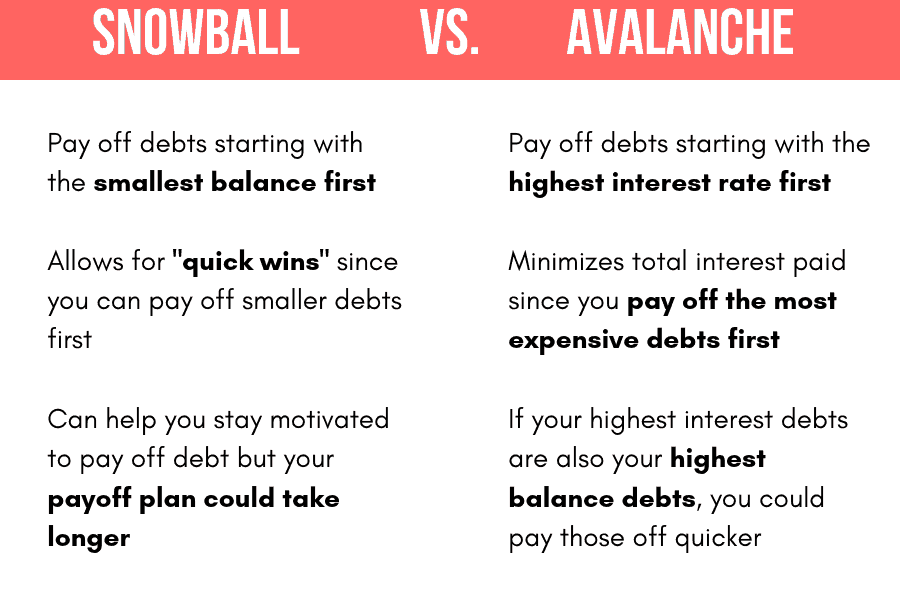

The most popular debt repayment methods are the debt snowball and the debt avalanche.

The debt snowball method (popularized by Dave Ramsey) has you paying off debts by the smallest balance to the highest. You pay as much money as you can toward the smallest debt while making minimum payments to the rest.

As you pay off the first debt, you roll that payment over to the next debt and repeat the process. You keep doing this until all of your debts are gone.

The debt avalanche uses the same approach, although instead of paying off debts by balance you focus on interest rates instead. So you start with the debt that has the highest APR, then work your way down.

Related post: Dave Ramsey Baby Steps for Financial Freedom

Debt repayment example

Here’s an example of how much you might cost yourself by only making the minimum payments to your debts.

Say you owe $10,000 in credit card debt at an APR of 19.99%. Your monthly minimum payment is $300 or 3% of the balance.

At that rate, it will take you four years and two months to pay it off. And it’ll cost you just over $4,700 in interest.

Now, say you come up with another $200 to put toward your debt each month.

Even if your interest rate doesn’t change, paying $500 a month toward your cards instead of $300 would cut your payoff time in half. And you’d save about $2,500 in interest.

6. Embrace frugality

Living frugally can free up more money in your budget that you could apply to your debt.

Again, you might be practicing frugal living habits already if you’re living on a low income. But if you need a few more frugal hacks to try, here are some tried-and-true ways to save money.

- Invest in a pair of clippers and give your kids haircuts at home

- Cancel cable and watch TV using low-cost streaming services like Hulu

- Switch from a contract cell phone plan to a prepaid plan (Tello offers plans starting at $5/month!)

- Stop going to the grocery store and use online ordering and pickup instead (saves you money on those impulse buys!)

- Use only cold water to do laundry and switch to dryer balls instead of dryer sheets to save money

- Turn off lights when leaving the room and unplug appliances you aren’t using

- Use a cashback app like Rakuten to earn back a percentage of what you spend

- Stick to finding ways to have fun as a family that cost little or nothing

These are all frugal habits I adopted as a newly single mom when I had a ton of debt and barely any money. And they’re all things I still do to save money so I know they work.

For more money-saving ideas, read these posts next:

- 21 Things to Stop Buying to Save Money Every Month

- 37 Helpful Money-Saving Hacks for Living on One Income

- 100+ Best Frugal Living Tips for Families to Save Money

7. Make your debt less expensive

Here’s one of the most important things to know if you’re focused on how to get out of debt on a low income:

High interest rates can be a huge obstacle to reaching your goal.

Banks and lenders charge interest because that’s one way they make money. But that doesn’t mean you have to settle for paying steep interest rates on credit cards or loans and forking over all that cash.

Instead, you find ways to bring those interest rates down.

You can call your lenders or creditors and ask for a rate cut. That can work with credit cards if you’ve always paid on time and are a good customer.

But asking doesn’t always mean receiving.

So here’s what else you can do:

- Transfer high-interest credit card debt to a new card with a 0% APR

- Take out a low-interest rate personal loan to consolidate debts

- Refinance your private student loans at a lower interest rate

- Consider refinancing your mortgage while rates are low

All of these options can save you money if you’re able to qualify for a lower rate than what you’re paying now.

To get the best rates, you’ll need a good credit score. If you’re clueless about where you stand credit-wise, then head over to Credit Sesame and sign up for a free account.

Credit Sesame is a free credit monitoring service that lets you track your credit score and get alerts on changes to your credit file. You can also use Credit Sesame to get recommendations for the best low-interest credit cards if you want to transfer balances.

Find Your Next Credit Card at Credit Sesame

Personalized card offers tailored to your needs

Need to transfer a balance? Looking for a new rewards card? Ready to start building credit? Save time (and headaches) by letting Credit Sesame find your perfect card match!

8. Use found money to pay off debt

Found money is an overlooked solution for how to get out of debt on a low income. Found money is basically any money you weren’t counting on in your budget.

So that includes things like:

- Refund checks

- Stimulus checks

- Rebates

- Bonuses you get from work

- Returned security deposits

- Cash gifts for birthdays or holidays

When you have extra money like this, whether it’s a few bucks or a few thousand dollars, consider putting all of it toward debt if you can.

You might be able to wipe out a good chunk of what you owe this way. But even smaller amounts make a difference.

You can use these websites to look for found money online.

9. Increase your income

If you’ve tried other tips for how to get out of debt on a low income but feel like you’re not getting anywhere, increasing your income may be the answer.

The good news is, there are so many ways to make extra money to pay down debt.

For example, you could:

- Ask for more hours at work if you’re paid hourly

- Get a part-time job on top of your full-time job

- Negotiate a raise if you’re paid a salary

- Sell things to make extra money

- Start a side hustle or your own business

Side hustles are great you can make money on a flexible schedule. That’s perfect if you’re a stay-at-home mom who needs to be there for her kids or a busy college student who’s juggling work and classes.

If you’re looking for some side hustle ideas to make extra money, these are my absolute favorite options:

- Take surveys online. It doesn’t take a lot of time and you could easily make a few hundred dollars extra each month with sites like Survey Junkie and Swagbucks.

- Use apps to save money when you shop. You can easily earn money back on purchases without having to do anything extra when you use apps like Rakuten and Dosh.

- Get paid to deliver groceries or food. Both require leaving home but you can make a decent amount of money in your spare time with companies like Instacart or DoorDash.

- Declutter your house and sell the stuff you don’t need. Apps like Decluttr make it easy to sell things you no longer need or want. You get a clean house and cash in your pocket!

- Get paid to write for websites and blogs online. Freelance writing is a great way to make a full-time income from the comfort of your own home. You can look for jobs on sites like Writers Work or FlexJobs.

- Start a blog of your own! Blogging can be a great way to make money online if you know what you’re doing. Check out this complete guide to starting a blog for beginners.

- Get paid to proofread or transcribe. Proofreading and transcription are high-paying skills to have and you can do them both online. Here’s a free webinar to learn more about proofreading, plus one that’ll teach you the basics of transcribing if you’re interested in either one.

- Become an online teacher. Teaching online is a great option for moms or anyone who has spare time and a subject they’re passionate about. I personally recommend Outschool for teaching online — teachers average $50 an hour!

Those are just some of the ways you can make money to help pay off debt. You can also explore free money hacks or cash in your change at a Coinstar near you.

For more ideas on making extra money, read these posts next:

- 5 Legit Business Ideas for Moms You Can Start to Earn $5,000+ Monthly

- 50 Legitimate Ways to Make an Extra $1,000 a Month From Home

- 50 Best Side Hustles for Moms to Make an Extra $500 a Month

Make Quick Cash With Survey Junkie

Take surveys. Earn rewards. Get paid.

Making extra money is that easy when you create an account with Survey Junkie. It’s free to sign up and you can earn real cash in your PayPal account or free gift cards, just for answering questions and sharing your opinions.

Get Help With Your Debt If You Need It

Sometimes, debt can just be too overwhelming. And no matter what you do, it’s a struggle to pay it off on a low income.

That’s when you might need to get help with managing debt.

Reaching out to a nonprofit credit counseling agency can help. Nonprofit credit counselors can help you come up with a workable plan for getting out of debt.

And if your debt is just too big, they may be able to suggest other solutions like debt consolidation, debt settlement, or even bankruptcy.

Those options aren’t necessarily ideal, since they can hurt your credit score. But they can help you get rid of your debt when you’re absolutely buried.

Final Thoughts

Getting out of debt isn’t always easy, especially when you aren’t making a lot of money. But it’s possible to pay off debt for good even on a low income if you’re committed to making it work. These tips can help you start your debt payoff plan and potentially make more money along the way so you can get closer to financial freedom.

Need more money tips? Read these posts next:

- How to Pay Off Debt as a Single Mom: 7 Practical Tips

- 140+ Frugal Meals for Tight Budgets (Quick and Delicious!)

- 80+ Frugal Food Hacks (Save More, Waste Less)

- Groceries on a Budget: 35 Ways to Save Money on Food (Without Coupons)