Last Updated on May 13, 2023 by Rebecca Lake

Single mothers (and single parents in general) often have to contend with financial struggles, which can include managing debt.

The types of debt a single mom might have can include credit cards, student loan debt, car loans or personal loans. Figuring out how to pay off debt as a single mom can be challenging, especially if you’re living on a low income or just don’t have much money to work with.

Making a plan for paying off debt as a single mother can help you get your financial situation under control. If you’re looking for a little debt relief as a single mom (or a single dad) these tips can help you start to see the light at the end of the tunnel.

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

Table of Contents

How to Get Out of Debt as a Single Mom in 7 Steps

Unless you’re lucky enough to receive a financial windfall, paying off debt is usually an ongoing process. And it’s easy to feel overwhelmed, especially if you’re a busy mom who’s trying to make ends meet on a single income.

Statistically, single-parent households are more likely to have debt. As a single mom of two, I’ve been there.

In 2014, I had nearly $100,000 in debt, split between federal student loans and credit cards. In 2016, I added to my debt total when I took on a $24,000 car loan after my old car died.

It took some time, but by the fall of 2021, I’d paid off the car loan, all my credit cards and $40,000+ in student loans. Today, I’m debt-free except for my mortgage.

So, can a single mom get out of debt? Absolutely, but it takes planning and a little hard work.

The good news is that financial independence isn’t an impossible goal if you have the right plan.

Step #1: Add up what you owe

The first step in figuring out how to pay off debt as a single mom is knowing what you owe. That means sitting down and adding it all up.

Make a list of all your debts, including:

- Who you owe money to

- How much you owe

- The monthly minimum payment

- Your actual monthly payments

- The interest rate for your debts

It can be a little scary to do this; I remember feeling panicked when I found out I was almost $100K in the hole!

But this is a necessary step if you’re serious about how to pay off debt as a single mom.

Looking for a simple money management tool? Empower makes it easy to track spending, saving, investing, and budgeting in one place so you can tackle your financial goals!

Step #2: Figure out what you can afford to pay

Once you know what debts you have and how much you owe, the next step is figuring out what you can afford to pay.

Making a simple budget can give you an idea of how much extra cash you might have to pay toward debt. A basic single mom budget should have your monthly income on one side and your monthly expenses on the other.

A single mom’s income might include:

- Paychecks from a 9 to 5 job

- Money earned from side hustles

- Passive income earnings

- Child support or alimony

- Government benefits

When you’re adding up your income to make your budget, I always recommend only including income you can count on month to month.

I know from personal experience how unreliable child support can be so I’ve never counted it in my budget. If you’re in a similar situation then you may be better off only budgeting with the money you know you’ll have in your bank account each month.

Next, add up your expenses. You can start with the necessities, like:

- Housing

- Utilities

- Groceries and food you eat at home

- Child care

- Gas or public transportation

These are the basic things you might need to pay to live each month. Your budget can also include non-essentials, like clothes, personal care or fees you pay for your kids’ school activities.

The more you can count out of the non-essential spending category, the more money you’ll have to pay off debt in the long run.

Step #3: Choose a debt repayment method

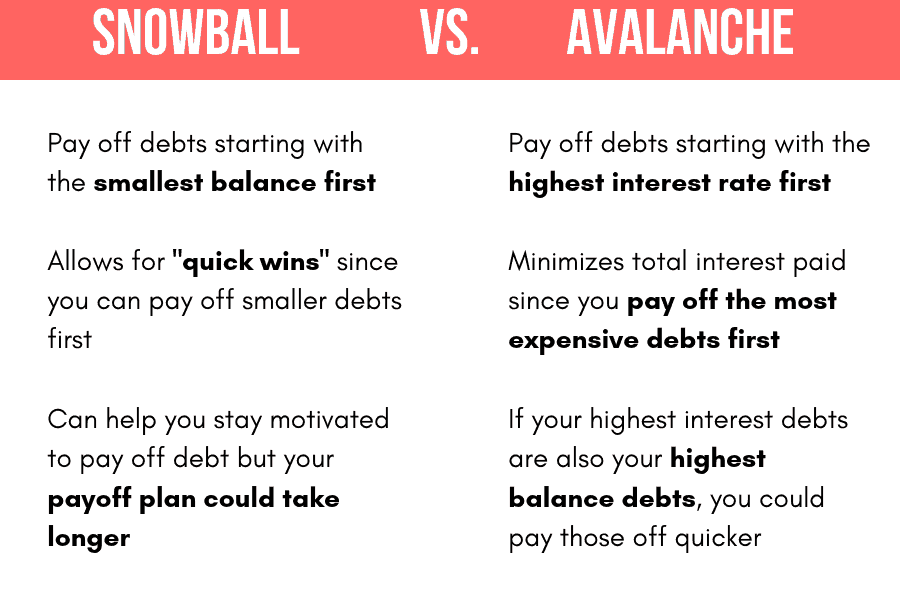

When it comes to how to pay off debt as a single mom, you’ve got some options. Two of the most popular ways to pay off debt are the debt snowball and the debt avalanche.

With the debt snowball, you rank all of your debts from lowest balance to highest. You pay as much as you can toward the smallest debt while making minimum payments to everything else.

Once you pay off the first debt, you roll its payment over to the next debt on the list. You keep paying the minimums to everything else, rinsing and repeating until all your debts are gone.

The debt avalanche method works the same way, with one difference. Instead of ranking debts from the smallest balance to the highest, you rank them from the highest interest rate to the lowest.

What’s the benefit of that?

It’s simple. Paying off your most expensive debt can save you more money in interest.

If you have credit card debt, you probably know just how high interest rates can be and what a financial burden that is. You pay and pay but it seems like the balance never goes down.

Whether it makes sense to choose the debt snowball vs. debt avalanche can depend on how much money you have to work with. In my experience, choosing the debt snowball can give you some motivation to keep going if you’re knocking out a smaller debt first thing.

And if you’re only making the minimum payments now, don’t feel guilty. That might be your reality if you’re living on one income, as it is for many single-parent households.

Step #4: Make your debt less expensive if you can

As mentioned, high interest rates can be a major roadblock when you’re trying to figure out how to pay off debt as a single mom. The more you can lower interest rates, the better.

Here are a few ways to do that.

- Transfer balances. A balance transfer credit card lets you move balances from card to another. For example, you might move a $5,000 balance from a card with a 17.99% APR to one with a 0% APR for 15 months. That could give you time to make a dent in what you owe without having to worry about interest charges.

- Refinance your auto loan or get rid of it altogether. If you have a car loan, refinancing could help you get a lower rate. What you have to be careful of, however, is negative equity. If you’re upside down in the car, you might not be able to refinance it. In that case, you might consider selling it to pay off the loan and using anything extra you might get to pay cash for a reliable used car.

- Refinance student loans. If you have student loans from private lenders, you might consider refinancing them if you can get a lower interest rate. Refinancing student loans could also help you lower your monthly payments. Just be aware of what refinancing might cost you in the long run if you’re getting a longer loan term.

- Get a low-rate personal loan. Personal loans can help you consolidate debt so you have just one payment to make each month. If you’re able to get a lower rate on a personal loan compared to what you’re paying on your credit cards, that could save some money.

- Refinance your mortgage. If you own a home, you might consider refinancing your mortgage if you could get a lower rate or reduce your monthly payments. Keep in mind that it’s a good idea to shop around and compare refinancing rates to find the best deal.

Tired of throwing money away on credit card interest? Transferring high-interest rate credit debt to a card with a 0% APR could save you serious cash and help you pay off debt faster. If you’re ready to make your credit card debt less expensive, compare balance transfer card offers with Credit Sesame.

Step #5: Look for extra money to pay off debt

One of the most important personal finance truths I’ve learned about how to pay off debt as a single mom is that cutting your budget often isn’t enough. You have to make more money to really make a difference in your financial life and reach your big goals.

How can a single mom make money? Especially if they’re already working full-time jobs?

You could get a part-time job (or multiple part-time gigs). Or you could ask for a raise at work, which might be worth considering if you’re past due for a salary increase.

I found that the best way to make money as a single mom was to monetize the skills I already had. So I started doing freelance writing work, which allowed me to continue homeschooling my kids who were 5 and 6 at the time.

Starting my business has allowed me to become a stay at home single mom, which has been invaluable to me and my kids.

If you’d like to be able to make more money and have more time with your kids, then you might want to consider what kind of side hustles or at home businesses you could start.

Here are a few ideas you might try.

- Freelancing writing (FlexJobs is a great place to find paying gigs)

- Blogging

- Becoming a virtual assistant or Pinterest VA

- Doing online proofreading jobs

- Teaching with Outschool

- Selling on Etsy (I started an Etsy shop with my teen daughter and we love it!)

- Selling digital printables

- Remote customer service jobs (check Virtual Vocations for listings)

- Starting a YouTube channel

You could also look at easy ways to make money in your spare time.

For example, you could get paid to share your opinions with Survey Junkie. Or you can make money when you shop by earning cashback with Rakuten.

You can also use any windfalls that come your way to pay off debt. For example, you might use your tax refunds to pay off a chunk of your debt each year.

The more you can pay toward your debt in the short term, the more money you’ll have available later to fund your long-term goals.

Make Quick Cash With Survey Junkie

Take surveys. Earn rewards. Get paid.

Making extra money is that easy when you create an account with Survey Junkie. It’s free to sign up and you can earn real cash in your PayPal account or free gift cards, just for answering questions and sharing your opinions.

Step #6 Get help with your debt

There are no government programs that help low-income families pay off debt. But there are some other options for single moms who are ready to get out of debt.

- Debt management plan. A debt management plan is a structured plan for paying off debt. You make one monthly payment to a credit counselor, who then splits your payment among your creditors. Meanwhile, your credit counselor might work with your creditors to get your interest rate reduced or certain fees waived. A debt management plan might be a good fit if you only have credit card debt to pay off.

- Debt resolution. Debt resolution allows you to settle your debt for less. You’re basically asking your creditors to accept less than what’s owed. Resolving debt can help you get out of debt faster if your creditors are willing to make a deal. You’ll need to have enough money to pay the settlement in full and settling can ding your credit score. But having used this method to clear up some past-due debts, I can tell you the feeling of financial relief was well worth it and I’ve been able to build up a good credit score over time.

- Bankruptcy. Bankruptcy isn’t an ideal way to get out of debt, since it can wreck your credit score. But if you’re a single mom who’s really struggling because you just have too much debt and not enough income, then filing for bankruptcy can get help you wipe the slate clean. There are certain requirements you’ll need to be able to meet, so you might want to talk to a credit counselor or get a free consultation from a bankruptcy attorney to help you decide if it’s the right move.

Step #7: Get other financial help if you need it

You can also look into federal programs, state programs and charitable programs that help single moms if you’re trying to get a handle on your finances. Again, you might not get direct help with debt but you might be able to get financial assistance that can make it easier to pay the bills.

Here are some of the programs for single mothers you can find through federal agencies and state agencies:

- Temporary Assistance for Needy Families (TANF). The TANF program provides low-income families with children with cash assistance. Single moms in financial need can also get childcare benefits and work assistance through TANF.

- Supplemental Nutrition Assistance Program (SNAP). Single parent households and other families who have financial difficulties paying for food can get food benefits through SNAP. Qualifying for SNAP, also referred to as the food stamps program, can relieve some of the financial burden of grocery shopping, especially since food inflation remains high.

- Women, Infants and Children (WIC). The WIC program provides vouchers for mothers and young children to purchase healthy foods. Depending on your child’s age, you might be able to get vouchers to buy formula, milk, cereal and other food items at grocery stores.

- Housing Choice Voucher Program. Offered through the Department of Housing and Urban Development (HUD), the Housing Choice Voucher Program or Section 8 helps eligible families qualify for affordable housing.

- Medicaid and CHIP. If you don’t have health insurance at work or you can’t afford to pay the premiums, you might be able to get affordable health care through Medicaid. Kids can qualify for low-cost or free health care through the Children’s Health Insurance Program (CHIP).

- Federal student debt relief. If you took out federal loans to pay for college, you could get help from the federal government to manage them. That includes forbearance programs, deferments and income-based repayment plans. If you work in public service, you might be eligible for loan forgiveness as well. If you’re going back to school, you might look into your federal student aid options, which can include Pell Grants.

- Low Income Home Energy Assistance Program (LIHEAP). LIHEAP offers funds to help people who are struggling to pay their utility bills. You can also get money to pay for weatherization or home improvements that can reduce your energy costs.

If you’re not sure what kind of help you qualify for as a single mom, you can contact your local Department of Social Services. Someone there should be able to review your financial situation and tell you what you might be eligible for and how to apply.

As your finances improve, you might talk to a financial advisor about the next steps you can take to get ahead. That might include buying life insurance, increasing your emergency savings fund or setting aside money for a down payment on a home.

Many advisors offer an initial consultation so you can get free financial advice. And if you can’t find an advisor to work with, you can always schedule a meeting with a nonprofit credit counselor.

Thinking about buying life insurance? Getting rate quotes from multiple insurers can help you find the best policy for your needs and budget. Credit Sesame makes it easy to compare quotes from different insurance companies in one place so you can get the coverage you need. Start comparing life insurance rates with Credit Sesame!

How to Pay Off Debt as a Single Mom FAQs

How can a single mother get out of debt?

A single mother can get out of debt by making a plan that works for her financial situation and sticking with it. For some single moms, that might mean just making the minimum payments consistently until they can grow their income enough to throw more money at their debts. For others, it might mean refinancing debts to get a lower interest rate or looking into debt management programs or even bankruptcy as a last resort.

How do single moms cope financially?

Surviving financially as a single mom starts with making a realistic budget that considers what you have coming in and what’s going out. Some of the best ways to manage finances as a single mom include making and sticking to a monthly budget, putting money into a savings account regularly and looking for ways to make extra money. Single moms can also look into financial assistance programs for needy families, which can provide help with things like rent payments or utility bills.

How do I pay off debt on a single income?

Paying off debt on a single income starts with having a plan. For example, you might build a baby emergency fund first to cover unexpected expenses. The next step is paring down your budget to free up more money to pay off debt. You can use the debt snowball method to pay off your smallest debt first. If you receive small amounts of money from refunds, rebates or birthday gifts, you can apply those amounts to your debt as well.

What is a good side hustle for a single mom?

There are lots of side hustles for single moms that can allow you to make money on your own schedule. Some of the best side hustles for single mothers include freelance writing, working as a virtual assistant, doing transcription or proofreading jobs online, pet-sitting and offering childcare services in your home.

Final thoughts on how to pay off debt as a single mom

Paying off debt as a single mom isn’t easy and you might have to give up certain things for a while to make your debt repayment plan work. At the end of the day, however, those sacrifices can be well worth it to get a fresh start so you can focus on your other financial goals. The less debt you have dragging you down, the easier it becomes to build a better life for you and your kids.

Need more money tips? Read these posts next:

- 29 Money-Saving Tips for Single Moms [Cut Your Budget Instantly!]

- 9 Smart Financial Tips for Single Mothers (Build Wealth as a Single Mom)

- How to Make Money Fast as a Woman

Take Control of Your Budget!

Grab these FREE budgeting printables and get your finances on track when you join the weekly newsletter!