Last Updated on September 9, 2023 by Rebecca Lake

When you need fast cash, you might search online for ‘pawn shop near me’.

Selling or pawning items can be a simple way to get money quickly. According to the National Pawnbrokers Association, there are nearly 11,000 pawn shops in the U.S. that serve millions of customers. So chances are, you’ve got at least one pawn shop nearby.

The best pawn shop near you is one that offers great prices for pawn items, has friendly staff and accepts different types of quality merchandise to pawn or sell.

Wondering where to find pawn shops locally? Today, we’re sharing a free pawn shop near me locator tool, ideas for the best things to sell at a pawn shop and tips on how to find a reputable pawnbroker near you.

Related post: Coinstar Near Me: How to Turn Coins Into Cash Fast

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

Table of Contents

Pawn Shop Locator Tool: Find a Pawn Shop Near Me

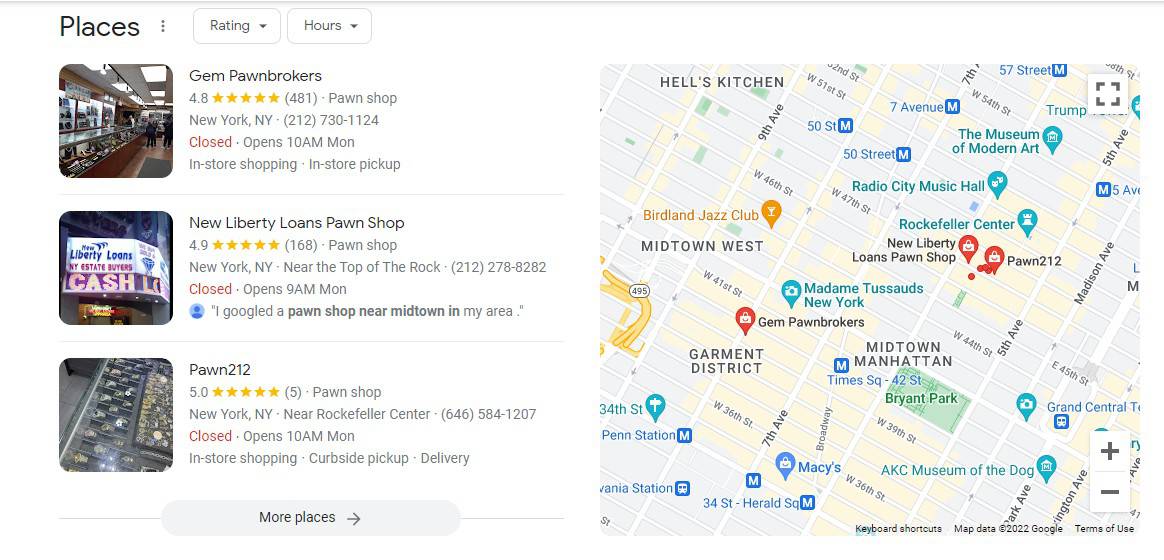

A simple Google maps search can help you find a pawn shop near me when you’re desperate for cash. It’s possible to find pawn shops all over the country, whether you live in a major city like Los Angeles or a small town in North Carolina.

Just type your zip code in the search box below to get results for pawn shops near you.

In addition to searching for ‘pawn shop near me’, you can also try searching for:

- ‘Nearest pawn shop’

- ‘Pawn shop near me open now’

- ‘Pawn shop near me walking distance’

- ‘Pawn shop near me open’

- ‘Find a pawn shop near me’

- ‘Nearest pawn’

- ‘Nearest pawn shop to my location’

- ‘Closest pawn shop to my current location’

- ‘Auto pawn loans near me’

- ‘Jewelry pawn shop near me’

- ‘Title pawn near me‘

- ‘Local pawn shops near me’

- ‘Pawn stores near me’

- ‘Best place to pawn things locally’

- ‘Expert gold buyers near me’ (if you want to pawn jewelry)

You can also include the name of a specific pawn shop to try and find locations nearby. For example, you might search for ‘Quik Pawn Shop near me’ if you live in Alabama.

Note: You may need to enable pop-ups to display your results.

How Do Pawn Shops Work?

Pawn shops work by allowing you to exchange different items for cash. You can pawn items with a short-term loan, or sell your items outright.

If you’re pawning something, you’re getting a collateral loan. The item you’re pawning secures the cash loan and the loan value is based on what the item is worth.

You make monthly payments to your pawn loan and potentially, a small one-time payment to cover fees. Your loan can also carry interest charges. The item is returned to you when you make the final payment on the loan.

Note: You’ll typically have 30 days to repay a pawnshop loan.

Assuming you pay the loan back in that time frame, you can get back the item you pawned. If you default on a pawnshop loan, the pawn broker gets to keep your item.

Pawnshops can also buy your items for cash if you don’t need a loan.

You tell the pawnshop what you have to pawn or sell and the pawn broker will give you an appraisal. If you’re happy with the amount, you can hand over the item and walk away with cash.

Related post: Gift Card Exchange Kiosk Near Me: Turn Unwanted Gift Cards Into Instant Cash!

Need Loan Funding Fast?

Get a personal loan from Upstart

Upstart offers unsecured personal loans ranging from $1,000 to $50,000. Get cash to consolidate dates, pay off medical bills, or cover emergency expenses. There are no hidden fees and you can get funds as quickly as the next day after you’re approved.

What Do Pawn Shops Buy?

A pawn shop can accept a wide selection of valuable items for pawn or purchase. The best pawn shops will pay top dollar for your items.

Some of the best things to pawn or sell at a pawn shop include:

- Brand-name merchandise of any kind, including new retail items in their original packaging

- New or used laptops and laptop accessories

- Personal computers (PCs) and PC accessories, especially for gaming computers

- Bikes, including mountain bikes or racing bikes

- Video games and game console systems (i.e., PS4, PS5, Xbox and Nintendo Switch)

- Home audio equipment

- Video equipment

- DJ equipment

- Digital cameras, camera accessories and equipment

- Musical instruments and accessories (like guitar cases or amps)

- Flatscreen TVs (great if you have a smart TV you don’t need)

- Fine jewelry, including diamond jewelry, gold jewelry and other jewelry items made of precious metals (many pawnshops specialize in gold buying)

- Loose gemstones, including diamonds, sapphires, rubies and emeralds

- iPads and tablets

- Sporting goods, like golf clubs, weights, football equipment, etc.

- Luxury handbags from top brands like Gucci, Fendi, Louis Vuitton, Prada and Chanel

- Unlocked newer generation cell phones and cell phone accessories (though some pawn shops won’t buy phones)

- Go Pros and dash cameras

- Power tools (drills, battery-operated screwdrivers, sanders, saws, etc.)

- Lawn equipment, including lawnmowers, leaf blowers and weed eaters

- Weapons, including collectible firearms and antique guns

- Certain types of vehicles, such as ATVs or dirt bikes (some pawn shops also buy cars)

- Collectible coins and currency

- Sports memorabilia, especially signed jerseys or hats, collectible cards and photographs

- Luxury watches (men’s and women’s)

- Hunting gear, including bows, arrows, knives, deer stands and tents

- Go-karts and dune buggies

- Collectible toys, including action figures, dolls and dollhouses, Hot Wheels and comic books

- Medical equipment

Keep in mind that there are certain things a pawn shop won’t accept. Some of the things you typically can’t pawn or sell at a pawn shop include:

- Stolen items

- Clothing

- Anything that’s considered to be contraband

- Military-grade weapons, including grenades

- Illegal drugs

- Forged items, such as false passports or driver’s licenses

- Fake or counterfeit luxury goods, such as knock-off bags or shoes

- Anything that’s broken

If you’re in doubt about what a pawnshop will buy or loan you cash for, your best bet is to call and ask. That way, you can save yourself a trip to a pawn shop near you if they won’t accept your items.

Related post: Sell Kids Clothes Near Me: Where to Sell Kids Clothes for Cash Fast!

What Are the Pros and Cons of Pawn Shops?

If you’re tempted to search for a pawn shop near me, it helps to know what to expect. Pawn shops can have both advantages and disadvantages if you need to flip items for money quickly.

Pawn shop pros

- Great place to get cash fast when you need it

- Sell your items the same day, without having to list them online or deal with buyers

- There’s room for negotiation on the price of your items

- Get short-term loans with no credit check

- Better loan terms than payday lenders

Pawn shop cons

- Pawn brokers may undervalue your items

- Failing to repay a pawnshop loan could mean losing your collateral

- Pawn shop loans charge fees and interest

- There are some things you can’t sell to a pawn shop

How to Get the Best Price at a Pawn Shop Near Me

The key to getting a great deal at a pawn shop is to pawn sell items that are in good condition and are reasonably in demand.

For example, if you have a brand new Samsung HDTV still in the box you’re likely to get more for it at the pawnshop than you would from a used model that’s several years old.

If you’re considering selling or pawning your items, here are a few tips for getting the best deal possible:

Do your research. Before you take your items to a pawn shop, spend some time researching the value online. That way, you’ll know where your starting point should be for negotiating a price.

Check the condition. Pawn shops want items that they can resell for a profit. Cleaning up your item and making sure that it’s in working order can increase your odds of being offered an attractive price.

Document your item, if possible. If you’re bringing valuable items to pawn or trade that have a unique history, then bringing documentation could convince a pawn broker to offer you a little more money. For example, if you’re selling collectible coins having a document certifying their value can help when it’s time to negotiate.

Be ready to bargain. Pawn shop brokers want to make money so you can’t expect them to offer full price for your items. As Rick from Pawn Stars is fond of saying “I take all the risk”. So you’ll need to have an idea of how much money you’d like to get going in and be ready to counter any offer the broker makes.

Be ready to walk away. It’s possible that a pawn shop owner may not be willing to meet you at your preferred price when pawning or selling items. In that scenario, you have to be ready to walk away from the deal and seek out another pawn shop if you think you can get a higher price somewhere else.

Need a short-term loan with no fees?

Dave can put up to $500 in your bank account in minutes!

If you’re short on cash and need money to pay bills or cover expenses, the Dave app can help. With the ExtraCash feature, you can get up to $500 with no credit check, no interest, and no fees! You’ll just need to download the Dave app and link it to your bank account to get started.

How to Choose a Pawn Shop Near Me

If you have a wide variety of items you want to pawn (or just one or two) it’s important to do your research to find the best pawn shop near you.

As you’re using the pawn shop near me locator tool, keep these things in mind when choosing a local store to deal with.

1. Review pawn loan terms

If you’re borrowing quick cash with a pawn loan, it’s a good idea to know beforehand what you’ll pay for it.

Specifically, it’s helpful to understand:

- How long the loan term is good for

- Payment amount and frequency

- The interest rate you’ll pay

- Loan fees

You should also understand what happens if you don’t pay your pawn loan on time and what that means since this is a collateral loan.

2. Compare prices

Whether you’re selling an item to a pawn shop or getting a pawn loan, it’s important to get a fair price for it.

When deciding where to pawn items near you, consider who offers the best deals for pawn loans or offers the most competitive prices when buying items.

Unless you’re absolutely desperate and need money right now, taking the extra time to get estimates from different pawn shops can help you get the best deal possible for your item.

3. Consider customer service

Getting the best service is also important when dealing with a pawn shop. Working with professional staff can make it easier to get the best prices

Great customer service can lead to a great experience overall, which matters if you’re a little nervous about borrowing money from a pawn shop.

And it’s also important to consider who owns the pawn shop. A local family business, for example, might take a different approach to offering great service than a pawn shop that operates hundreds of retail stores across the country.

4. Read reviews

Checking online reviews can give you an idea of how customer satisfaction compares at different pawn shops near you and what kind of prices you can expect for your items.

Reviews from previous customers can be a good indicator of what you can expect when you visit the pawn shop.

Keep in mind that negative reviews may not paint the whole picture. So use your judgment when deciding whether a pawn shop has a good reputation.

5. Check the overall feel

Aside from excellent customer service and good people on staff, also consider the vibe you get when visiting a particular pawn shop.

For example:

- Is the pawn shop licensed and insured?

- Where is the location and is it convenient to where you live?

- Does the store have a great selection of items available, including new merchandise and used merchandise?

- Are a wide variety of items accepted at your local pawn shop or only at select stores? (If the pawn shop has more than one location.)

- Is the store cluttered or junky looking? (Tip: Nice stores are usually well-lit and well-organized.)

- Does the store offer a product protection plan to cover items that are sold there?

- Overall, is it a secure facility and do you feel safe visiting?

Asking those kinds of questions can help you find the best pawn shop near you to work with so you can have the best experience overall.

At the end of the day, it’s best to trust your gut. If a pawn shop doesn’t pass the vibe check, you may want to look elsewhere.

Pawn Shop Near Me FAQs

If you’ve never visited a local pawn shop before, you might not understand what it involves or you can use them to get quick cash. Here are some of the most frequently asked questions about pawning or selling items for cash.

Is there a credit check for pawnshop loans?

There’s typically no credit check required to get a pawnshop loan, so there’s greater flexibility in terms of how you qualify.

That’s what makes pawn shop loans an attractive option for people who need to get cash fast but may lack good credit scores.

How long do you have to pay a pawn loan?

Typically, you’ll have 30 days to repay a pawn loan.

This is pretty standard across the pawnshop industry, though you may find pawn loans with shorter or longer repayment terms.

Regardless of how long you have to repay a pawn item loan, be sure to understand what you’ll pay for interest and fees.

What happens if you don’t pay back a pawn shop loan?

If you don’t repay a pawn loan, the pawnshop can keep your collateral. The pawnbroker can then resell your pawned item or items at a fair price.

Since there’s no credit check, there are no credit consequences if you don’t repay a pawn shop loan. But if you want to get your items back later, you’ll have to buy them for whatever price the pawn shop is charging.

For that reason, it may be a good idea to only pawn items that you’re comfortable losing if something happens and you can’t repay the money.

Is it better to sell or pawn at a pawn shop?

If you have valuable items that you don’t necessarily need to keep or you don’t want the financial responsibility of repaying a pawn loan, you could sell your items outright to a pawn shop instead.

Selling items could put quick cash in your hands. And there’s nothing to repay.

But it’s important to make sure you’re getting an accurate price.

There’s no standard rulebook in the pawn industry that determines how pawn shops set their prices. Pawnshops typically offer anywhere from 30% to 50% of the item’s value.

If you’re selling a diamond engagement ring that you paid $5,000 for, then you might only get $2,500 for it at most.

That’s a fairly steep markdown, but it’s typical for pawnshops to offer those kinds of prices. After all, they have to be able to resell the item later at a profit.

It’s a good idea to research what your items are worth before selling them to a pawnshop to determine whether you’re getting the best price. You may also want to look into what you might be able to get by selling your items elsewhere.

Other places you can sell things to make money include:

- Facebook Marketplace

- Local Facebook bargain groups

- Craigslist

- eBay

- Etsy (for vintage items or craft supplies)

- LetGo (now part of OfferUp)

- Wish

- Mercari

- Decluttr app

You can sell different things to make money on each site or app, which may be a great way to pick up some extra cash while decluttering your house.

What can I pawn for $50?

If you need to make a quick $50, there are plenty of things you can pawn, including:

- Laptop computers

- Game systems and video games

- DVDs, Blu-ray discs and video players

- Cameras

- Cell phones

- Sporting equipment

- Baseball cards or other high-value trading cards

- Luxury handbags, shoes and other accessories

- Guitars or other musical instruments

- Fine jewelry

- Watches, including smart watches

- Fitbit devices and other wearables

Are the items you’re pawning worth more than $50?

Possibly. But if you need instant cash then a visit to a pawn shop near you with any of these items could put money in your hands in no time.

Are pawnshop loans worth it?

A pawn loan could be worth your time if you need money quickly, have a valuable item to pawn or sell and aren’t able to qualify for another type of short-term financing. Pawn shop loans generally aren’t as risky or costly as loans from payday lenders either.

On the other hand, personal loans could be the better option when you need money if you’d rather not use your valuables as collateral and you have a decent credit score.

Personal loans can let you borrow anywhere from $500 to $100,000, depending on the lender.

You’ll have to pay that money back with interest but you’ll have months or possibly years to do it instead of just a few weeks. And as long as you’re paying on time you can build good credit in the process.

If you’re interested in applying for a personal loan, head to Credit Sesame to check your credit scores first. This can give you an idea of what kind of loans you’re likely to qualify for.

You can also visit Upstart to compare personal loan options and check your rates.

Need Loan Funding Fast?

Get a personal loan from Upstart

Upstart offers unsecured personal loans ranging from $1,000 to $50,000. Get cash to consolidate dates, pay off medical bills, or cover emergency expenses. There are no hidden fees and you can get funds as quickly as the next day after you’re approved.

Related post: Laundromat Near Me? How to Find a Cheap, Safe Place to Do Laundry

Bottom Line: Are Pawn Shops a Good Way to Get Cash?

When you need to borrow money or sell items for cash fast, there may be no better place than a local pawn shop. (And if you want to buy retail merchandise at affordable prices, you can also shop today at a pawn shop near you.)

Pawn shops can offer convenient solutions when you need money. But consider ways you can improve your finances so you don’t need to rely on quick cash loans.

Getting on a budget, for example, can help you to save money and curb overspending. Paying down debt means you don’t have as much money going out each month.

And finding ways to make more money can make it easier to build up emergency savings and break the paycheck to paycheck cycle.

Need more money tips? Read these posts next:

- 35 Best Online Proofreading Jobs for Beginners (Make $50+/Hr!)

- 30 Easy Ways to Make Instant Money Online Absolutely Free

- How to Get Free Gift Cards With Minimal Effort (25 Hassle-Free Ways!)

- Free Money Hacks: 60 Easy Ways to Get Free Money