Last Updated on September 9, 2023 by Rebecca Lake

Pawn shop loans can put money in your hands quickly when you need cash. A pawn shop loan is a personal loan that’s secured by collateral.

Applying for loans at pawn shops may not be an obvious choice when you need money desperately. However, getting a loan from a pawn shop might be a realistic solution if you’re desperate for money.

Wondering how pawn loans work, or if they’re a good way to borrow when you need extra money? Here’s a closer look at the basics of pawnshop loans and how to get a loan at a pawn shop.

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

Table of Contents

What Are Pawn Shop Loans?

A pawn shop loan is a type of short-term loan that allows you to borrow money from a pawn shop using one or more items of value as collateral. Your collateral acts as security for the loan.

The first pawn shop loans originated in China more than 3,000 years ago as a form of short-term credit. Pawn loans allowed peasants to borrow money while using their personal possession as collateral.

Today, there are approximately 11,000 pawn stores serving millions of customers in the U.S., according to the National Pawnbrokers Association. Pawn shops provide a valuable service to people who need cash quickly and can’t obtain credit through traditional means.

Need Loan Funding Fast?

Get a personal loan from Upstart

Upstart offers unsecured personal loans ranging from $1,000 to $50,000. Get cash to consolidate dates, pay off medical bills, or cover emergency expenses. There are no hidden fees and you can get funds as quickly as the next day after you’re approved.

How Do Pawn Shop Loans Work?

Pawn shop loans work like other types of loans, in that they allow you to borrow money. But the process for getting a pawn shop loan isn’t exactly the same as other loans.

Here’s how getting a pawn loan works.

- Bring your items to the pawn shop. The first step in getting a pawn shop loan is to bring in an item of value that you’re willing to use as collateral. Some of the things pawn stores accept as collateral include electronics, jewelry and gaming consoles.

- Get your items appraised. The pawn shop will appraise your item to determine its value so it can make a loan offer. Loan amounts are usually a percentage of the item’s value.

- Accept the loan offer. Once your items are appraised, the pawn shop will make you a loan offer. If you agree to the loan amount, you’ll have to sign a loan agreement that specifies the repayment terms.

- Get cash. Once you sign the loan agreement, the pawn shop will give you the cash loan amount that you agreed on.

Pawn shop loans have to be paid back and you’ll usually have around 30 days to do so. Like other loans, pawn loans can charge interest and fees.

Once you’ve fully repaid the loan, you can go back to the pawn shop and retrieve your item.

What can I use as collateral for a pawn shop loan?

Pawn shops can accept a wide variety of items for cash loans. Some of the items you might be able to use as collateral or sell outright to a pawn shop include:

- Gold and silver jewelry

- Watches

- Coins and bullion

- Electronics, including smartphones, tablets, and laptops

- Musical instruments

- Firearms (note that some pawn shops may only buy antique guns)

- Tools

- Sports equipment

- Collectibles, including sports memorabilia, comic books, and figurines

- Antiques

- Designer handbags and accessories

- Power tools and construction equipment

- DVDs, CDs, and Blu-ray discs

- Cameras and photography equipment

- Home audio and stereo equipment

- Video game consoles, handheld gaming systems and games

- Lawn and garden equipment

- Hunting and fishing gear

- Car audio and security systems

- Musical recordings and instruments

- Bicycles and cycling gear

- Power generators and other outdoor equipment

- Scrap gold, silver, and other precious metals

- Artwork and sculptures

- Industrial equipment

Pro tip: If you’re not sure whether your local pawn store will accept your items, it’s a good idea to call ahead to see what kind of things they buy.

Keep in mind that pawn shops typically only buy items that are in good condition and have decent demand. If you’re not able to get a pawn loan, you might still be able to sell your items for cash on Facebook Marketplace, local Facebook bargain groups or Craigslist.

Do pawn shops give loans on car titles?

Some pawn shops offer loans on car titles. This type of loan is known as a title pawn or car title loan.

To get a car title loan from a pawn shop, you’d need to give the pawn shop the title to your vehicle as collateral. The amount you can borrow will depend on the value of your car and the pawn shop may also check your income or credit.

You might be able to borrow more money with a title loan vs. a regular pawn loan. However, the biggest risk of a car title loan is that you can’t pay it back. In that case, the pawn shop would be able to keep your car.

Is there anything you can’t sell to a pawnshop?

Yes, there are some things pawnshops won’t accept as collateral. The laws and regulations on what can be bought and sold vary by state and even by city.

In general, pawn shops won’t accept illegal items, contraband, or anything they can’t legally sell, including:

- Stolen property

- Counterfeit items

- Illegal drugs or drug paraphernalia

- Hazardous materials

- Firearms (depending on state laws)

Additionally, pawn shops can set their own policies on what they will and won’t accept. For example, your local pawn store might not accept certain types of electronics or limit jewelry-buying to certain brands.

Need a short-term loan with no fees?

Dave can put up to $500 in your bank account in minutes!

If you’re short on cash and need money to pay bills or cover expenses, the Dave app can help. With the ExtraCash feature, you can get up to $500 with no credit check, no interest, and no fees! You’ll just need to download the Dave app and link it to your bank account to get started.

What Can I Use a Pawn Shop Loan For?

You can use a pawn shop loan for any purpose you need. Pawn shops don’t set any rules on how you can use the money.

Some of the most common reasons people take out pawn shop loans include:

- Paying bills

- Making rent or mortgage payments

- Covering emergencies or unexpected expenses

A pawn shop loan is designed to be a short-term financial solution when you’re experiencing a money struggle.

How much money can I get from a pawn shop loan?

The amount of money you can get from a pawnshop loan will depend on the value of the item or items that you provide as collateral.

As mentioned, pawn shops usually lend a percentage of the item’s appraised value. The percentage used can vary depending on the pawn shop, but it’s typically around 25% to 60%.

For example, say you have a gold ring you want to use as collateral. The pawn shop appraises it at $1,000. You might be able to borrow $250 to $600, depending on the pawn shop’s loan percentage.

How Much Does a Pawn Shop Loan Cost?

Pawn shop loans aren’t free and the cost can vary depending on which store you’re getting the loan from.

There are two main costs to know: the interest rate and fees.

How are interest rates and fees calculated for pawn loans?

The interest rates on pawn shop loans are determined by store and by state law. They can be as high as 25% per month, though some states might cap the rate at just 2%.

Interest rates and fees for pawn loans are typically calculated based on the loan amount and the length of the loan term. Pawn shops can also charge additional fees, including:

- Storage fees for your item

- Late fees if you don’t repay the loan on time

Pawn shops can charge storage fees for keeping your item while you have an outstanding loan balance. Late fees are charged if you don’t repay the loan by the due date.

Here’s an example of how much a pawn loan costs.

Say you get a $100 pawn shop loan with a 20% monthly interest rate and a $20 storage fee. At the end of the first month, you’d $140. If you’re unable to repay the loan plus interest and fees within the loan term, the pawn shop may extend the loan for additional fees or keep your collateral.

Pro tip: When comparing pawn shop interest rates by state, remember that there can be significant differences from one area to the next.

Pawn Shop Loan APR Calculator

Pros and Cons of Pawn Shop Loans

There are good things–and a few bad things–about getting a pawn shop loan. Looking at the pros can cons can help you decide if one is right for you.

Pros of pawnshop loans:

- Quick access to cash. Pawn shop loans are a quick and easy way to get cash when you need it. It’s possible to get a loan within a few hours without a credit check or lengthy approval process.

- No credit check. Pawn shops don’t require a credit check, which means that even if you have a poor credit or no credit, you may still be able to get a loan.

- No credit score impact. Since pawn shops don’t require a credit check, getting a pawn shop loan won’t affect your credit scores.

- Keep your items. With a pawn shop loan, you can get cash without having to sell your belongings outright. As long as you repay the loan on time, you can get them back.

Cons of pawnshop loans

- High interest rates. Pawn shop loans typically come with high interest rates and the longer you take to pay off the loan, the more it will cost.

- Loss of collateral. If you’re unable to repay your loan, the pawn shop can keep your items.

- Limited loan amounts. Pawn shop loans are typically small, with most loans ranging from $50 to $500. They might not work for you if you need a bigger loan.

- Collateral requirements. To get a pawn shop loan, you need to have something of value to use as collateral. And there are certain items pawn shops won’t accept.

Pawn Shop Loan Alternatives

Not sure if a pawn loan is right for you? You’ve got some other options for borrowing.

Here are a few pawn store loan alternatives you might consider.

Personal loans. Banks, credit unions and online lenders like Upstart can offer personal loans to people who need cash. You might be able to borrow more money and get a better rate with a personal loan vs. a pawn loan.

Payday loans. Payday loans are short-term loans that let you borrow from your next paycheck. They’re convenient but they can charge exceptionally high interest rates.

Credit card cash advance. If you have credit cards, you might be able to get a cash advance from your credit line. The catch is that cash advances can charge a higher APR and interest starts accruing right away.

Borrowing from friends or family. You might consider borrowing money from friends or family members if they’re willing and able to help. Just keep in mind that if you don’t pay them back that could hurt your relationship.

Selling items. If you have items of value that you’re willing to part with, you can sell them online or at a pawn shop to get the money you need.

Cash advance apps. Cash advance apps like Dave can give you access to small amounts of cash. That might come in handy if you need a quick $100 but be sure to check out the interest rates and fees first.

Need a short-term loan with no fees?

Dave can put up to $500 in your bank account in minutes!

If you’re short on cash and need money to pay bills or cover expenses, the Dave app can help. With the ExtraCash feature, you can get up to $500 with no credit check, no interest, and no fees! You’ll just need to download the Dave app and link it to your bank account to get started.

Who Are Pawn Shop Loans Good For?

Pawn shop loans can be a good option for people who need quick cash but don’t have access to traditional forms of credit, such as bank loans or credit cards. And you might consider a pawn loan if you don’t have a credit history yet since there’s no credit check requirement.

You might consider a pawn loan if you:

- Need to borrow a fairly small amount of money

- Have something of value to use as collateral

- Are confident that you can pay the loan back on time

If you’ve got good credit, then there are more affordable ways to borrow, including low-rate personal loans. So you might want to shop around first before going with a pawn loan.

And if you do get a pawn shop loan, remember to read the fine print so you understand all of the terms and conditions.

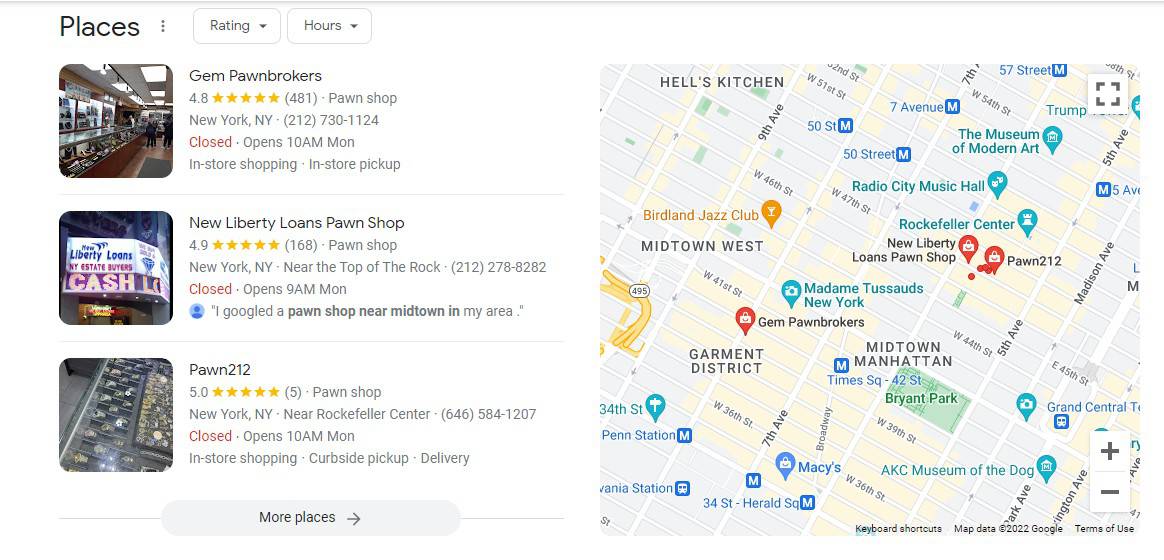

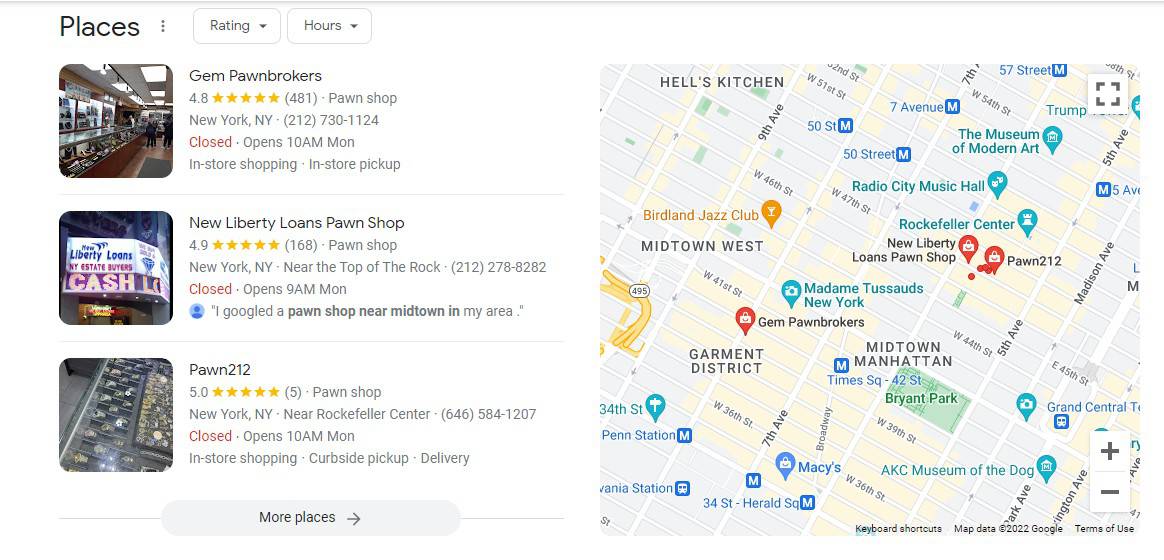

Where Can I Get a Pawn Shop Loan?

You can get a pawn shop loan at a local pawn shop or a pawn shop online. It’s easy to find a pawn shop near you using a simple Google search.

You can try trying in any of the following terms to find pawn shops in your area:

- Pawnshop loans near me

- Pawn loans near me

- Cash America pawn near me

- Pawn shops that do payday loans near me

- Title pawn near me

- Pawn shop loans near me

- Pawn shop near me

- Best pawn shop online

You could also try searching using your city name. For example, you could type in “pawn Detroit” or “pawn Atlanta” to find pawn shops nearby if you live in either of those cities.

When choosing a pawn shop, it may be helpful to check out reviews from other borrowers. It’s also a good idea to make sure the pawn shop is properly licensed and is able to legally make loans.

Frequently Asked Questions (FAQs)

What’s the difference between a pawn shop loan and selling items to a pawn shop?

The main difference between getting a pawn shop loan and selling things to a pawn shop is that a loan allows you to get your collateral back. When you sell items to a pawn shop, you’re getting cash and the pawn shop gets to keep your stuff. The pawn store can then resell those items to someone else.

Can anyone get a pawn loan?

In general, anyone who’s at least 18 years old and has a valid government-issued ID can get a pawn shop loan. Pawn shops may set specific restrictions on what you’ll need to qualify for a pawn loan.

Do pawn shop loans affect your credit?

No, pawn shop loans typically don’t affect your credit because the debt isn’t reported to the credit bureaus the way that traditional loans or lines of credit are. Pawn loans usually don’t require a credit check; if you fail to pay, you can lose your collateral but your credit score won’t take a hit.

How do pawn shops make money?

There are two ways pawn shops make money. First, pawn shops make money by charging interest and fees on pawn loans. Second, they make money by buying items from customers at a low price and then reselling them to someone else at a higher price.

What happens if you don’t pay a pawn shop loan?

If you don’t repay a pawn shop loan on time, the pawn shop has the right to keep your collateral. In some cases, the pawn shop may offer to extend the loan term or work out a repayment plan with you. But they’re not required to do so.

Is it better to pawn or sell?

Whether it’s better to pawn items vs. selling them can depend on how much you could get and whether you want to keep your valuables. Selling usually puts the most money in your pocket but a pawn loan would let you get your collateral back.

Bottom Line: Are Pawn Shop Loans a Good Idea?

Should you take a pawnshop loan? Pawn shop loans can be a useful option if you need cash quickly and you’re not able to borrow money elsewhere. They’re typically easier to qualify for compared to other forms of credit. And since there’s no credit check, they could be a good option for people with bad credit or no credit history.

However…it’s important to consider the high interest rates and fees that are usually involved. And of course, you run the risk of losing your collateral if you can’t pay. So it’s important to look at all of the options for getting money quickly when you need it.

Need more money tips? Read these posts next:

- 100+ Free Money Hacks (That Actually Work!)

- 30 Easy Ways to Make Instant Money Online Absolutely Free

- Sell Gift Cards Instantly Online [Get Instant Cash for Gift Cards]

- Gift Card Exchange Kiosk Near Me: Turn Unwanted Gift Cards Into Instant Cash!