Last Updated on September 30, 2023 by Rebecca Lake

Are you panicking about how to afford Christmas for your family this year?

I’ve so been there.

I remember my daughter’s first Christmas. My then-husband and I were flat broke. The only reason we had a Christmas that year is that my dad lent us his credit card to buy a small tree and a few gifts.

It was a Christmas, but not exactly a joyful one.

I felt terrible about not having money for anything. And even worse that my dad had to step in and pay for it.

I swore that was the last Christmas we’d ever be in that situation. And it was because I learned my lesson about saving and making a budget for the holidays well in advance.

If your financial situation has you fretting over the upcoming holidays, I totally feel you. After all, you want to make good memories for your kids. And while money isn’t everything, having a little doesn’t hurt.

That’s why I decided to share some of my best tips for how to afford Christmas when you’ve got little money to spare.

LIKE FREE MONEY?

Here are some of my go-to apps for earning extra cash!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid, no special skills or experience required!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

Table of Contents

How to Afford Christmas When You Have No Money

Managing Christmas on a budget takes some planning and a little creativity. The tips I’m sharing here are all ones that I’ve used in past years to save money for Christmas.

You don’t have to follow all of them but the more tips you try, the easier affording Christmas when you’re broke can be. And I’ll also share a few ideas to help you to get free money for Christmas.

Let’s dive in!

1. Set realistic expectations for the holidays

If you’re struggling with how to afford Christmas when you’re broke, the first thing you need to do is get your mindset right.

Because here’s the thing, it is so easy to get carried away when planning for Christmas. Especially when you have kids.

I’m guilty of buying way too many things and having more “stuff” doesn’t guarantee a happier holiday season. In fact, it can be quite the opposite.

So think about what your perfect Christmas and holiday season looks like. What matters to you most?

Chances are, it’s not a big pile of gifts or fancy decorations or any of the stuff you get from the store. Instead, it’s all about making memories and spending time together as a family.

If you haven’t talked with your partner/spouse and kids about your expectations for the holidays yet, now’s the time to do it.

You don’t have to go into gory details about your finances. But you can let your kids know that you’re aiming for simple and fun for the holidays, not piles and piles of stuff.

And while you’re at it, you can brainstorm some fun (and frugal) ways to enjoy Christmas as a family. Making holiday planning a team effort can help you make the most of the season, even if you’re spending less.

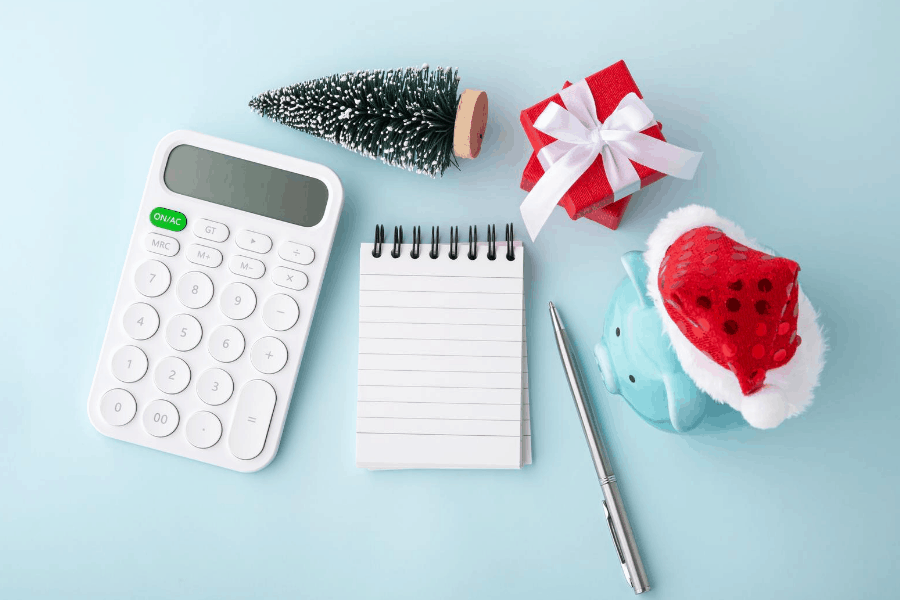

2. Figure out how much you can spend on the holidays

Once you’re in the right mindset, figuring out how to afford Christmas means looking at how much you can realistically spend. Making a budget for the holidays will save your life if you’re trying to make this work without a lot of money.

So where do you start with creating a Christmas budget?

First, make a list of all the expenses you typically spend money on during the holidays. That might include:

- Christmas presents and other holiday gifts

- Wrapping paper, tags, bows, and tape

- Shipping fees if you’re mailing gifts

- Custom Christmas cards and postage

- Professional family photographs

- Holiday meals and Christmas food shopping

- Holiday entertainment and family activities

- Crafts or handmade gifts you plan to make

- Holiday decor (including indoor and outdoor decorations)

- Travel expenses, if you plan to go visit friends and family

Now, here’s what you need to do next if you’re trying to work out how to afford Christmas: take that list and toss it out.

Seriously. If you’re working with a super tiny budget, then trying to include everything in your holiday spending plan might not be realistic.

So, make a second list but this time, only include those expenses that are non-negotiable for your family to enjoy the holidays. For example, you might narrow it down to gifts, food, and one or two family activities.

Will you feel like a cheapskate if you don’t splurge on fancy Christmas cards like everyone else is sending out?

Maybe.

Will seeing everyone’s holiday travel photos on Instagram or Facebook make you wish you could afford Disney in December?

Possibly. (Totally been there myself.)

And will you get Pinterest envy when you see all the amazing Christmas decor ideas popping up in your feed?

You might.

But will you feel better about planning a Christmas budget you can afford, without having to run up debt?

Absolutely!

3. Cut out unnecessary expenses (if you can)

I know what you’re thinking. I’ve already cut my budget to the bone, so what else can I do?

When you’re already slashed your budget, you might assume there’s nothing else to cut. But it’s a good idea to leave no stone unturned when you’re trying to figure out how to afford Christmas.

So, go over your monthly budget again and look at all the things you spend money on. Can you find even an extra $25? $10?

That’s not a lot of money but every extra dollar you can come up with counts if you’re trying to cover Christmas expenses on a shoestring. And if you’ve looked and looked but turned up nothing, you could use a tool like Rocket Money to look for savings.

Rocket Money analyzes your spending to find things you can weed out of your budget. And you can also use Rocket Money to set and track your savings goals.

Save More With Rocket Money

Stop overpaying and start saving!

Rocket Money is an all-in-one personal finance app that helps you find savings instantly, lower your bills, and keep more of your hard-earned cash.

It’s a simple way to build savings back into your budget every month, without getting nickel and dimed.

4. Start a Christmas savings plan

If you’ve gone over your list of what you want or need to spend money on for Christmas, the next step is finding the cash to pay for it. Starting a Christmas savings plan means you’re not scrambling to cover expenses at the last minute.

You can open a high-yield savings account at an online bank, or stash your extra cash in a Christmas Club savings account if you prefer. Once you’ve got a place to keep your savings, you can commit to setting aside a little bit of money each payday.

Grow Savings Faster With Current

Current is a digital banking app that makes it easy to grow savings, manage spending and track your goals in one place! You can set up individual savings pods for different goals and earn the same competitive APY for each one.

Aside from making saving a breeze, Current also comes with other great features like fee-free overdraft and access to 40,000+ ATMs!

**View product disclosures

What if you just cannot find the money to save? You could try these savings tips to dig up some extra cash.

- Try a no-spend November. A no-spend November is a quick and easy way to save money for Christmas. The goal is to not spend money on anything besides necessities for the month and part that cash in savings instead. It can be a quick and easy way to get the money together to cover your Christmas budget.

- Use found money to save for Christmas. Found money is money that comes to you when you’re not necessarily expecting it. It means things like tax refunds, work bonuses, or rebates — any extra income you haven’t included in your regular budget.

- Earn cash back with apps. Cashback apps can save you money by paying you back a percentage of what you spend. You sign up for apps, link your debit card, and then earn cash back when you shop at partner stores. It’s easy money if you were already planning to spend.

If you’re looking for a good cashback app for saving money on holiday shopping, Rakuten is my go-to pick. With Rakuten (formerly Ebates) you can earn up to 40% cash back when you shop online with the Rakuten browser extension or in stores with the Rakuten mobile app.

You can earn even more cashback (up to $30) each time you refer friends and family to Rakuten. And you can also snag a $10 welcome bonus when you sign up and make a qualifying purchase!

I’ve made close to $1,500 with Rakuten so I know it’s a legitimate way to get extra cash to save for Christmas.

Want to Get Cash Back When You Shop?

Making extra money is easy with Rakuten!

Rakuten is a free app and browser extension that helps you find coupons and discounts when you shop online or in stores. You can earn up to 40% cashback when you shop at hundreds of partner retailers, plus get a $10 sign-up bonus and up to $30 in bonus cash for each person you refer!

5. Get on the nice list with a holiday side hustle

5. Get on the nice list with a holiday side hustle

A side hustle can come to the rescue when you’re trying to decide how to afford Christmas or if you even can. I’ve got a great list of 27 easy side hustles you can do to earn money for holiday spending.

And if you need a quick money win, try these options:

Earn cash (or gift cards) with surveys

Taking surveys is a great way to earn extra cash or free gift cards for Christmas or any time of year. You can also use apps to earn free gift cards that you can use for holiday spending or give away in lieu of buying presents.

If you’re looking for some survey sites to try, here are the ones I recommend. And be sure to check out each one, as some of these sites offer $5 – $10 in bonus cash just for signing up!

Got some gift cards that you don’t plan to shop with (or give away)? You could always sell them instead. Find a gift card exchange kiosk near you to trade your gift cards for instant cash!

Top Pick for Selling Gift Cards: EJ Gift Cards

EJ Gift Cards makes it easy to sell unwanted gift cards for cash or Bitcoin, without ever leaving home. Just enter your card details to get an instant offer, accept the terms, and get paid fast!

Take care of pets

I love pets of all kinds so getting paid to hang out with them seems pretty sweet to me. And the holidays are a great time to make money as a pet sitter or dog walker, since so many people are traveling.

If you’re interested in holiday pet sitting, you could try Rover to find gigs in your area.

This site connects pet owners and sitters, and you could make $1,000 or more each month!

Sell things you don’t need

If your family is like mine, you’ve probably got more than a few things you don’t need lying around. Selling them on Facebook or through an app like Decluttr is an easy way to scoop up extra cash.

You could also take expensive items and other valuables to a pawn shop. Pawn shops can loan you money for your items or pay you cash to purchase them.

Here are a few posts you might find helpful if you’re trying to sell things for cash:

- Best Things to Sell at a Pawn Shop (120+ Things You Can Pawn for Quick Cash)

- Sell Gift Cards Instantly Online [Get Instant Cash for Gift Cards]

- 50+ Things to Sell to Make Money (Sell Stuff for Cash Fast!)

- How to Pawn Jewelry [An Easy Guide]

You can also search for a pawn shop near you if you’d like to pawn or sell some of your items.

6. Save on your holiday food budget

My favorite thing about the holiday season isn’t the gifts or the pretty lights. It’s all about the food!

In years past, I’ve spent $300+ of my holiday budget on food alone. Pretty crazy, right?

If you’re planning holiday dinners or attending get-togethers, there are lots of ways to keep your grocery bill low. Try these tips to save on your holiday food budget:

- Use Ibotta to save. Ibotta is a cashback app that pays you money back when you shop for groceries. It’s a super simple way to save money on food during the festive season and all year round.

- Join store loyalty programs. If your favorite grocery store or retail store has a loyalty rewards program, sign up for it! You could earn rewards toward purchases or at the very least, get coupons to shop with.

- Clip coupons. Clipping coupons might seem a little old-fashioned but it’s a tried and true way to save money on your food bill. You can clip paper coupons or search online for digital coupons to make the items on your shopping list cheaper.

- Buy in bulk. Buying in bulk can be a good way to save if you end up paying less per unit than you would to buy smaller amounts. If you’re going to buy in bulk for the holidays, make sure you have a plan for putting any extras to use. For example, if you’re buying vegetables or meats in bulk, you could use them to whip up inexpensive freezer meals for after the holidays.

- Go potluck. Planning family dinners can get crazy if you’re expecting a crowd. Not to mention it can cost you big-time money. Making the whole thing potluck can be a money-saver (and it might just save your sanity, too).

- Shop generic. Generic brands can be cheaper alternatives to name brands. As you make your holiday food shopping list, consider what you can swap out for store brands in order to cut costs.

7. Make your holiday shopping list and check it twice

Do you love or hate holiday shopping? Black Friday and Cyber Monday sales are always a temptation but if you’re trying to navigate how to afford Christmas, you have to be choosy about spending.

Try these ideas to save money on shopping so you don’t end up with a holiday money hangover.

- Consider DIY gifts. Offering handmade gifts can be cheaper than buying them, especially if you have a lot of people on your shopping list. And a handmade or DIY present can be a more meaningful gift than something you buy in a store.

- Skip the cards. If you just don’t have it in the budget to pay for Christmas cards this year, then don’t buy them. Period. You can always send an emailed Christmas greeting or better yet, create an email letter chain that gets passed around to everyone in the family. Won’t cost you anything and it’s a more interactive way to spread holiday cheer.

- Shop the dollar store. There’s no shame in having a dollar store game if you’re feeling broke at Christmas. It’s a great money-saver for buying things like decorations, gift bags, and wrapping paper. The best part? You don’t even have to go to the store to shop anymore. Dollar Tree will ship it free to your local store and you can just go pick it up for less holiday hassle!

Need a short-term loan with no fees?

Dave can put up to $500 in your bank account in minutes!

If you’re short on cash and need money to pay bills or cover expenses, the Dave app can help. With the ExtraCash feature, you can get up to $500 with no credit check, no interest, and no fees! You’ll just need to download the Dave app and link it to your bank account to get started.

8. Try the rule of four for kids

Kids are little budget-drainers, aren’t they? Well, mine are anyway, especially around the holidays.

So here’s what I do to save money at Christmas (and not end up adding to their collection of unnecessary “stuff”). I use the rule of four and buy them:

- Something to wear

- Something to read

- Something they want

- Something they need

The “need” is usually a more expensive item but because I’m buying fewer things altogether, I can afford to spend more on it.

9. Take advantage of free or cheap holiday experiences

I love doing all the fun holiday things. And one way I save money at Christmas is by trying to do as much of the “fun” stuff as possible for free.

If you need ideas for fun holiday activities, here are a few you can steal:

- Attend a free tree lighting (Our town hall makes this a big event each year and it’s free!)

- Try a Christmas parade (Again, this is something our town does for free.)

- Check out local churches for free events, like a living nativity or holiday festivals

- Pile in the car and drive around to look at the lights

- Go to a holiday craft fair (But vow not to spend any money.)

- Have a backyard campfire and sing carols

- Make simple holiday crafts with stuff you have around the house

- Have a snow day (if it snows where you live)

- Volunteer as a family to help others in need

Remember, the real fun of the Christmas season is being together as a family, not spending money!

10. Ask for holiday help if you need it

I’ve given you some useful tips on how to afford Christmas, at least, I hope so.

But what if you’ve tried all of them and you’re still struggling to make the holidays work financially? That’s when you ask for help.

You could reach out to family like we did that first Christmas. But if that’s not an option or you just don’t feel comfortable, other places can offer financial assistance for families during the holidays.

Here’s a short list of places to try when you need help with how to afford Christmas:

- Salvation Army

- United Way

- Toys for Tots

- Your local Department of Social Services

- Local Churches

- Local Charities

These kinds of organizations can help with things like toys and clothes for kids, gifts for adults, food, and assistance with utility bills. All of that can make the holidays less stressful.

And if you feel weird about getting that kind of help, I get it. I know what it’s like to have to go to a food pantry or apply for Medicaid for your kids because you are broker than broke.

But sometimes, asking for help is necessary so if you’re reluctant about it, try to keep an open mind. And when your financial situation improves, you can pay it forward to someone else.

Final Thoughts

Figuring out how to afford Christmas when money is scarce can be challenging, but it’s not impossible. Taking time to look at your spending and figure out what’s realistic for you can help you get through the holiday season with less stress.

Comments are closed.