Last Updated on September 30, 2023 by Rebecca Lake

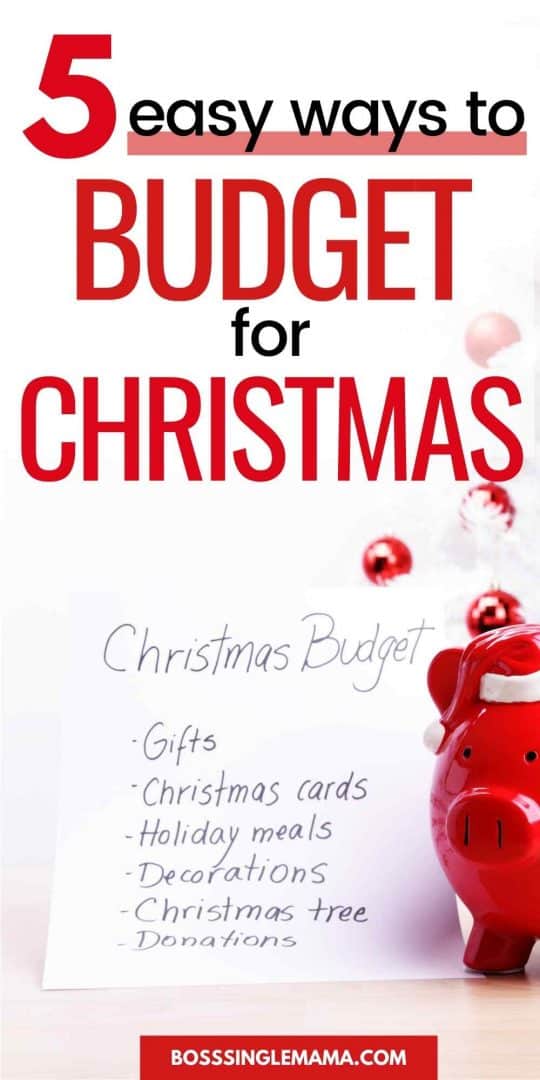

Is this the year that you’ve vowed to make a holiday budget and stick to it?

Knowing how to create a Christmas budget can save you money (and stress) once the holiday season rolls around. Instead of scrambling to figure out how you’ll pay for holiday shopping and other Christmas purchases, you can relax and enjoy quality time with your family because you know you’ve got it covered.

Don’t know how to create a Christmas budget? These tips can help you plan out your spending for the festive season without breaking a sweat.

Want Free Money?

Check out my favorite apps for earning cash fast!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions. Get paid to answer questions in your spare time!

Upside. Get cash back when you shop or fill up at the pump. Use this link to get up to $0.25 cents back for every gallon you buy.

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid for your opinion. An easy way to earn extra cash!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

Honeygain. Got unlimited data that you’re not using? Sell your unused data for quick and easy cash with Honeygain!

Table of Contents

Importance of Knowing How to Create a Christmas Budget

Christmas budgeting isn’t that different from creating a monthly household budget. And having a holiday budget is just as important as having a plan for managing your monthly expenses.

When you know how to create a Christmas budget, you can:

- Plan out holiday purchases, without having to wait until the last minute

- Spend only what you’ve planned and avoid racking up credit card bills

- Prioritize purchases so that you’re not wasting money

- Give yourself time to save ahead for Christmas

- Minimize holiday headaches and stress because you don’t have to worry about how to afford Christmas

Budgeting for Christmas just makes sense because you know you’re going to spend money so why not do it with a plan?

What is the average Christmas budget?

Wondering how much other people spend on Christmas?

According to the National Retail Federation, a typical Christmas budget is around $1,000. And despite inflation making prices higher, Americans continue to increase the amount of money they spend on the holidays year over year.

You might budget more for Christmas or less, depending on what you can afford and what’s on your holiday shopping list. Knowing the average Christmas budgeting amount can give you an idea of how much to earmark for your own holiday shopping.

How to Create a Christmas Budget

Making a Christmas budget is pretty straightforward. On one side, you have the amount you plan to spend (or can afford to spend). On the other, you have all of your Christmas expenses.

Some experts recommend budgeting for Christmas using just two categories: gifts and everything else.

But if you’re trying to plan a frugal Christmas on a budget and you’re watching every penny, then it might make sense to break your budget up a little more.

Here’s how to create a Christmas budget, step by step.

1. Set your spending limit

The first step in budgeting for Christmas is knowing what you want to spend (or what you can afford to spend).

Some things to consider for coming up with a target number include:

- How many people you plan to buy gifts for

- How much to spend on Christmas gifts per person

- Whether your holiday plans include travel

- What you have saved for Christmas already

- How much you can afford to add to Christmas savings per month

The more things you add to your holiday budget, the more you might spend. But the key is to find a number that you can afford so you don’t have to use credit cards to pay for the holidays.

Pro tip: Add 10% to your final total as a “cushion” for any unexpected holiday expenses that might come up.

2. Figure out what you need to save

Once you know what your target for Christmas budgeting is, the next step is finding the money to pay for it.

Here’s a simple way to do it.

- Look at what you have set aside for Christmas savings now.

- Figure out how much you can afford to save each month for Christmas.

- Multiply that by the number of months (or weeks) you have until you need your Christmas savings.

For example, if you’re reading this on October 1st and plan to start holiday shopping on December 15th, you have 11 weeks to save. Your savings goal is $1,000.

If you have $300 you could put toward your Christmas savings plan now, then you’d only need to save another $64 a week to hit your goal.

Looking for a new financial best friend?

The Dave app makes savings, spending, and earning easier!

Dave is a personal finance app that’s designed for people who want to simplify finance. You can budget, spend, and grow your savings all in one place while earning a competitive interest rate on your money. Dave also makes it easy to get up to a $500 cash advance in minutes, with no interest or fees!

3. Set your holiday budget categories

The next step for how to create a Christmas budget is dividing up the money you plan to spend into different categories.

Again, you could go the simple route and have one category for gifts and one for everything else. Or you might divide your categories up like this instead.

- Christmas presents/holiday gifts

- Travel expenses

- Wrapping paper, gift boxes, tags, and bows

- Christmas cards and postage

- Christmas food shopping

- Indoor holiday decor

- Outdoor Christmas decorations

- Christmas events and fun

Your holiday budget might have more categories or less, depending on what you normally spend money on at the holidays. Once you’ve got your categories down, you can move on to the next step.

4. Decide how much to spend in each category

If you’ve made it this far, congratulations–your Christmas budget is almost done!

This can be the trickiest part in how to create a Christmas budget since you have to decide how much money should go to each category.

How much to spend on Christmas gifts per person?

Deciding how much to spend on Christmas gifts per person starts with knowing how much you want to spend on gifts altogether.

So let’s say you’re using the average holiday budget of $1000 as a guide. You want to use $500 of that for gifts.

If you have 10 people to buy for, you spend $50 on each one. Easy peasy.

But what if you want to spend more on your spouse or kids? That can change the math a bit.

So, say you want to spend $100 on your spouse. You have two kids and you want to spend $100 on each of them.

Now, you have $200 to spend on the 7 other people on your list. Now your gift budget per person drops to around $28.50.

This is a rough example, but it can help you figure out how you want to split up your gift budget based on who you’re buying for.

What is a good Christmas budget per child?

In terms of what to budget for Christmas per child, it can depend on their age and what you have to spend.

If you have three kids, for example, then $100-$150 per child might be the max. But if you have just one child, you might spend $200 or $250 instead.

One way to keep Christmas spending for kids in check is to use the rule of 4 for holiday gifts.

The 4 gift rule says you should buy kids:

- Something they want

- Something they need

- Something to wear

- Something to read

Sticking with the 4 present rule can save you money at Christmas. And it can keep you from cluttering up your kids’ rooms or your house with extra stuff they don’t really need.

5. Keep track of your budget

Once you’ve got your budget for Christmas set, go over it one more time to make sure it’s realistic.

Specifically, look for:

- Holiday expenses you might be able to reduce or eliminate

- Christmas expenses you forgot to budget for

This doesn’t take much time to do and it can ensure that your finalized holiday budget is doable.

If you’re budgeting for Christmas earlier in the year, you might want to do this again as it gets closer to the holidays. This way, you can plan ahead for any changes you might need to make.

For example, if you’ve added one or two people to your gift list you might need to adjust your gift spending. Or if you’ve saved more than you planned for Christmas, you might want to add those extra funds in to your holiday budget.

And you’ll also want to track your Christmas budget as you spend. Keeping track of what you’re spending in each category can help you see how much money you have left and where you may need to cut back to stay within your target.

Looking for a simple money management tool? Empower makes it easy to track spending, saving, investing, and budgeting in one place so you can tackle your financial goals!

Bonus Tips for How to Create a Christmas Budget

When you’re living on a tight budget, it pays to make every penny count at the holidays.

So here are a few more tips that can help you save money at Christmas and stretch your budget.

Set up a Christmas savings fund

If you’re planning to save money for Christmas each payday, consider setting up a separate savings account for it.

Keeping Christmas savings apart from the money you use to pay bills or cover everyday expenses means you won’t be tempted to spend it. And with the right savings account you could earn some decent interest while you’re at it.

Online banks typically offer higher interest rates than traditional banks. And they can charge fewer fees to boot. It’s worth shopping around to compare savings rates to find the best savings option.

Grow Savings Faster With Current

Current is a digital banking app that makes it easy to grow savings, manage spending and track your goals in one place! You can set up individual savings pods for different goals and earn the same competitive APY for each one.

Aside from making saving a breeze, Current also comes with other great features like fee-free overdraft and access to 40,000+ ATMs!

**View product disclosures

Automate Christmas savings

Once you’ve got your Christmas savings fund set up, schedule automatic deposits to grow your money.

This is as simple as setting up a recurring transfer from checking to savings each payday. You could also look for a savings account that offers automatic savings features, like round-ups to help you grow your money.

Use a budget planner to keep track of spending

I’m a visual person so I need to write things down. Trying to keep track in my head just doesn’t work.

If you’re the same way then using a holiday budget template or worksheet is a no-brainer.

Using a budget planner for Christmas makes it easy to see where your money is going. You can also keep track of holiday to-do lists for organizing your home or mailing out holiday cards.

Remember, you can snag a free holiday budget planner in the resource library!

Earn cash back to save for Christmas

If you need extra money to save for Christmas, there’s a simple solution: use cashback apps to shop.

Cashback apps pay you back a percentage of what you spend at specific shops. You can also get access to coupon codes and special discounts for even more savings.

With Rakuten, for example, you can earn up to 40% cashback when you shop online using the Rakuten browser extension or in stores with the Rakuten mobile app. I’ve personally used this app to make almost $1,500.

You can also make money with Rakuten by referring friends and family members. And you can get a $10 cash welcome bonus when you sign up and make a qualifying purchase.

Want to Get Cash Back When You Shop?

Making extra money is easy with Rakuten!

Rakuten is a free app and browser extension that helps you find coupons and discounts when you shop online or in stores. You can earn up to 40% cashback when you shop at hundreds of partner retailers, plus get a $10 sign-up bonus and up to $30 in bonus cash for each person you refer!

Get free gift cards for Christmas

Getting free gift cards for Christmas is great because you can use them to shop and save money. Or you can give them out as gifts to other people.

There are different apps you can use to earn gift cards for doing simple tasks, like playing games or checking emails.

- Swagbucks offers free gift cards for doing things you’re probably doing online already. For example, you can get free gift cards for watching videos or searching the web.

- MyPoints pays you in free gift cards for taking short surveys and you can earn rewards for shopping online.

You can also get gift cards by taking surveys. You answer questions and earn points or cash that you can redeem for Amazon gift cards, Walmart gift cards, restaurant gift cards, and retail store cards.

If you’re looking for some survey sites to try here are a few of my favorite options.

Survey Junkie is hands-down my favorite since you can earn cash in your free time for taking surveys and the pay rates are above-average.

Make Quick Cash With Survey Junkie

Take surveys. Earn rewards. Get paid.

Making extra money is that easy when you create an account with Survey Junkie. It’s free to sign up and you can earn real cash in your PayPal account or free gift cards, just for answering questions and sharing your opinions.

Use frugal hacks to save on Christmas

Frugal living tips can help you rack up even more holiday savings.

For example, instead of buying gifts, you might try making them instead if it’s cheaper.

Pinterest offers tons of great ideas on simple gifts you can make with items from the dollar store. Or you might be able to make gifts with things you already have around the house.

You can also try out some frugal holiday traditions to save money at Christmas.

Simple things like making holiday-themed slime or reading Christmas books out loud can create fun holiday memories. And they don’t have to cost a lot of money.

Start a holiday side hustle to make extra money

Making extra money for Christmas can help you avoid being broke during the holidays. And there are plenty of side hustles you can do to make money for Christmas, including side jobs from home!

If you need a few ideas, you might try:

- Taking surveys with Survey Junkie

- Getting paid to watch videos with InboxDollars

- Making and selling printables online

- Offering pet-sitting or dog-walking services

- Getting paid to wrap gifts

- Starting a holiday baking business

- Making Christmas crafts to sell

- Learning how to proofread

- Becoming a virtual assistant

- Driving for DoorDash

- Grocery shopping with Instacart

You could also look into side hustles that you can do all year long to make money. For example, you might try freelancing writing or blogging.

Final Thoughts

The holidays should be a time for family, friends, and fun–not stressing about money. Getting a head start on Christmas budgeting can help you get through the holiday season without financial headaches. And the best gift of all may be starting the New Year without holiday debt.

Before you go, remember to grab your free Christmas budget template!