Money worries are all too common, especially when inflation keeps prices high or the news hints at a recession. Anxiety about money can spike when you experience a financial crisis that affects you personally.

Nearly half of Americans say that money negatively impacts their mental health. If you’re one of them, it helps to know how to cope. Today, I’m sharing some proven tips to help you manage financial stress when dealing with a difficult money situation.

Want Free Money?

Check out my favorite apps for earning cash fast!

Survey Junkie. Earn up to $50 per survey just for sharing your opinions. Get paid to answer questions in your spare time!

Swagbucks. Make money by playing games and watching videos. Join for free and get a $10 bonus when you sign up!

InboxDollars. Take surveys and get paid for your opinion. An easy way to earn extra cash!

Rakuten. Earn up to 40% cash back at hundreds of retailers, online or in stores. And get $30 for each person you refer, along with a $10 sign up bonus!

CashApp. Need a simple app for sending and receiving money? Get $5 free when you use code ‘VZXRXZN’ to join CashApp.

How Financial Stress Affects Your Health

Money stress can impact your health in different ways. How financial stress manifests for you can depend on the reason for the stress, your physical condition, and your overall personality.

Some of the areas where you may notice negative impacts include:

- Sleep patterns

- Mental health

- Self-esteem

- Physical health

- Relationships

Financial stress can cause insomnia or other disruptions in your sleep, make you feel more anxious or ashamed of your situation, and increase your risk for certain health conditions, like heart disease or stroke.

Stress over money can also take a toll on your work life if you’re less productive or more prone to mistakes and affect your relationships with friends, family members, and loved ones.

The more proactive you are in trying to manage financial stress, the more you can minimize the potential for negative effects on your health.

How to Manage Financial Stress When Overwhelmed

If you’re living in financial crisis mode it can be difficult to figure out what to do first to control money stress. These tips are designed to give you an action plan to reduce stress levels.

1. Identify the source of your financial stress

There are lots of things that can make your money situation feel stressful. Pinpointing what’s behind your stress can give you a better idea of how to approach it.

Maybe you’ve been laid off from work. Or you’ve had an unexpected expense come along that you’re not able to cover with your emergency fund. Or it’s something else, like:

- Feeling overwhelmed by debt

- Learning how to manage your budget and track your spending

- Being behind on bills

- Experiencing a drop in income that makes it harder to live within your means

- Trying to rebuild a poor credit score

- Worrying about what your retirement will look like (or if you’ll even have one)

- Wondering if a recession will cause the economy to tank

- Being uncertain about how changing interest rates might affect you

Ask yourself what it is that’s bothering you the most. Once you know what’s stressing you out you can work on the next step.

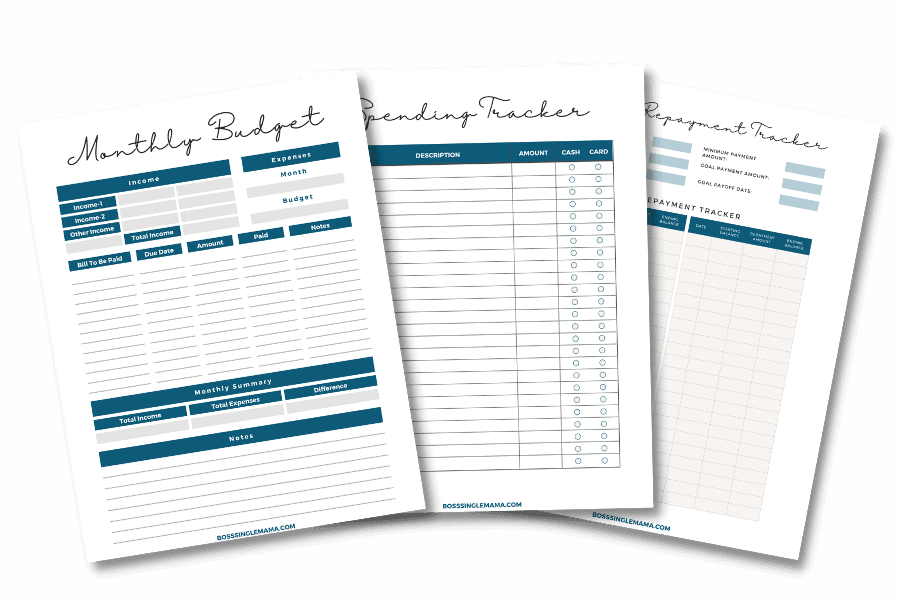

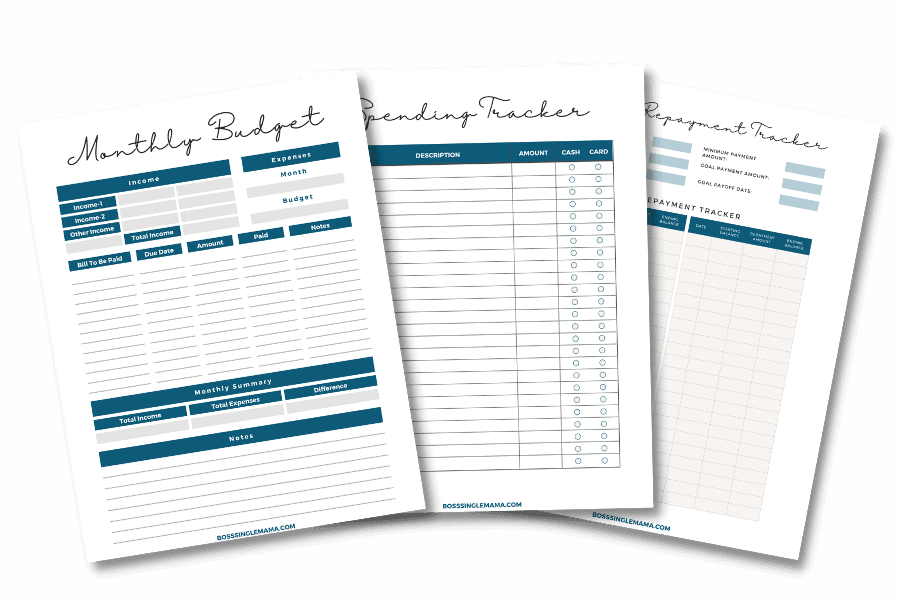

Get Your Budget on Track

Grab these free printable budget templates to take control of your money!

2. Focus on what you can control

If you’re overwhelmed by multiple money problems, take a deep breath.

Freaking out won’t solve the problems and it won’t make you feel better, either. Here’s what you need to do instead: focus on what you can fix and let the rest go for now.

There are some things you just won’t be able to do anything about. Like which way the stock market is moving or what’s happening with the economy.

So zoom in on what you can do right now to improve your finances.

That includes things like:

- Tracking the money you’re spending every month

- Making a budget if you don’t have one

- Facing up to how much debt you have and what it’s costing you in interest each month

- Brainstorming ideas for ways to make extra money

At this point, you just need to figure out what you can do. Knowing what’s within your reach can help you feel a little more in control of your financial life when you have money anxiety.

3. Prioritize what’s most important

When you have money struggles, you may not know what to do first. Or you might want to try to fix everything at once.

But that can be overwhelming. And if you’re already stressed, you don’t need to add to your overwhelm.

Go through your list of things that are causing financial stress that you can do something about. And then prioritize which ones are most important for you to tackle first.

For example, if you’re behind on bills figure out which ones you need to get caught up on right now. Then look at your budget to see what you can afford to pay toward them.

If your biggest source of money stress is low income, you could start researching different ways to make money outside of your regular job.

Having a priority list to follow keeps you focused. And addressing your biggest financial stressor first can make working through the smaller things easier.

4. Use lists to stay on track

Checklists and to-do lists are so helpful. When you have a list of things you need to do in order you don’t have to think about it. You can just follow the plan.

If you have one priority you’re working on to manage financial stress, break down what steps you need to take.

For example, say that you’re struggling with credit card debt. Your checklist might look something like this:

- Stop using your cards so you’re not adding to your debt

- Make a list of your cards, including the balance and APR

- Figure out the minimum payment for each credit card

- Go over your budget to see how much more you can afford to pay each month, on top of the minimum

- Consider transferring your credit card balances to a card with a 0% APR to save money

- Decide whether to use the debt snowball or debt avalanche method to pay your cards down

- Figure out how long it will take you to pay off all the debt

When you break things out step by step, it’s easier to see what you have to do next. And that’s a relief when you’re trying to manage financial stress since you’re not scrambling for ideas.

5. Find the positives

When hard financial times hit, you might feel hopeless or worry that things will never get better. Or you might be blaming yourself for past money mistakes.

None of that helps with managing stress associated with your finances, though. And really, it could just make it worse.

So instead of dwelling on the negatives, be on the lookout for the bright spots.

For example, get a notebook and keep a running list of things you’re grateful for, even when times get tough.

Celebrate every financial win you have, whether it’s big or small. Paying off $100 in debt or saving $50 when you’ve never managed to save a dime before are both reasons to toot your own horn.

Develop a positive mantra you can use as a reminder to yourself that you won’t let financial stress get to you.

These are little things but they can make a big difference in how you look at your financial situation. And changing your perspective to highlight the good things can make the bad things less intimidating.

6. Take care of your mental, emotional and physical health

Stress — whether it’s financial or otherwise — can be terrible for your health.

It can affect your body in so many ways and it can also take a toll on you mentally and emotionally.

If money is causing you stress, then it’s super important that you don’t neglect taking care of yourself while trying to take care of your finances.

Here are a few ways you can do that:

- Eat healthy. When you’re stressed out, it’s natural to want to indulge in junk food. But stress eating isn’t great so try to stick with healthy, energy-boosting foods instead.

- Meditate. Meditating can help calm your mind and get centered. Pick a few simple meditations to start and try to relax and tune out the noise for 10 or 15 minutes each day.

- Exercise. Exercise can be a stress reliever and it can help you stay healthy. So even if it’s just taking a walk around your backyard, get your body moving daily.

- Protect your sleep. When I say protect your sleep, I mean make getting good rest a priority. Go to bed earlier and sleep later if necessary. Do whatever you have to do to wake up feeling refreshed.

- Journal. Writing down what you’re feeling can be a good way to relax. And it can also help you get perspective on what’s stressing you out with money.

If you need more self-care ideas, try these tips.

Get Your Budget on Track

Grab these free printable budget templates to take control of your money!

7. Get help if you need it

At some point, you may hit a wall where your money anxiety is just too much to deal with. And when that happens, it may be time to ask someone to help you manage financial stress.

The kind of help you look for can take different forms.

For example, if you need financial assistance to pay the bills or buy groceries, you might consider government programs for people who are struggling.

Or if you need help working out a plan for managing your budget and debt, then you might look for a non-profit credit counselor or a financial advisor to work with.

And sometimes the help you need might just be a friendly ear who can listen to your troubles.

Whatever kind of help you need, don’t be afraid to seek it out. When your financial situation recovers you can pay it forward by helping someone else.

Final Thoughts: How Do You Manage Financial Stress?

Money shouldn’t make you feel anxious but if it does, it’s important to know what you can do about it. Periods of financial stress can eventually pass but in the meantime, it’s helpful to have some strategies you can fall back on to deal with it. Remember to share this post if you found it helpful!

Comments are closed.